Leading aerospace and defense company Orbital ATK, Inc. (NYSE:OA) signed an agreement with Thales Alenia Space, a joint venture between Thales and Leonardo-Finmeccanica for the supply of Pressurized Cargo Modules (‘PCM’).

Details of the Contract

Per the deal, Thales Alenia Space will provide nine additional PCMs to Orbital ATK for upcoming cargo resupply missions to the International Space Station (‘ISS’). These cargo modules have been designed to carry supplies and science experiments on Orbital ATK’s Cygnus spacecraft under the National Aeronautics and Space Administration’s (‘NASA’) Commercial Resupply Services (‘CRS’) contract.

The Cygnus spacecraft consists of two basic components – the Service Module built by Orbital ATK and the PCM developed by Thales Alenia Space. As per the latest contract, the new module configuration incorporates a number of upgrades over the previous version. Utilization of the new configuration will allow the Cygnus spacecraft to supply a higher load of cargo to the ISS.

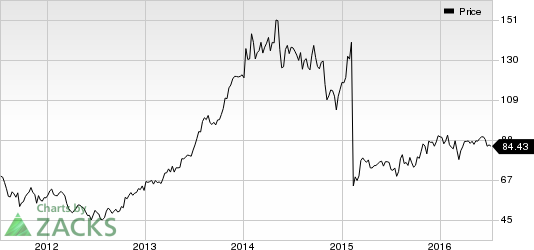

ORBITAL ATK INC Price

Previous Dealings with the NASA

The NASA awarded the CRS contract to Orbital ATK for ensuring commercial cargo delivery and disposal services to and from the ISS.

The company is scheduled to complete 10 CRS-1 missions to the ISS before transitioning to launch cargo logistics missions under the CRS-2 contract in 2019.

Orbital ATK has worked with the NASA on other missions too, for which the company provided a wide array of products and services.

In April, Orbital ATK was awarded the Sounding Rocket Operations Contract III by the NASA. Per the deal, the company will provide support for the agency’s Sounding Rockets Program. Sounding rockets are used to conduct suborbital missions for scientific and atmospheric research. (Read more: Orbital ATK (OA) Clinches Contract Worth $200M from NASA)

Orbital ATK is also the prime contractor for the NASA’s Balloon Operations, which are supervised by the Goddard Space Flight Center’s Wallops Flight Facility and managed by the Columbia Scientific Balloon Facility in Palestine, TX.

Overview

The company’s efforts on introducing new products and services, backed by the joint expertise of Orbital Sciences Corporation and Alliant Techsystems Inc., continue to boost the flow of both domestic and international contracts. The company plans to invest nearly $125 million in research & development (R&D) activities in 2016, which will help it to develop new products and further expand its market.

Moreover, the company is involved in more than 100 major Development and Production Programs with its customers. These programs, along with its wide range of product offerings, ensure an uninterrupted source of revenues and inflow of new contracts.

Zacks Rank & Key Picks

Orbital ATK currently carries a Zacks Rank #3 (Hold).

Some better-placed stocks in the same space include Curtiss-Wright Corporation (NYSE:CW) , HEICO Corporation (NYSE:HEI) and Raytheon Company (NYSE:RTN) , each carrying a Zacks Rank #2 (Buy).

CURTISS WRIGHT (CW): Free Stock Analysis Report

HEICO CORP (HEI): Free Stock Analysis Report

RAYTHEON CO (RTN): Free Stock Analysis Report

ORBITAL ATK INC (OA): Free Stock Analysis Report

Original post

Zacks Investment Research