AGN Is Trading Higher With Its Sector Peers

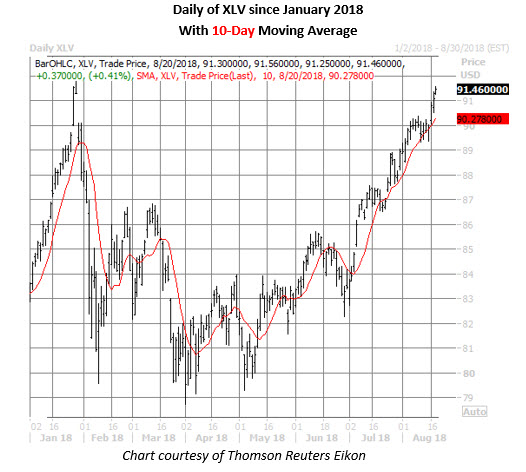

Healthcare stocks are trading higher today, extending an impressive run up the charts in recent months. At last check, the Health Care Select Sector SPDR ETF (NYSE:XLV) is up 0.4% at $91.46 -- a chip-shot away from its Jan. 29 record high of $91.79. Options traders are responding in kind, with calls crossing the tape at four times what's typically seen at this point in the day.

By the numbers, 14,400 XLV calls have been exchanged so far, with almost 71% of this volume centered at the September 93 strike. It looks like one trader in particular bought to open 9,159 contracts at 58 cents apiece, creating an initial cash outlay of $531,222 (number of contracts * premium paid * 100 shares per contract).

This is also the most the call buyer stands to lose if XLV settles below $93 at the close on Friday, Sept. 21, when the front-month options expire. Profit, meanwhile, will accumulate on a move north of breakeven at $93.58 (strike plus premium paid) -- roughly 2.4% above the fund's current perch.

Additional upside would just mirror the exchange-traded fund's longer-term trajectory, with XLV up 16% since dipping below the round $80 in early April. Plus, in early July, the shares took out recent resistance in the $86 region, and are now trading above support at their rising 10-day moving average.

One XLV component getting in on today's healthcare rally is Allergan (NYSE:AGN), with the shares up 2.8% to trade at $190.83. The stock has added almost 33% since its mid-May lows near $143, but is running out of steam in the $190 neighborhood, which contained AGN's late-January surge.

Nevertheless, Allergan call options are crossing at three times the expected intraday pace this afternoon. Speculative players appear to be buying to open the weekly 8/24 195-strike call, betting on a break out above $195 by expiration at this Friday's close.