Why the U.S. dollar still reigns supreme

Taking a look at recent options activity, two names to take note of are Beyond Meat (NASDAQ:BYND) and Altria Group (NYSE:MO). Both showed up on a list from Schaeffer's Senior Quantitative Analyst Rocky White of stocks that have seen the most weekly options volume in the past 10 days. Here's a breakdown of the trading on BYND and MO.

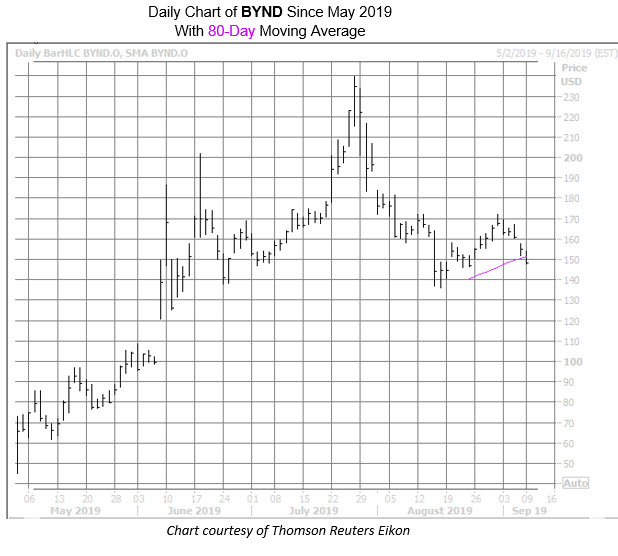

Looking first at buzzy faux-meat concern BYND, news that competitor Impossible Foods is accelerating global expansion, with availability in China, has the equity eyeing its third straight loss, down 4% to trade at $148.83. Not only that, BYND is on course to close south of its newly formed 80-day moving average for the first time ever.

In the options pits, most of Monday's activity has taken place at the weekly 9/13 140-strike put, where new positions are being bought to open, suggesting that these traders are predicting even more downside for the stock by the end of this week.

This move towards pessimism is a break from the typically bullish-leaning options activity, where over 117,000 calls have been bought in the past 10 days at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), compared to 71,670 puts. Plus, the largest increases in open interest during that time were the weekly 9/13 160- and 162.50-strike calls.

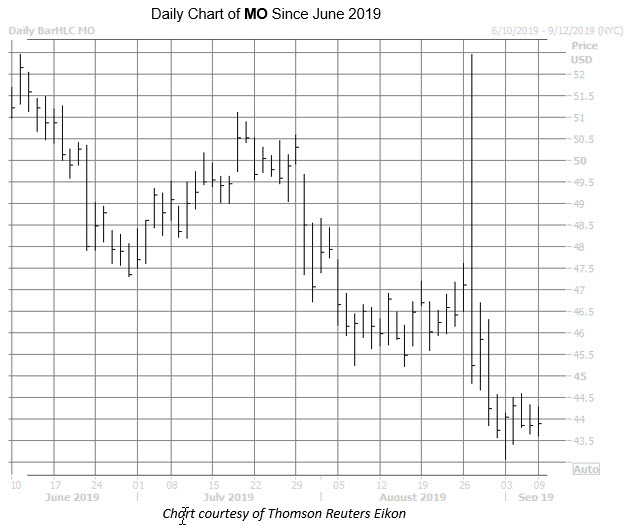

Turning our attention to shares of MO, the stock is up 0.1% at $43.91, at last check, as investors monitor the latest e-cigarette controversy. That is, Food and Drug Administration (FDA) is cracking down on marketing efforts from Juul -- which is owned by Altria -- and Altria needs to respond with a new plan of action within 15 business days. The stock is down 11.1% year-to-date, and just came off a seven-month low of $43.07.

Calls are still outnumbering puts on an overall basis, with 16,000 across the tape, compared to 12,000 puts. It's mostly from long-term traders adjusting positions, with the March 2020 47.50-strike call and 45-strike put standing as the most popular. Coming into Monday, call buying had been popular at the major exchanges, where 119,650 long calls crossed, compared to fewer than 39,000 puts.