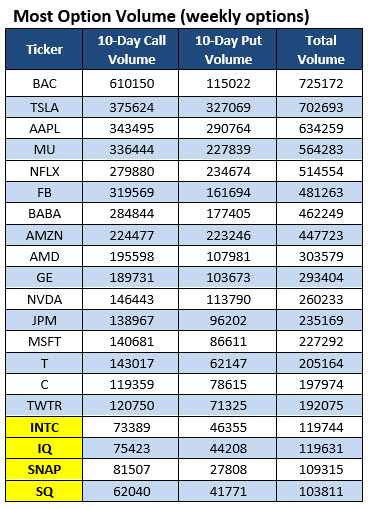

Bank stocks will be in focus shortly, with several big names set to kick off the new earnings season. Bank of America Corp (NYSE:BAC) and JPMorgan Chase & Co. (NYSE:NYSE:JPM) are two such names are set to report in the next week-- likely putting recent options traders on edge.

In fact, both stocks popped up on Schaeffer's Senior Quantitative Analyst Rocky White's list of 20 stocks that have attracted the highest options volume during the past 10 trading days. Call traders have been especially active in BAC and JPM options pits the past two weeks, with call volume handily outnumbering put volume in both instances. (Names highlighted in yellow are new to the list.)

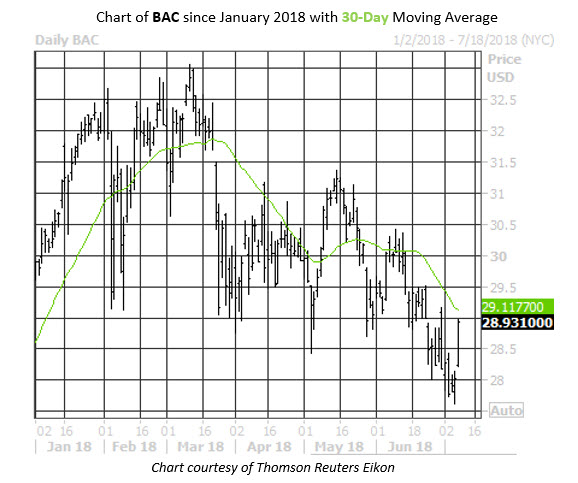

Bank of America Stock Looking For Post-Earnings Boost

Digging deeper, the July 29.50 call saw a notable increase in open interest over this two-week time frame, with nearly 80,000 contracts added. Data from the major options exchanges shows a mixture of buy-to-open and sell-to-open activity here, with those buying the calls expecting a post-earnings bounce from BAC, while those writing the calls see the $29.50 level as a short-term ceiling.

Regardless of direction, those wanting to bet on BAC stock may want to consider doing so with options. The security's Schaeffer's Volatility Index (SVI) of 23% ranks in the 21st percentile of its annual range, meaning short-term options are pricing in relatively low volatility expectations at the moment, despite earnings on the horizon.

Bank of America will report earnings before the open next Monday, July 16. The stock's recent history of earnings reactions has been mostly positive; the shares have closed higher the day after their report in five of the last eight quarters. And while the security's earnings reactions have been mostly muted -- averaging a next-day move of just 0.9% over the past eight quarters -- the options market is pricing in a 2.9% move, regardless of direction, this time around.

Bank of America stock is currently up 3.2% to trade at $28.93, putting it just above its year-to-date breakeven level. The banking shares are coming off their fourth straight weekly loss, and have been guided lower by their descending 30-day moving average since the Fed rate hike in mid-June.

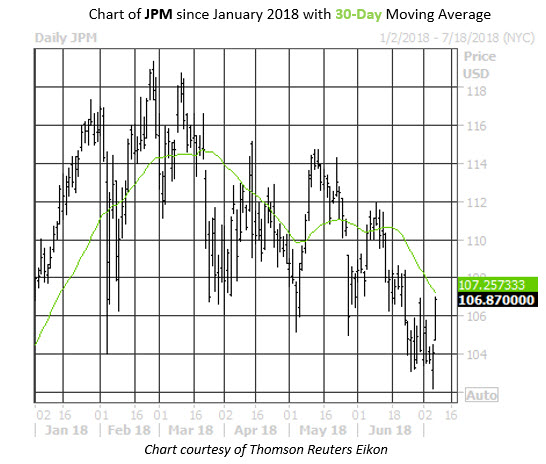

JPMorgan Call Volume Nearing Annual Highs

Looking at JPMorgan, the July 107 call saw the biggest increase in open interest over the past two weeks, adding nearly 8,3000 contracts. Data shows mostly buy-to-open activity at this strike, indicating options traders are expecting JPM stock to make a sustainable post-earnings push in the next two weeks.

This call bias stands up over the long run, too. Data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows JPM has racked up a 50-day call/put volume ratio of 2.67, which is 2 percentage points from a 52-week high.

JPMorgan will report its earnings before the open this Friday. Just like sector peer Bank of America, JPM's earnings reactions have been muted, averaging a next-day move of 1.2% over the past eight quarters. This time around, options traders are bracing for a 3.3% post-earnings move, regardless of direction.

At last check, JPMorgan stock was up 2.8% to trade at $106.87, also taking back its year-to-date breakeven level. The equity has been stuck in a channel of lower lows since mid-May, with potential resistance standing at the 30-day moving average.