Shipping concern FedEx Corporation (NYSE:FDX) is down 0.3% at $167.36 today, as traders look to be gearing up for the company's fourth-quarter earnings report, slated for release after the market closes on Tuesday, June 25. Below we will take a look at how FDX has been faring on the charts, and what the options market is pricing in for the security's post-earnings moves.

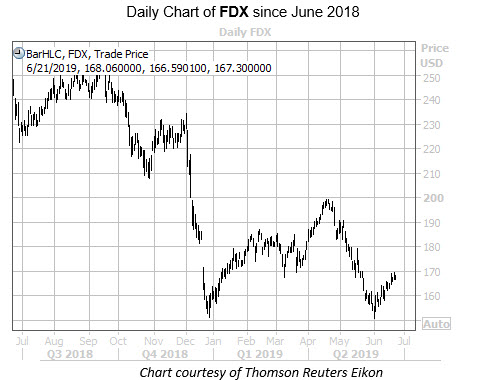

FedEx stock is down roughly 36% from its September 2018 highs. The UPS rival has suffered several bear gaps in that time frame, and its most recent rebound attempt in April was turned back at the round-number $200 level. After that rejection, FDX went on to retest its late-December lows in the $150 area.

Taking a look at FedEx's earnings history, the stock has closed lower the day after earnings in each of the past five quarters -- including a 12.2% plunge in December. Over the past two years, the shares have swung an average of 4% the day after earnings, regardless of direction. This time around, the options market is pricing in a larger-than-usual 6.7% swing for Wednesday's trading.

However, FDX has shown a tendency to make bigger moves than options traders were expecting over the past 12 months. This is based on its Schaeffer's Volatility Scorecard (SVS) of 83 (out of a possible 100).

As far as direction, data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows FDX with a 10-day put/call volume ratio of 1.23, ranking in the 94th percentile of its annual range. In other words, puts have been purchased over calls at a much quicker-than-usual pace.