The U.S. dollar has been trending higher in recent sessions, as the 10-year Treasury yield trades near 3% -- a key level it topped earlier today for the first time since January 2014 -- pointing to stiffer inflationary pressures and increased expectations the Fed will raise rates at a quicker-than-forecast pace. As such, the PowerShares DB US Dollar Bullish (NYSE:UUP) is coming off a fourth straight win, which marked its longest daily win streak since early February, though it seems set to end this run today.

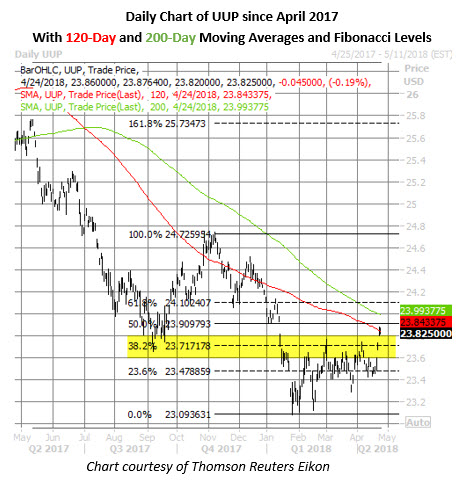

Taking a quick step back, UUP has added roughly 3.4% since bottoming at a three-year low of $23.09 on Jan. 25. The shares are now trading above the $23.72 mark, which coincides with a 38.2% Fibonacci retracement of their November-through-January decline. And while the stock is down 0.2% at last check to trade at $23.88, it's still on track to close north of its 120-day moving average for a second straight session, which hasn't happened since late December -- the 200-day trendline is looming overhead near $24.

Nevertheless, the fund's 200-day moving average is just overhead, which is currently docked at $24. UUP hasn't closed above its 200-day moving average since last May, while the $24 level served as a floor back in May 2016, and again at the start of of this year. Options traders have targeted this strike, too, with the June 24 call home to peak open interest of 39,680 contracts.

Data from the major options exchanges and Trade-Alert confirms a number of these calls were bought to open on April 3 for a volume-weighted average price (VWAP) of $0.19, making breakeven at expiration $24.19 (strike plus VWAP). UUP would need to rally another 2% from its current perch to topple this level.