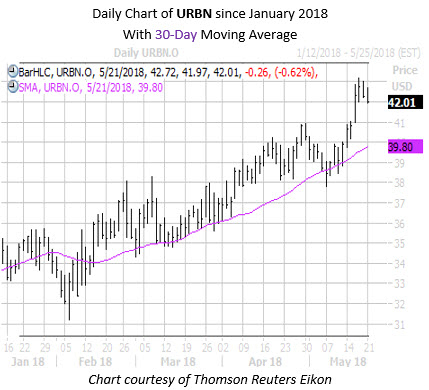

Retailer Urban Outfitters, Inc. (NASDAQ:URBN) is slated to report first-quarter earnings today after market close. On the charts, URBN has been on a tear, gaining 116% over the past 12 months, and on Friday reached a three-year high of $43.18. The stock has enjoyed support from the rising 30-day moving average since mid-February.

Digging into earnings history, URBN has posted a positive return the day after five of the company's last eight reports, including the past three. Overall, the stock has averaged a post-earnings swing of 8.7% of the past two years, regardless of direction. This time around, the options market is pricing in a 14.1% next-day move, per data from Trade-Alert. From the equity's current price of $42.01, a move of this magnitude to the upside would put the shares just under $48 -- into record-high territory.

Looking towards the options pits, traders have been heavily bullish ahead of the company's earnings release, with data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) showing a 10-day call/put volume ratio of 2.54, ranking in the 88th annual percentile. This shows URBN calls have been purchased over puts at a faster-than-usual clip.

What's more, the security's Schaeffer's put/call open interest ratio (SOIR) of 0.35 ranks in the low 3rd percentile of its annual range. In other words, speculative players have rarely been more heavily skewed toward calls over puts, looking at options that expire in the next three months.

Analyst sentiment has been mixed, with 10 of the 18 brokerage firms following the retailer sporting "hold" or worse ratings. However, Urban Outfitters just this morning received a price-target hike to $47 from $42 at SunTrust Robinson.