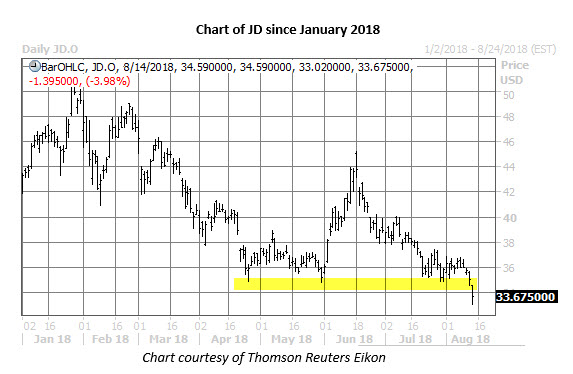

U.S.-listed shares of Chinese e-commerce companies are struggling today amid a negative earnings reaction for Vipshop (VIPS). One name taking a hit is Jd.Com Inc Adr (NASDAQ:JD) -- last seen down 4.7% at $33.43, and fresh off an annual low of $33.02 -- but options traders are initiating bullish positions ahead of the Beijing-based firm's own turn in the earnings confessional before the stock market opens this Thursday, Aug. 16.

At last check, around 96,000 calls and 56,00 puts have changed hands on JD so far today -- three times what's typically seen, and volume pacing in the 100th annual percentile. Most active by a mile is the August 34 call, where more than 13,200 contracts have traded. It looks like new positions are being purchased here for a volume-weighted average price of $0.98, making breakeven at this Friday's close $34.98 (strike plus premium paid).

Today's activity echoes a broader trend seen among short-term JD traders. Schaeffer's put/call open interest ratio (SOIR) for the Chinese stock is docked at 0.64, which registers in the 26th annual percentile. In other words, speculators are more call-heavy than usual among options expiring in three months or less.

This optimism is seen outside of the options arena, as well. Of the eight analysts covering the shares, six maintain a "strong buy" rating -- with not one "sell" on the books. Plus, the average 12-month price target of $46.69 is a 39% premium to current trading levels.

This could put JD stock at risk for bigger losses, especially if history repeats itself. Specifically, the shares have closed lower in the session subsequent to reporting in three of the last four quarters, averaging a loss of 3.3%. This time around, the options market is pricing in a 10.1% next-day swing for JD.com shares, regardless of direction.

Looking closer at the charts, today's downside mirrors the equity's recent price action. JD stock has surrendered roughly 34% since its late-January high north of $50, and is down 26% from its mid-June peak near $45. What's more, the shares are now trading below $35 -- a level that corresponds to the security's negative 15% year-to-date return, and had served as a floor since late April.