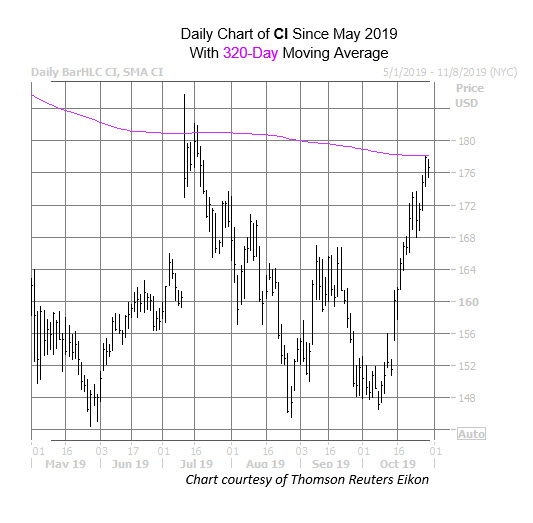

Health services stock Cigna Corp (NYSE:CI) has been in rally mode since its one-month low of $146.50, hit earlier this month. Since then, the stock has ended higher during all but three sessions, set to clock over a 16% monthly gain -- its biggest in 10 years. A run in with its 320-day moving average has the stock pulling back from yesterday's three-month high of $178.13, however, down 0.8% today at $176.69, as traders gear up for the company's third-quarter earnings report, due out before tomorrow's open.

Looking back, CI's last three post-earnings moves have been negative. More broadly speaking, the stock's earnings reactions over the past two years have been mixed, with an average next-day move of 1.7% in either direction. This time around, the options market is pricing in an even bigger move of 5.9%.

While recent earnings history doesn't bode particularly well for the security, Cigna (NYSE:CI) has done well in November, historically speaking. The equity just showed up as one of the best stocks to own next month, per data from Schaeffer's Senior Quantitative Analyst Rocky White, boasting a 90% positive return rate over the past 10 years, and averaging a 4.6% monthly pop.

Drilling deeper, sentiment among the options pits has been unusually bullish lately. On the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), 3.32 calls have been picked up for every put over the past 10 days. This ratio sits higher than 88% of all other readings from the past year, too, suggesting a much bigger-than-usual appetite for calls over puts in recent weeks.

Echoing this, CI's Schaeffer's put/call open interest ratio (SOIR) of 0.51 sits in the 6th percentile of its annual range. This suggests short-term options players have rarely been more call-heavy during the past 12 months.

The brokerage bunch has favored the insurance name, too. Currently, 17 of the 20 in coverage have given Cigna (NYSE:CI) a "strong buy" rating. In the same vein, the consensus 12-month price target of $209.73 represents a level the equity hasn't hit since late last year.