Another stock in line for this week's slew of retail earnings is Foot Locker, Inc. (NYSE:FL). Last seen trading up 1.5%, at $52.64, Foot Locker is slated to report its second-quarter earnings before the market opens, tomorrow, Aug. 24. Below we will dig deeper into the options market's outlook for FL's post-earnings move, and how the shoe retailer has been faring from a technical viewpoint.

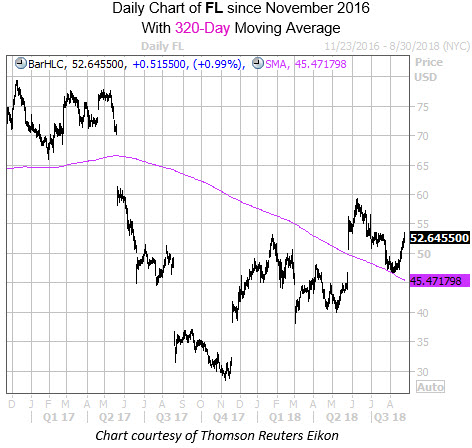

Foot Locker stock has experienced a series of bear and bull gaps over the past two years, most recently moving back above the 320-day moving average -- for the first time since mid-2016 -- in late May. Since then, the falling trendline has acted as support for the shares, FL bouncing off the key level earlier this month. That said, Foot Locker stock has picked up 12.5% since January.

Looking at earnings history, the stock has closed higher the day after the company reported in five of the last eight quarters, including an enormous 20.2% surge in the most recent quarter on May 25. Overall in the past two years, the shares have moved 15.8% the day after earnings, on average, regardless of direction. The options market this time is pricing in a similar 15.1% move for Friday's trading.

Options traders have been quite bullish toward Foot Locker stock. Data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows FL with a 10-day call/put volume ratio of 5.55, ranking in the 95th percentile of its annual range. In other words, calls have been bought over puts at a faster-than-usual clip during the past two weeks.

What's more, short interest on FL surged over 17% during the past two reporting periods, and now represents 9.25% of the stock's total available float. At the stock's average daily trading volume, it would take shorts roughly one whole week to cover.