Investing.com’s stocks of the week

Short Interest Accounts For Over 17% Of The Stock's Float

Shares of Switch (NYSE:SWCH) are slightly lower in afternoon trading, down 0.9% at $9.21, at last glance, as traders gear up for the company's third-quarter earnings. The security's fifth-ever report is slated to surface after the market closes tomorrow, Nov. 13. Below, we will dive into what the options market is expecting for the stock's post-earnings moves and take a look at how SWCH has been faring on the charts.

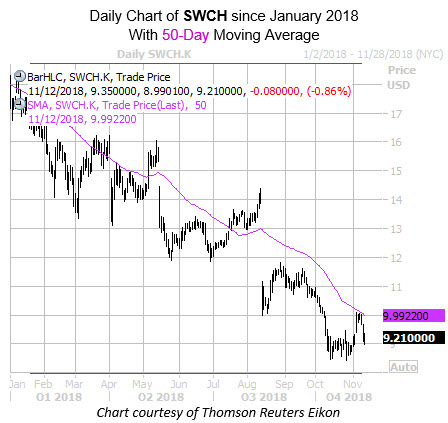

Overall, the technology name has struggled on the charts since its initial public offering (IPO) this time last year. Specifically, a series of post-earnings bear gaps and pressure from the falling 50-day moving average have contributed to the stock's underperformance. Year-to-date, SWCH has shed 49%.

Digging into its brief earnings history, SWCH has closed lower the day after all four previous earnings reports, including a 22.4% drop last quarter. Looking broader, the shares have averaged a 14.6% loss the day after earnings. This time around, SWCH options are pricing in a 24% swing for Wednesday's trading.

Lastly, short interest on SWCH represents a healthy 17.3% of the stock's total available float. This means that at the tech name's average pace of trading, it would take short sellers just over seven days to buy back their bearish bets.