BlackBerry Ltd (NYSE:BB) is scheduled to report fiscal second-quarter earnings ahead of the open today, Sept. 28. The former smartphone maker has been quiet on the charts in recent months, per its 60-day historical volatility of 29% -- in the 1st annual percentile. However, the options market is pricing in an outsized move for tomorrow's trading, and speculators appear to be positioning for a positive earnings reaction.

Most recently, Trade-Alert has the implied daily earnings move for BB at 11.1% -- bigger than the average 7.4% next-day move the stock has seen over the last three quarters. These historical returns have tended toward the downside, with the shares logging back-to-back post-earnings losses in March and June.

Nevertheless, options traders have targeted short-term calls in recent weeks. Specifically, the weekly 9/28 10.50-strike and weekly 10/5 9.50-strike calls have seen the biggest increases in open interest, with more than 4,300 total contracts added. Data from Trade-Alert signals some buy-to-open activity at each strike, suggesting speculators are betting on positive price action for BB through next Friday's close.

Outside of the options pits, sentiment is skewed toward the skeptical side. The 39.59 million BB shares sold short account for a healthy 7.5% of the stock's available float, or 12.2 times the average daily pace of trading.

Plus, all five covering analysts maintain a tepid "hold" rating. However, the average 12-month price target of $11.61 is a 12.9% premium to current trading levels, which puts BlackBerry stock at risk for price-target cuts on another negative earnings reaction.

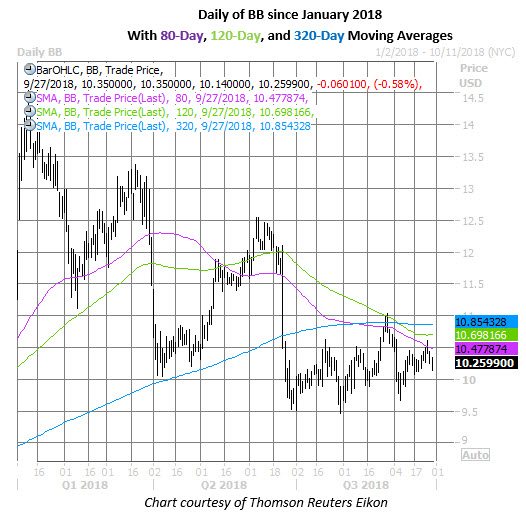

Looking at the charts, it's not too hard to see why most of Wall Street is pessimistic toward the software stock. BB has shed more than 29% since its mid-January four-year peak at $14.55, last seen down 0.6% at $10.26. More recently, the security has been stuck churning beneath its 80-day, 120-day, and 320-day moving averages, which are all located near BlackBerry's late-June earnings-induced bear gap.