Oil prices plunged today, pressured by global supply concerns. July-dated crude futures closed down 1.6% at $64.75, and have now lost more than 4% since rumors first began circulating last week that the the Organization of the Petroleum Exporting Countries (OPEC) and Russia are considering lifting the cap on crude output. This negative price action is being echoed in the United States Oil Fund (NYSE:USO), but one options trader is positioning for a big bounce ahead of OPEC's June 22 meeting.

At last check, roughly 149,000 calls have changed hands on USO -- almost tripling what's typically seen. The bulk of the action is centered at the October 14 and 16 calls, which were apparently used to initiate a long call spread for a net debit of $0.40 per spread, or $1.6 million (40,000 contracts * premium paid * 100 shares per contract), according to Trade-Alert.

The short call lowered the entry cost of just buying a call outright, while also dropping the breakeven mark to $14.40 (bought strike plus net debit) -- a level that's 9.9% above the fund's current perch. The maximum potential gain for the spread is limited to $1.60 per spread (difference between the two strikes less the net debit), no matter how far above $16 USO might surge through October options expiration. Risk, meanwhile, is limited to the initial cash outlay.

This bullish bias just echoes the broader trend seen in USO's options pits in recent weeks. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the fund's 10-day call/put volume ratio of 1.12 ranks in the 87th annual percentile, meaning calls have been bought to open over puts at a quicker-than-usual clip.

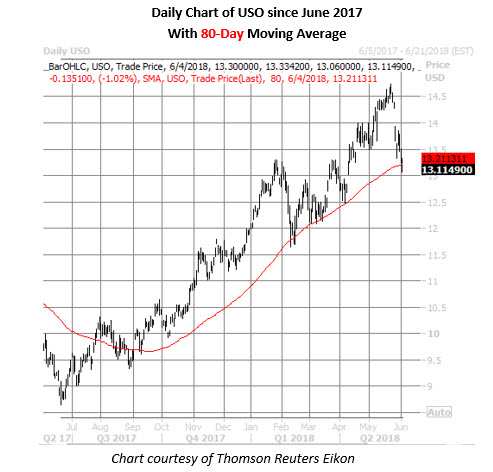

And looking at the charts, it's not surprising to see optimism growing toward the energy exchange-traded fund (ETF). From last June's low of $8.65 to its late-May two-year peak at $14.74, USO rallied 70%. Since then, the shares have tumbled 11% to trade at $13.12 -- breaching their first-quarter highs near $13.20, and pacing for their first close below the 80-day moving average since August.