As earnings season chugs along, dating app service Match Group Inc (NASDAQ:MTCH) is set to release its third-quarter report after the market closes this Tuesday, Nov. 6. Ahead of the event, the stock is down 2.3% today to trade at $50.98, despite receiving a price-target hike to $61 from $56 at Deutsche Bank (DE:DBKGn). Meanwhile, options traders are pricing in a single-day stock move that's more than double the norm.

Over the last eight quarters, Trade-Alert data shows MTCH making an average move of 7.7% in the trading session after its earnings are released, regardless of direction. And in the last five reports, MTCH's post-earnings reaction has been positive, including a 17.3% burst last August. This time around, the options market is pricing in an 18.2% post-earnings move for the stock, based on at-the-money implied volatility (IV).

Options traders are preferring puts over calls, suggesting a bearish bias among speculative players. On the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 10-day put/call volume ratio of 1.22 is in the 94th percentile of its annual range. This indicates a healthier-than-usual appetite for long puts relative to calls on MTCH during the past two weeks.

Echoing this, the stock's Schaeffer's put/call open interest ratio (SOIR) stands at a steep 1.25, which arrives in the 87th percentile of its annual range. In other words, puts handily outnumber calls among options set to expire within three months.

Traders wanting to speculate on Match with options will be interested to know that the stock's Schaeffer's Volatility Scorecard (SVS) sits at a lofty 92 out of a possible 100. This means MTCH has handily exceeded the volatility expectations priced into its options over the past year.

Should Match stock enjoy another post-earnings surge, shorts could be squeezed. Short interest on the stock dipped by 2.7% in the past two reporting periods, but the 24.08 million shares sold short still represents a robust 48.1% of its float. At the equity's average daily trading volume, it would take more than 11 sessions for all of these shorted shares to be repurchased.

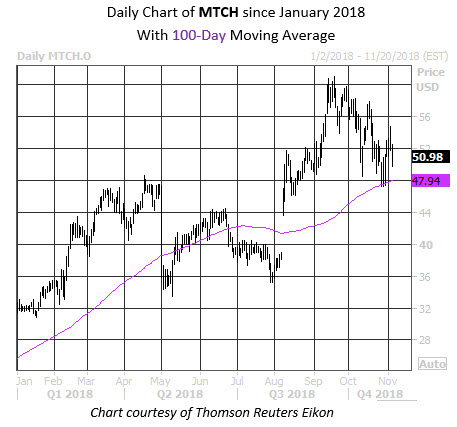

On the charts, MTCH stock nabbed a record high of $60.95 on Sept. 19. The shares pulled back shortly amid the recent broad market sell-off, but the dip appears to have been contained by their 100-day moving average. Overall, the equity boasts a 62.8% lead in 2018.