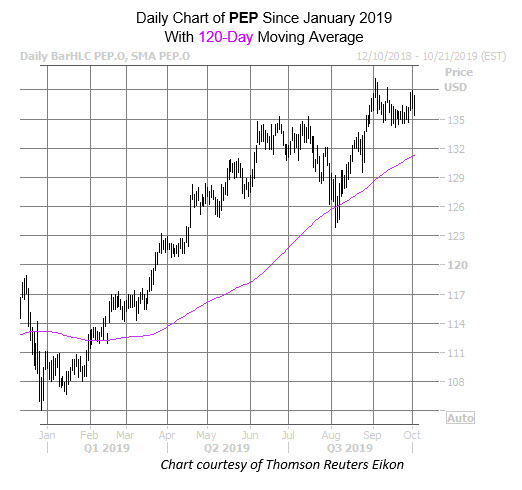

Food and beverage concern PepsiCo Inc (NASDAQ:PEP) is down 1.5% at $135.33 today, just ahead of its third-quarter earnings, slated for release before the open tomorrow. This dip follows the equity's second-highest close on record, ending yesterday at $137.37 -- just beneath its early September peak around $139. In fact, PEP has been climbing steadily higher for the better part of the year, up 22% since the beginning of January, with its last pullback caught by the 120-moving average.

Some options players today, however, are expecting a steep pullback for PEP. Over 5,000 puts have exchanged hands so far -- two times what is normally seen at this point -- compared to only 2,500 calls. Some of this action is taking place at the weekly 11/8 137-strike put, where contracts are being opened at a volume-weighted average price of $3.40. This means these buyers will profit if the stock falls below $133.60 (strike minus premium paid) by the time these contracts expire on Nov. 8.

This bearish sentiment is nothing new, though. On the the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), PEP sports a 50-day put/call volume ratio of 0.85. This ratio sits higher than 90% of all other readings from the past year, suggesting a healthier-than-usual appetite for puts over calls of late.

Historically speaking, PEP has tended to make fairly modest moves following its last eight earnings reports. While six of these eight post-earnings swings were positive, the stock's average next-day return is just 2%, regardless of direction. This time around, the options market is pricing in a slightly wider than average 4% swing.

Analysts are split on the Frito Lay owner, with half dubbing the security a "strong buy," while the other half say "hold." The 12-month consensus target price of $135.15, on the other hand, is right in line with current levels. Should Pepsi earnings exceed expectations tomorrow, an unwinding of pessimism in the options pits, or a round of upbeat analyst attention, could push the shares to new heights.