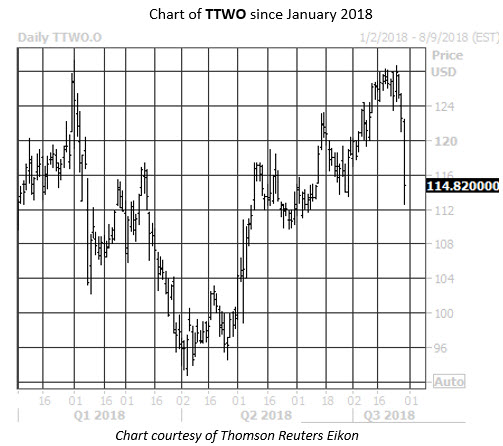

Take-Two Interactive Software Inc (NASDAQ:TTWO) stock is struggling today, down 6.7% to trade at $114.82, pulling back with the rest of the video game sector. What's more, Take-Two will report fiscal first-quarter earnings after the close on Thursday, Aug. 2. Ahead of the event -- and after suffering steep losses last week -- TTWO options bears have started to come out of the woodwork.

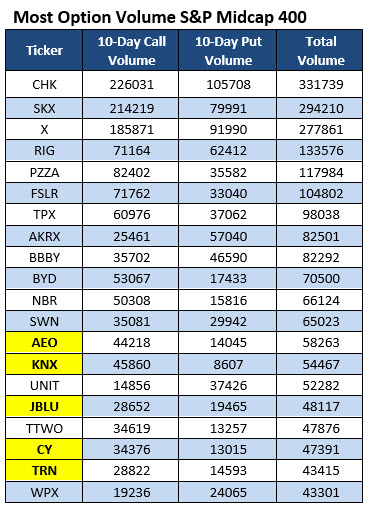

In fact, the stock popped up on Schaeffer's Senior Quantitative Analyst Rocky White's list of 20 mid-cap stocks that have attracted the highest options volume during the past 10 trading days. (Names highlighted in yellow are new to the list.) While Take-Two call volume was more prevalent on an absolute basis, options traders have been more put-skewed than usual lately.

As alluded to above, at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), TTWO's 10-day put/call volume ratio of 0.65 is in the elevated 85th percentile of its annual range. While this ratio indicates that bought calls still outnumbered puts on an absolute basis, the elevated percentile tells us that traders have initiated bearish bets over bullish at a faster-than-usual clip during the past two weeks.

Shifting gears to today, a flurry of options traders have flocked to puts. More than 4,600 Take-Two puts have changed hands today -- three times the intraday norm, and volume on track for the 98th percentile of its annual range. Leading the charge is the September 100 put, where it appears new positions are being opened. If this is the case, options traders are banking on TTWO's pullback to continue, with the shares breaching the century mark before September options expiration. The video game stock hasn't been south of $100 since early May.

Those wanting to bet on TTWO with options are in luck, considering the stock has consistently rewarded premium buyers over the past year. This is based on its elevated Schaeffer's Volatility Scorecard (SVS) reading of 82 (out of a possible 100), which indicates the equity has tended to make outsized moves compared to what the options market was expecting.

Just last week, on July 25, Take-Two stock peaked at $128.70 -- within striking distance of its Feb. 1 all-time high of $129.25. Since then, however, the stock has sharply pulled back, shedding more than 10%. The security is on track today for its worst single-day loss since Feb. 8.

Take-Two stock has a rather upbeat history of post-earnings reactions. The video game maker has enjoyed positive earnings reactions in seven of the past eight quarters, including a 12.2% jump last August. On average, the equity has moved 6.1% the day after earnings over this two-year time frame, regardless of direction. This time around, the options market is pricing in a bigger-than-usual 12.7% single-session post-earnings swing.