Data center concern Switch Inc (NYSE:SWCH) is scheduled to report its fourth-quarter earnings after the close on March 12. In anticipation of this report, SWCH stock is up 2.7% at $8.29 -- set to snap a three-day losing streak. Below, we take a look at how Switch shares have been performing on the charts, and what options traders are expecting after earnings.

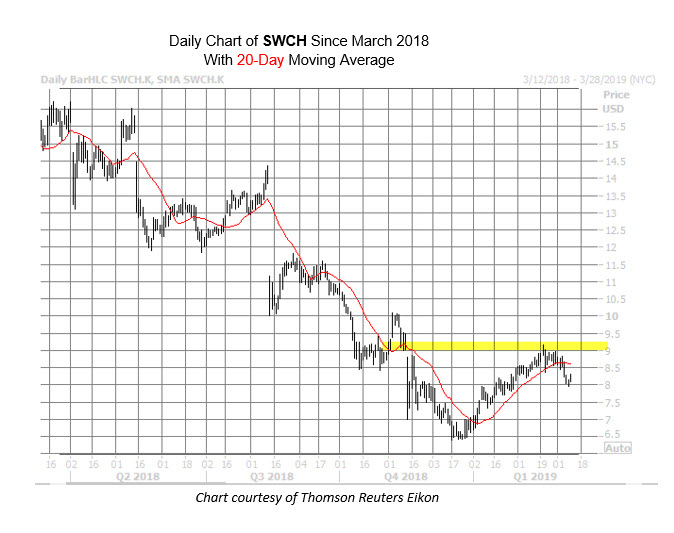

Since bottoming out at an all-time-low of $6.39 on Dec. 17, SWCH has rallied nearly 30%. However, after running into a roadblock in the $9 area -- where the stock was trading before a post-earnings bear gap in November -- the equity has pulled back, breaching the support of its 20-day moving average.

From a longer-term standpoint, SWCH is no stranger to post-earnings bear gaps. It has suffered a negative earnings reaction after each of its last five reports, and averaged a one-day drop of 16.4%. This time around, the options market is pricing in a larger-than-usual 20.1% move for Wednesday's trading.

As such, it's no surprise that options traders have been upping the bearish ante of late. SWCH puts bought to open have outnumbered calls by an almost 3-to-1 ratio on the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) during the past 10 weeks. This ratio is higher than 99% of all other readings from the past year, indicating a healthier-than-usual appetite for bearish bets lately.

Echoing that, the 9.42 million Switch shares sold short represent a whopping 30.6% of its available float. This represents over eight sessions of pent-up buying power, at the security's average daily trading volume, should the company snap its string of earnings misses tomorrow night.