The most important thing to recognize about trading options is that the best thing about option trading and the worst thing about option trading are the same things. To wit:

The best thing about trading options is that there are so many strategy choices available. The worst thing about trading options is that there are so many strategy choices available.

In a nutshell, it is nice to have a lot of flexibility, unfortunately, it also is easy to get a bit overwhelmed by it all. The keys are:

To understand the pro’s and con’s of any strategy you are considering and also, the best time to use it – i.e., trending market, range-bound market, high volatility, low volatility, etc.

And sometimes it is possible to “tweak” a fairly standard strategy and potentially increase it usefulness. Let’s consider an example.

Ticker SMH

For the record, while I am using SMH as an example I am NOT endorsing any particular outlook for that ticker and I am not making any predictions regarding where it is or is not headed next. With that caveat firmly in mind, the examples that follow assume that a trader has a slightly bullish outlook for ticker SMH in the months ahead. Let’s look at, a) a standard options trading strategy, and, b) one way to “tweak” that strategy to gain more upside potential.

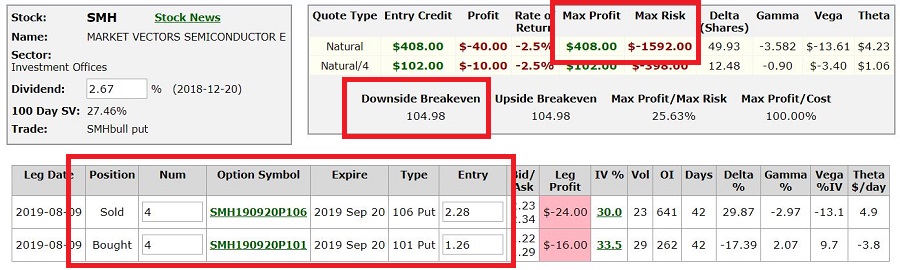

The “standard” strategy that we will highlight first is referred to as the “bull put credit spread” or bull put spread for short. This trade sells an out-of-the-money put and buys a further out-of-the-money put. The trade makes money as long as the underlying security remains above the strike price of the short option. With SMH at $111.48 a share, our example the trade involves:

*Selling 4 Sep20 SMH 106 puts at $2.28

*Buying 4 Sep20 SMH 101 puts at $1.26

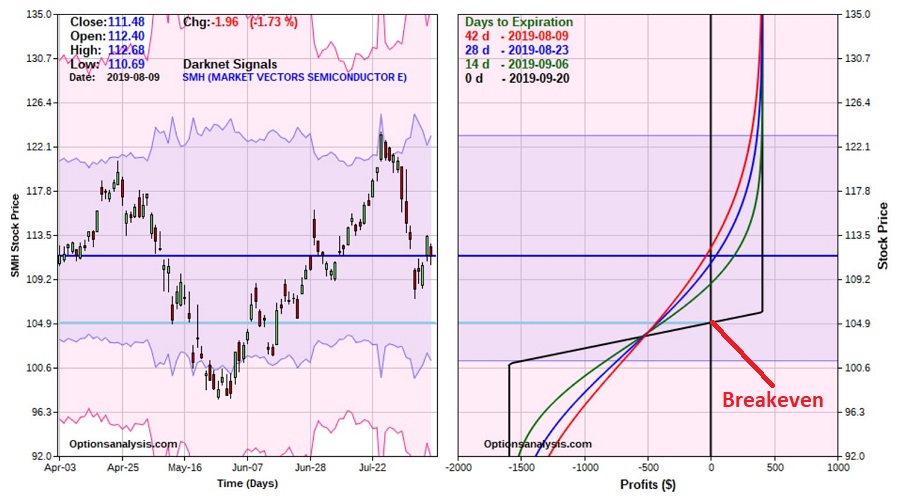

Figure 1 displays the details and Figure 2 displays the risk curves.

Figure 1 – Bull Put Credit Spread details (Courtesy www.OptionsAnalysis.com)

Figure 2 – Bull Put Credit Spread risk curves (Courtesy www.OptionsAnalysis.com)

This position has:

The bottom line is that at any price above $106 a share, this trade makes $408.

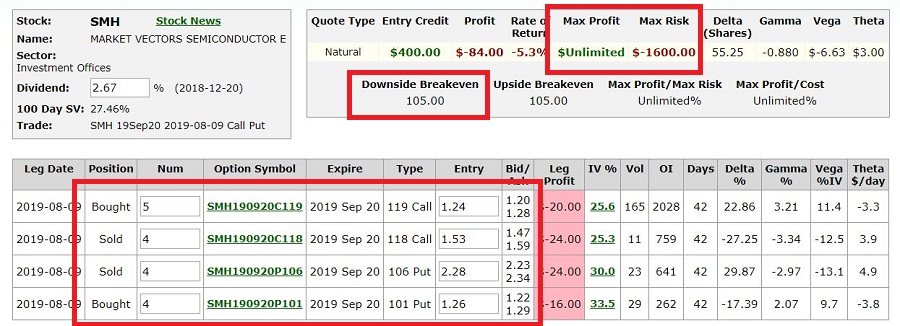

Now let’s consider a slightly different outlook. Let’s say for example that our trader likes the idea of some downside cushion but that he or she also thinks that there is a chance that SMH will rally strongly in the next several months. To accomplish this goal the trader might layer on another spread using call options as follows:

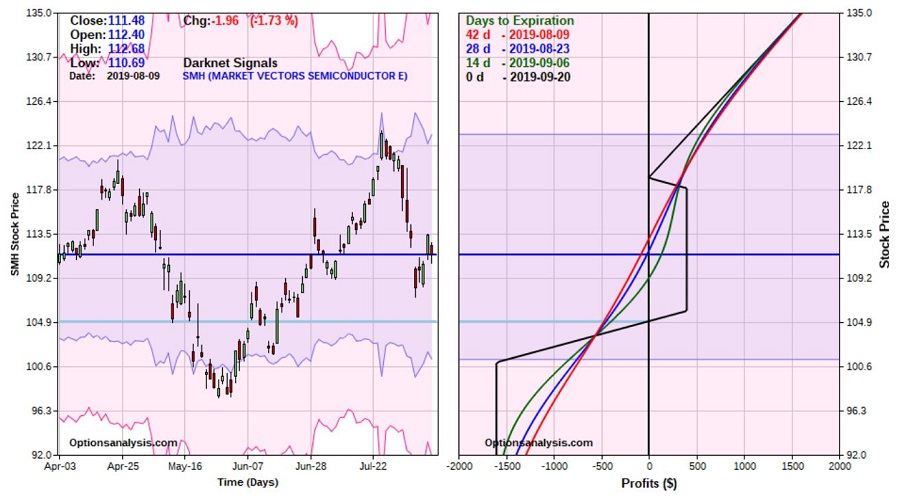

Figures 3 and 4 display this trade through expiration.

Figure 3 –“Alternative” spread details (Courtesy www.OptionsAnalysis.com)

Figure 4 – “Alternative” spread risk curves (Courtesy www.OptionsAnalysis.com)

This position has:

In other words, it has roughly the same profit potential ($400) and the same maximum risk ($1,600) as the original credit spread, however, it also enjoys the potential for unlimited profit potential if in fact SMH does rally sharply.

HOWEVER, it also has that “weird dip” at expiration (visible in Figure 4 as the black line between 118 and roughly 123). So how do we deal with that? One potential solution is to resolve to exit the trade with no less than 7 days left until expiration. The risk curves for this trade up through 7 days prior to expiration (i.e., as of Sep 13th) appears in Figure 5.

Figure 5 – “Alternative” spread risk curves 7 days prior to expiration (Courtesy www.OptionsAnalysis.com)

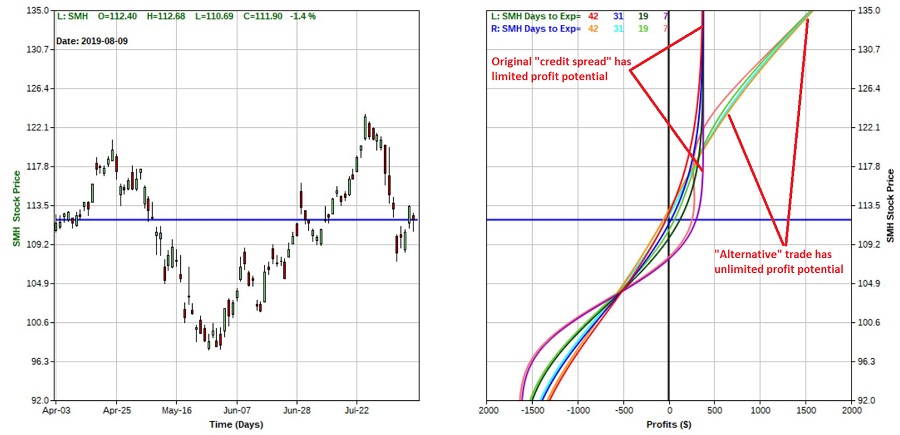

Now let’s overlay the risk curves for the 2 trades as of 7 days prior to option expiration. This comparison appears in Figure 6.

Figure 6 – Original credit spread versus alternative spread with 7 days left until expiration (Courtesy www.OptionsAnalysis.com)

As you can see, the one significant difference is that if in fact, SMH DOES rally sharply, the 2nd trade can keep making more money.

Summary

I need to emphasize again that I am NOT “recommending” any of the trades appearing in this article. The sole purpose is to illustrate that, well, there are so many ways to trade options – and that that can be a good thing.