The Consumer Staples Select Sector SPDR (NYSE:XLP) is an exchange-traded fund (ETF) meant to move with the tides of the U.S. consumer staples sector. Among its top holdings are Coca-Cola (NYSE:KO), which is getting hammered today on weak guidance. However, ahead of a busy week of events for several other top XLP holdings, including PepsiCo Inc (NASDAQ:PEP), Walmart (NYSE:WMT) Kraft Heinz (NASDAQ:KHC), Colgate-Palmolive (NYSE:CL), and Mondelez (NASDAQ:MDLZ), it looks like one options trader is betting big on short-term support for XLP shares.

Pepsi is slated to report quarterly earnings tomorrow, Feb. 15. Meanwhile, Walmart and Kraft Heinz are expected to report earnings next week -- on Feb. 19 and Feb. 21, respectively. In addition, Mondelez and Colgate-Palmolive will present at the Consumer Analyst Group of New York conference on Tuesday, Feb. 19.

Against this backdrop, XLP has seen roughly 24,000 puts change hands today -- six times the average afternoon volume. That's compared to fewer than 2,000 XLP call options traded so far.

However, the put volume doesn't appear to be bearish in nature. According to Trade-Alert, it appears one speculator sold to open 20,000 weekly 2/22 54.50-strike puts for about $1.8 million. By doing so, the trader expects XLP to finish north of $54.50 on Friday, Feb. 22, when the weekly options expire. In this instance, the puts will expire worthless, allowing the investor to retain the entire seven-figure premium received at initiation.

Today's appetite for short puts runs counter to the recent trend. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), XLP has racked up a 10-day put/call volume ratio of 3.78 -- in the 88th percentile of its annual range. In other words, options traders have bought to open XLP puts over calls at a faster-than-usual pace during the past two weeks.

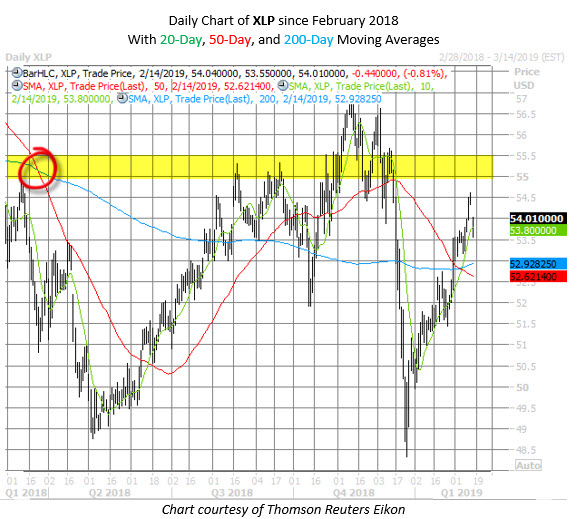

XLP has been on fire since its annual low of $48.33 on Dec. 26, rallying almost 12% in that time frame, with help from its 10-day moving average. The ETF on Wednesday touched its highest point since mid-December, but is down today with KO shares, last seen 0.8% lower at $54.01. However, the fund is now staring up at the $55-$55.50 area, which acted as a speed bump in mid-2018, and its 50-day and 200-day moving averages just made a "death cross" for the first time since last March. This ominous-sounding technical indicator preceded a steep sell-off for XLP.