Retail stocks have been in focus today, under pressure after some ugly retail sales data. And while SPDR S&P Retail ETF (NYSE:XRT) has erased its initial losses, put traders have come of the woodwork in droves.

More specifically, almost 19,000 XRT put options have changed hands today, double the average intraday amount and nearly 12 times the number of calls traded. Most of the attention is on the exchange-traded fund's (ETF) February 44.50 put, where it looks like new positions are being opened as part of a spread.

Specifically, it seems one trader may have sold to open 5,000 44.50-strike puts, but hedged their bets by buying to open 3,000 February 45 puts. In this instance, the trader is expecting XRT to stay atop $44.50 through tomorrow's close, when the options expire, but the purchase of the higher-strike puts limits their risk in the event of a notable drop. In fact, if XRT ends the week between the strikes, the trader can pocket the net credit from the sale of the 44.50-strike puts, and the bought 45-strike puts will still be in the money.

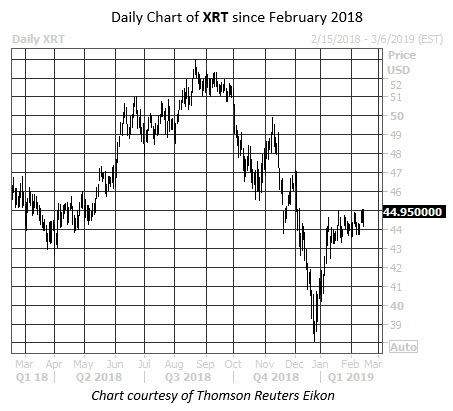

On the charts, XRT at last check was marginally higher to trade at $44.95 -- right in that sweet spot -- off its session low of $44.18. The aforementioned $45 level has served as a stiff ceiling since early December. Overall though, the retail ETF has gained 18% since its Christmas Eve bottom near $38.

Despite XRT's rebound, options traders have been buying to open puts relative to calls at a quicker-than-usual pace for some time now. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), XRT's 10-day put/call volume ratio of 12.09 ranks in the 90th annual percentile.

Echoing this, the ETF's Schaeffer's put/call open interest ratio (SOIR) of 5.27 registers in the 94th percentile of its annual range. In other words, short-term speculators are more put-heavy than usual toward XRT, with near-term put open interest more than quintupling near-term call open interest right now.