Option Buyers Pick Up Oracle Calls Before Earnings

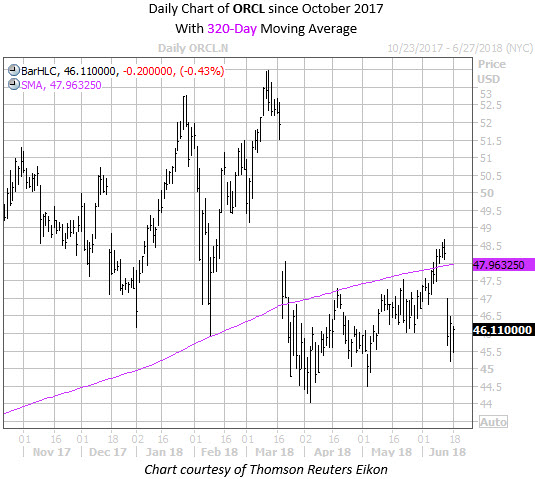

Cloud concern Oracle Corporation (NYSE:ORCL) is slated to report its fiscal fourth-quarter earnings after the close tomorrow. Oracle stock is down 0.4% at $46.11, at last check, after last week suffering an analyst-related bear gap back below the 320-day moving average. What's more, ORCL shares have a history of negative earnings reactions, and below we will take a look at what the options market is pricing in for the stock's next post-earnings move.

Digging into earnings history, ORCL has closed lower in the session following each of the company's last three reports, including a 9.4% loss in March. Widening the scope, the stock has averaged a one-day post-earnings swing of 5.9% over the past two years, regardless of direction. However, the options market is pricing in a slightly larger-than-usual 8.3% move this time around, per data from Trade-Alert.

As mentioned earlier, the stock gapped back below its 320-moving average last Thursday, and has since danced just below its year-to-date breakeven level. From a longer-term perspective, ORCL notched an all-time high of $53.47 in mid-March, shortly before the aforementioned earnings gap lower, and since hitting a low of $44.04 in early April, has been in a channel of higher lows and highs.

Aside from last week's bearish brokerage notes, attention has been mostly optimistic on Oracle stock. Of the 25 analysts covering the tech concern, 14 sport "buy" or "strong buy" recommendations. At the same time, ORCL's average 12-month price target of $55.15 prices in a 19% premium to current levels.

In the options pits, sentiment has also been leaning quite bullish. Data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) currently shows the stock with a 10-day call/put volume ratio of 3.44. This lofty ratio means that more than triple the amounts of calls have been purchased over puts during the past two weeks of trading.

Should Oracle once again miss earnings expectations tomorrow night, the stock could be vulnerable to an additional round of negative analyst attention. In the same vein, a mass exodus of option bulls could translate into added headwinds for ORCL.