Etsy Inc (NASDAQ:ETSY) will report second-quarter earnings after the close on Monday, August 6. Below we will take a look at what the options market is pricing in, and how Etsy stock has been performing on the charts.

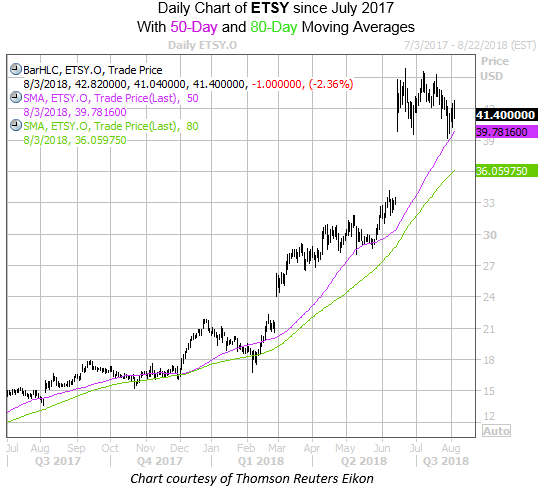

ETSY stock is down 2.4% to trade at $41.40 today. However, the security has been in a long-term uptrend since its early 2017 lows, guided higher by its rising 50-day and 80-day moving averages, and has more than doubled in value since January. After the firm raised its revenue growth outlook in mid-June, ETSY gapped higher, touching a record peak of $45.88 on June 21, and has subsequently consolidated its gains atop the $40-$41 area.

Looking at the outperformer's earnings history, the equity did see an impressive 20.4% lift the day after its February report, and rallied more than 11% after earnings a year ago. Looking back eight quarters, the shares have moved 9.9% the day after earnings, on average, regardless of direction. This time around, the front-month August 40 straddle is pricing in expectations for a 12.8% move.

Meanwhile, data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows Etsy stock with a 10-day put/call volume ratio of 0.99, ranking in the 94th percentile of its annual range. While the absolute ratio may indicate a slight preference for calls, the lofty percentile suggests puts have been purchased over calls at a faster-than-usual clip during the past two weeks. Another strong earnings showing could spook option bears, translating into a tailwind for the stock.

Echoing that, ETSY puts are flying off the shelves at nine times the average intraday pace today, with more than 2,000 traded. It looks like speculators are betting on a round-number break for the stock after earnings, buying to open the August 40 put.

Lastly, short interest on ETSY rose more than 12% during the most recent reporting period, and currently represents 7.2% of the stock's total available float. At Etsy stock's average daily trading volume, it would take just over a week for shorts to cover their bearish bets. A short squeeze in the wake of strong earnings could push ETSY onto its next leg higher.