The December Australian Dollar rebounded overnight from last week’s sharp sell-off on Monday with investors driven by signs of progress in discussions to resolve the fiscal logjam in the U.S. Additionally, there was also optimism in Europe where officials appear to be closer to releasing delayed aid for Greece.

U.S.lawmaker comments over the weekend are leading investors to believe that a compromise was possible in talks to avert the $600 billion “fiscal cliff”, which threatens to trigger a recession in early 2013.

A little clarity is going a long way as investors appear to see the light at the end of the tunnel and are pricing in a possible compromise.

Adding further to the positive shift in investor sentiment is the start of discussions by European officials to resolve the funding request by Greece. The meeting which begins today, Tuesday, is expected to conclude with Greece receiving a two-year funding deal. Additional terms would include the postponement of any longer-term solution until after a September 2013 German general election.

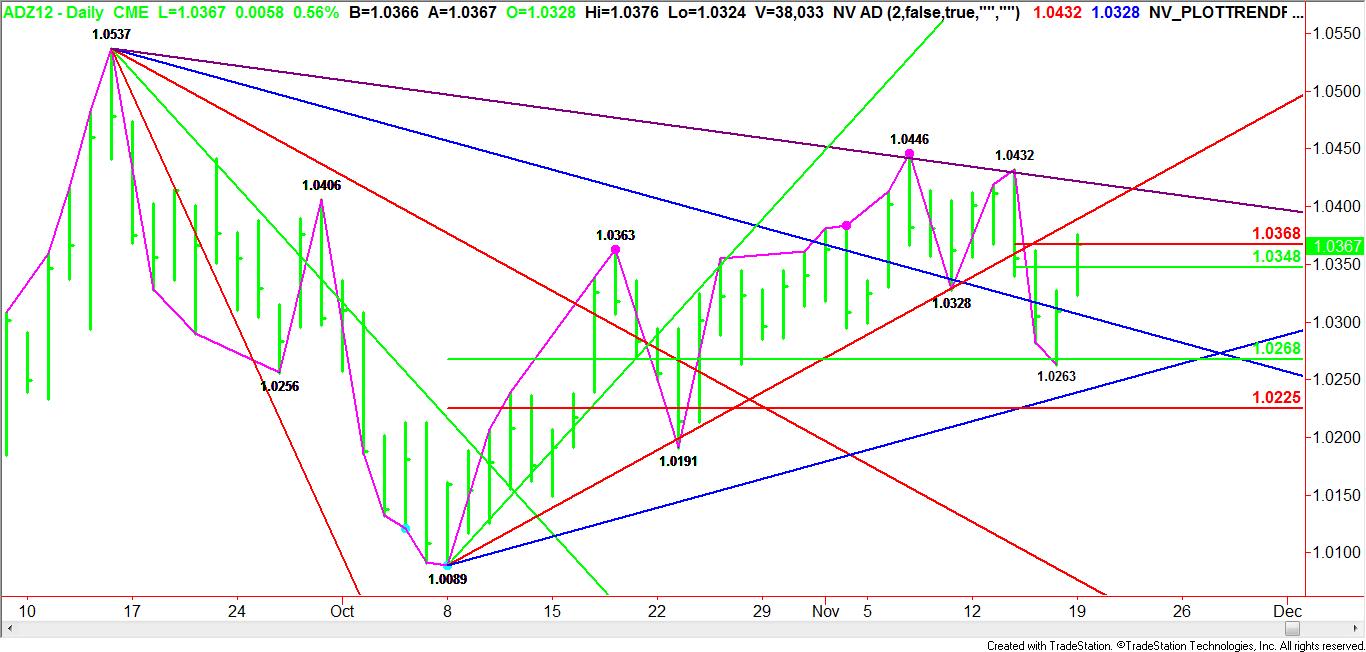

Technically, the December Australian Dollar is in a downtrend on the daily chart, but Friday’s reversal bottom is generating enough follow-through momentum on Monday to fuel a possible challenge of a pair of tops at 1.0446 and 1.0432. Besides these two levels, a slow-moving downtrending Gann angle drops in at 1.0422 to provide additional resistance.

Late last week the market tested the 50% level created by the 1.0089 to 1.0446 range at 1.0268. The actual bottom was 1.0263. The new short-term range is 1.0263 to 1.0432. Monday’s surge triggered a test of this zone with the upside momentum threatening to take it out with conviction.

If demand for higher yielding assets continues, then look for the December Australian Dollar to grind higher throughout the session.

U.S.lawmaker comments over the weekend are leading investors to believe that a compromise was possible in talks to avert the $600 billion “fiscal cliff”, which threatens to trigger a recession in early 2013.

A little clarity is going a long way as investors appear to see the light at the end of the tunnel and are pricing in a possible compromise.

Adding further to the positive shift in investor sentiment is the start of discussions by European officials to resolve the funding request by Greece. The meeting which begins today, Tuesday, is expected to conclude with Greece receiving a two-year funding deal. Additional terms would include the postponement of any longer-term solution until after a September 2013 German general election.

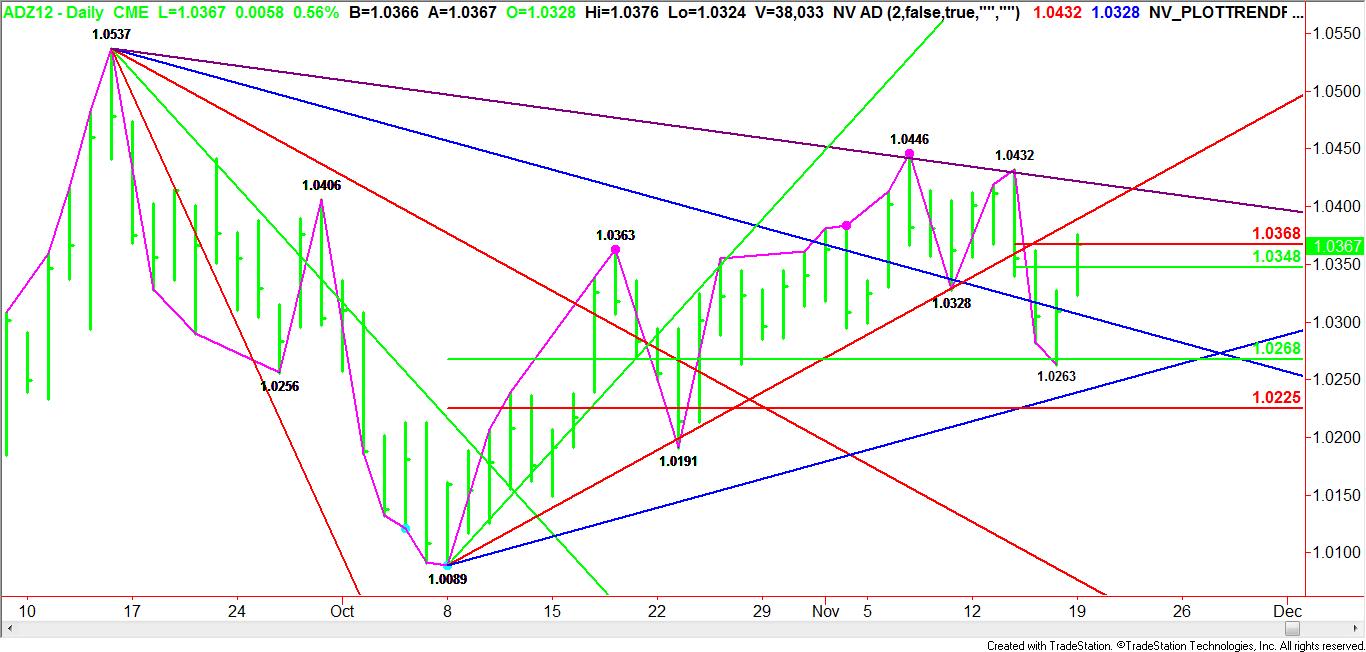

Technically, the December Australian Dollar is in a downtrend on the daily chart, but Friday’s reversal bottom is generating enough follow-through momentum on Monday to fuel a possible challenge of a pair of tops at 1.0446 and 1.0432. Besides these two levels, a slow-moving downtrending Gann angle drops in at 1.0422 to provide additional resistance.

Late last week the market tested the 50% level created by the 1.0089 to 1.0446 range at 1.0268. The actual bottom was 1.0263. The new short-term range is 1.0263 to 1.0432. Monday’s surge triggered a test of this zone with the upside momentum threatening to take it out with conviction.

If demand for higher yielding assets continues, then look for the December Australian Dollar to grind higher throughout the session.