Market movers today

- Today, focus is first and foremost on the ongoing Brexit negotiations, as the deadline for reaching a deal before the EU summit is tomorrow. There was 'no breakthrough' over the weekend and the rest of the EU seems less upbeat than the Irish. It was also a blow for Johnson that DUP's deputy leader Dodd said 'no' to the current proposal. We now think the probability of a deal is 20% (from below 10% previously) but our base case remains another Brexit extension followed by a snap election. For more details see our Brexit Monitor: 20% probability of a deal but another extension followed by snap election remains our base case , 13 October.

- Markets will also focus on the ongoing trade negotiations between the US and China after they completed 'phase one' of the negotiations on Friday. Despite the renewed optimism, in particular from the US side, we think there are still significant hurdles for a more comprehensive deal.

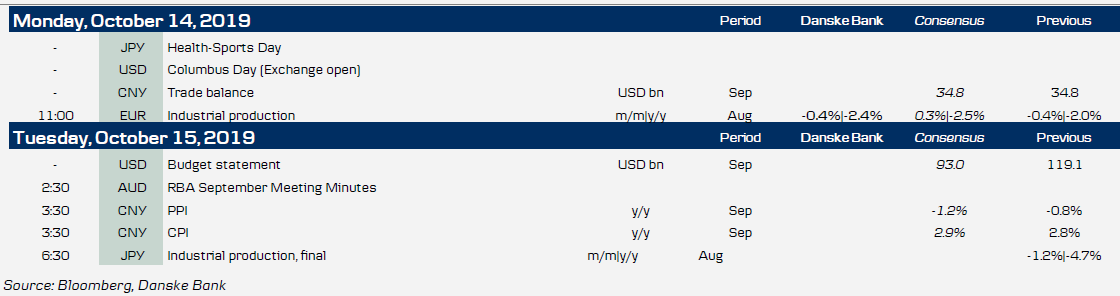

- Today we have a thin calendar in terms of economic data releases. The euro area industrial production in August will likely attract attention given the weak PMIs. We do not expect the data to bring any cheer, showing the industrial recession dragging out in Q3.

- Otherwise this week, focus is on US retail sales, which will be vital for the Fed's decision whether to cut again later this month or not. We have plenty of FOMC members speaking this week ahead of the Fed's blackout period beginning on 19 October.

- In the Nordics, we are in particular interested in the Swedish unemployment data for September due out on Thursday. We have seen an unexpectedly hefty rise in unemployment over the past months. We feel that unemployment data may be a bit exaggerated. We were wrong about a correction last month but we make another attempt this time around.

Selected market news

Risk sentiment improved late on Friday as rumours circulated on a potential US-China agreement. While markets were slightly less optimistic before closing, the positive risk performance (Dow Jones +1.2%) has carried over to Asian markets this morning, which is up by a similar magnitude. Added to the trade talks, optimism about Brexit is expected to support risk sentiment today.

On Friday, the Fed sent a strong signal to the short end of the US curve as it announced a balance sheet expansion via bill purchases at least into Q2 next year, with an initial pace until mid-November of USD60bn. This is not to be seen as a restart of QE, but as an offer of sufficient liquidity in the short end of the curve.

Scandi

Fixed income markets

This week, Germany is tapping in the 2Y (Tuesday) and 30Y (Wednesday) segments. We see little value at the front end of the German curve given the negative carry to e.g. swaps and the risk that the upcoming tiering will trigger selling of negative yielding short-dated bonds from European bank treasuries. France is tapping in the medium-term segment (3Y, 6Y and 7Y) and linkers (5Y, 6Y and 10Y) and Spain is active in the 2Y, 5Y and 10Y segment. Spain will announce the volume later today. We still see value in 10Y Spain versus 10Y France. EUR35bn is coming to the market alone this week followed by another EUR105bn the coming two weeks. In total, we estimate a EUR104bn positive net cash flow the following three weeks. The ECB reinvestment need is also record high with EUR29bn in October. For more see Government Bonds Weekly that we published on Friday.

Yesterday, ECB board member Holzmann from Austria said that the ECB QE policy is ‘counterproductive’. He also argued that the inflation target temporarily could be set at 1.5% and that he hoped for a new course under Lagarde, see here. The ECB board is obviously more divided than ever and if we furthermore are starting to discuss a lower inflation target the obvious trade is to position for lower inflation expectation (alternatively higher real rates). We still see 5Y5Y EUR inflation hitting 1% here in 2019 and see the recent risk-driven move higher in 5Y5Y as temporary. This week we will have a series of ECB speeches mainly in connection with the IMF Washington gathering later this week.

FX markets

We see the interim trade war deal (and positive Brexit talks) as an opportunity to re-position for broad dollar strength in a few week(s) time. This week, the key theme is answering how long the optimism can persist. We see room to price a lower EUR/SEK, EUR/NOK and higher EUR/JPY, whereas EUR/USD is probably done. See more in US-China Trade - 'Phase 1' trade-deal not a game-changer for the global economy, 12 October.

GBP has rallied the past few days as the perception of a no-deal Brexit risk has shifted materially. There is genuine progress in politics but the market move is purely driven by the perception of digital risk in GBP and hence, we expect volatility to remain high as we move towards the October deadline. Our base case remains an extension with EUR/GBP at 0.90. See Brexit Monitor: 20% probability of a deal but another extension followed by snap election remains our base case, 13 October

We have raised our EUR/SEK forecast to 1M 10.90, 3M (NYSE:MMM) 11.00, 6M 11.20 and 12M 11.20 as we remain firm in our view that the downturn will continue. The labour market is deteriorating, there is a marked cyclical slowdown, inflation is muted and expectations are falling, with external growth conditions worsening and international central banks cutting rates. Given that we continue to see headwinds for the SEK we thus recalibrate our forecast. See FX Strategy - EUR/SEK: Winter is coming, 11 October 2019.

As expected, the incumbent PiS party won another four-year term in the Polish parliamentary election with a projected support of 43.6% of the votes. That would translate into a majority of seats - 239 - in the 460-seat lower house of parliament. Unlike the last election when the PIS victory shook financial markets, the solid track record of the government in managing the Polish economy and public finances over the past four years means yesterday’s election will not impact PLN in any material way. Instead the currency is likely to strengthen on the back of the US-China trade deal.

Key figures and events