Optimism is now a dirty word in the world of finance it seems, as increased bullishness at the prospects for the U.S. economy led to a huge sell-off across markets overnight. The dollar pulled higher, U.S. debt sold off heavily, and stock markets plunged on the belief that the Fed is much closer to moving away from loose monetary policy than many had thought.

The comments from the Fed were carefully attuned, and it looks like this is a meeting that was taken with the very real knowledge that markets have been spooked of late by what the central bank could be up to. This was a withdrawn release, designed to explain that the tapering away of asset purchases will come but they are wary of scaring the horses.

The balancing act in the data revisions comes down on the side of tapering sooner rather than later, given that growth is roughly the same as it was during the March meeting and unemployment is also towards the lower side of March expectations.

The key will be inflation. The Fed’s stock measure of inflation (Personal Consumption Expenditure) only rose 0.7% through the year to April, less than half the bank’s target. The Fed expects these measures to remain muted through 2014 even with the diminished downside risk, so it is easy to see policy to remain unlimited.

Bernanke was at pains to make it clear yesterday that ceteris paribus, all things being equal, should the recovery continue at a similar pace to now then tapering should begin in Q3 of this year with asset purchases being phased out at some point in 2014

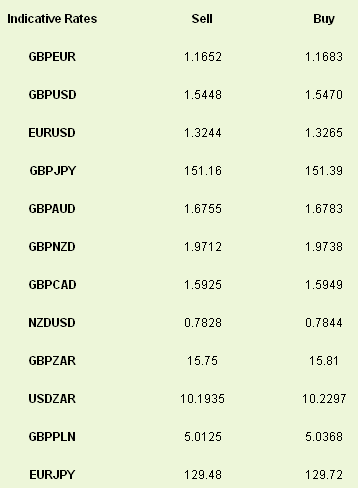

This was music to USD bull ears and the dollar gained over a per cent against all of its crosses in short order. I am always reticent to make predictions in the 24hrs after a big move such as this, but I fear we have seen the near-term top in GBP/USD.

If the withdrawal of stimulus was not enough to scare markets lower, poor data from China helped the bears. HSBC’s survey of manufacturing companies showed a sector contracting at a much faster rate than had been expected. This comes only a few days after interbank lending markets in country showed the strain of a central bank tired of excess liquidity, with the 7-day repo rate hitting a whopping 12%.

Poor Chinese data and a strong dollar have contributed to a massive fall-off in the Aussie dollar and is at its lowest level since mid-2010. Likewise, other EM currencies such as ZAR, INR, NZD and PLN have been taken to the woodshed overnight and hedging looks attractive at these levels.

Away from the heat and light of the Fed and China, the Bank of England published the minutes of its latest meeting yesterday. Outgoing Governor Mervyn King, alongside two other members of the MPC voted for more stimulus but were outdone by the remainder of the committee. The basis of the recovery is established according to the board, but we still see further stimulus from the Bank.

In the short-term, the key to Carney’s success will be just how well he can convince members of the MPC that the loose monetary policy and ‘forward guidance’ (i.e. declarations of loose monetary policy for a certain time period) can work. King and two other members of the currency rate setting committee have been outvoted on no fewer than three consecutive occasions coming into this July meeting. Carney joining the panel will not shift the balance immediately.

Following last night’s fun and games, the tin hats are firmly on this morning and we could easily see further losses through the session.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Optimism Abounds - Unless You Were Long

Published 06/20/2013, 06:07 AM

Updated 07/09/2023, 06:31 AM

Optimism Abounds - Unless You Were Long

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.