Optimal Payments Review Of Interim Results

Optimal Payments (OPAY.L) reported stronger than expected H112 revenues and EBITDA, driven by revenue upside from the straight through processing (STP) business. Recent restructuring in the Stored Value (SV) business has reduced the ongoing cost base and revenues appear to be picking up in H2 as the VIP programme starts to take effect. We raise our revenue forecasts for FY12 and FY13 to reflect strength in STP, and despite lowering gross margins to reflect mix and higher processing costs, we increase our FY12 EBITDA forecast by 17% and FY13 by 8%.

H1 reflects strength of STP business

H1 y-o-y revenue growth of 37% was driven by strong STP volumes, as existing customers generated more business and new customers started using the STP processing platform. Restructuring of the SV business was completed in Q1, resulting in a lower cost base. This should remain relatively fixed enabling any upside in high gross margin (c 74%) SV revenues to drop through to EBITDA. STP partnerships signed in H1 have already started to deliver new customers and banking partnerships under discussion in Europe and the US could lead to additional customers in those regions. The STP platform could support substantial growth in volumes without requiring additional investment.

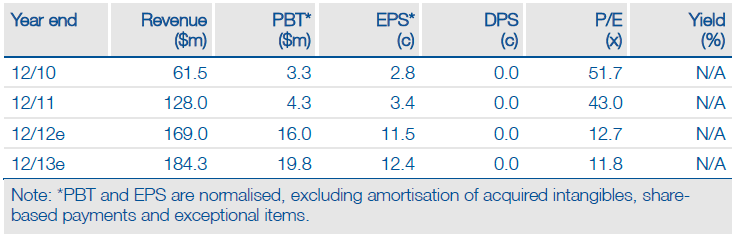

Estimates raised for FY12 and FY13

We have increased our revenue estimates for FY12 (+16%) and FY13 (+17%) to reflect the substantially stronger than expected STP business. Although H1 SV revenues were below expectations, the business has shown a material uptick in H2 and our H212 and FY13 forecasts are substantially unchanged. We have factored in higher processing costs for both businesses, but as the fixed operating cost base remains substantially unchanged, the gross profit upside drops through to the EBITDA line, leading to upgrades to EBITDA of 17% in FY12 and 8% in FY13.

Valuation: Still at a discount despite EBITDA growth

Since the end of March, the share price has risen 34%, but on a FY12e EV/EBITDA multiple of 6.5x our upwardly revised forecast, OP still trades at a discount to peers. On current margin projections this appears reasonable although we highlight that OP generates strong free cash flows (FY12e FCF yield 5.6%; FY13e 9.3%) and if it is able to expand margins to closer to peer levels, the multiple could rise to at least 8x (110p/share).

To Read the Entire Report Please Click on the pdf File Below.

Optimal Payments (OPAY.L) reported stronger than expected H112 revenues and EBITDA, driven by revenue upside from the straight through processing (STP) business. Recent restructuring in the Stored Value (SV) business has reduced the ongoing cost base and revenues appear to be picking up in H2 as the VIP programme starts to take effect. We raise our revenue forecasts for FY12 and FY13 to reflect strength in STP, and despite lowering gross margins to reflect mix and higher processing costs, we increase our FY12 EBITDA forecast by 17% and FY13 by 8%.

H1 reflects strength of STP business

H1 y-o-y revenue growth of 37% was driven by strong STP volumes, as existing customers generated more business and new customers started using the STP processing platform. Restructuring of the SV business was completed in Q1, resulting in a lower cost base. This should remain relatively fixed enabling any upside in high gross margin (c 74%) SV revenues to drop through to EBITDA. STP partnerships signed in H1 have already started to deliver new customers and banking partnerships under discussion in Europe and the US could lead to additional customers in those regions. The STP platform could support substantial growth in volumes without requiring additional investment.

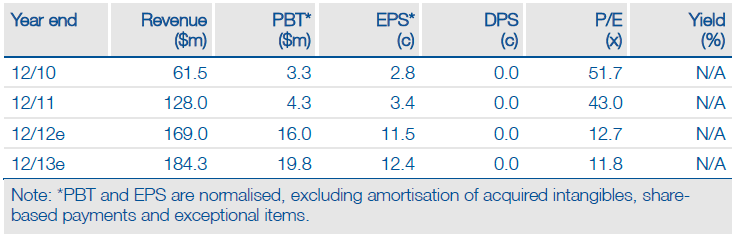

Estimates raised for FY12 and FY13

We have increased our revenue estimates for FY12 (+16%) and FY13 (+17%) to reflect the substantially stronger than expected STP business. Although H1 SV revenues were below expectations, the business has shown a material uptick in H2 and our H212 and FY13 forecasts are substantially unchanged. We have factored in higher processing costs for both businesses, but as the fixed operating cost base remains substantially unchanged, the gross profit upside drops through to the EBITDA line, leading to upgrades to EBITDA of 17% in FY12 and 8% in FY13.

Valuation: Still at a discount despite EBITDA growth

Since the end of March, the share price has risen 34%, but on a FY12e EV/EBITDA multiple of 6.5x our upwardly revised forecast, OP still trades at a discount to peers. On current margin projections this appears reasonable although we highlight that OP generates strong free cash flows (FY12e FCF yield 5.6%; FY13e 9.3%) and if it is able to expand margins to closer to peer levels, the multiple could rise to at least 8x (110p/share).

To Read the Entire Report Please Click on the pdf File Below.