In a world of zero interest rates and macroeconomic worries, there are a limited number of investment alternatives that can provide reasonable returns and allow investors to sleep at night. Stocks appear to be reasonably valued but are currently being held hostage by concerns about Europe and weakening US economic numbers. Government bonds have rallied to the point where they are paying negative real yields. What is an investor to do?

Despite well-rehearsed macroeconomic concerns, the US corporate sector remains healthy. While US corporations are likely to experience some ill effects from a slowing global economy, companies are well-positioned to weather a slowdown. Since the 2008 financial crisis, US corporations have repaired their balance sheets; they have reduced debt, extended debt maturities, increased working capital, and built up healthy cash balances. As a result, corporate credit quality in the United States remains robust.

Moody’s Investors Service is currently forecasting that the corporate default rate over the next 12 months will be less than 3%, which is significantly below the historical average of 4.6%. Due to macroeconomic concerns, however, the high-yield bond and loan markets are trading as though the default rate will be between 5 and 6%.

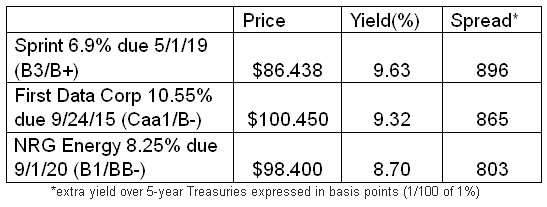

This disparity creates an opportunity for investors looking for attractive risk-adjusted returns. Many borrowers whose 5-7 year bonds offer yields between 7-10% are highly unlikely to default. Here is a small sample of some of these bonds:

Bonds and loans are contractual obligations by a borrower to repay the lender at a date certain. These contracts restrict the company’s ability to incur additional leverage, pay dividends, or engage in other activities that diminish the company’s ability to meet its repayment obligation. Loans rank at the top of a borrower’s capital structure and have a senior claim on the borrower’s assets; and they also pay floating interest rates, which eliminates interest-rate risk. Bonds rank below a borrower’s loans but above its stock, and high-yield bonds are hybrid debt-equity instruments that pay high coupons.

Cumberland’s Core High-Yield and Opportunistic Credit Strategies invest in high-yield bonds and loans, as well as on a limited basis in some mortgage REITs, bank preferred stocks, and other instruments that produce yield income based on corporate credit. We expect companies that are capable of meeting their obligations to produce attractive real returns regardless of market volatility.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Opportunities In High-Yield Credit

Published 06/05/2012, 02:30 AM

Updated 05/14/2017, 06:45 AM

Opportunities In High-Yield Credit

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.