With each passing day, the situation gets worse. The addiction gets deeper. The problem is, most folks don’t understand what’s happening. They’re taking a short-term look at a very long-term problem.

It’s not earth-shattering news that interest rates are in ultra-low territory. In many ways, rates are virtually nonexistent. That fact has stirred one of the greatest, most resilient bull markets in history.

But too many investors are focused on a single idea. They ponder when the Federal Reserve will start to raise rates. It’s a fine question for the curious. But it’s not important. At least not in the long run.

After all, the addiction to free money has spread across the planet... and it’s not disappearing anytime soon.

For proof, we point to a report recently released by the Bank of England that shows just how long interest rates are likely to remain in record-low territory. A single image from the central bank shows us that we shouldn’t care much about the first rate hike. It’s the trajectory of the increase that matters.

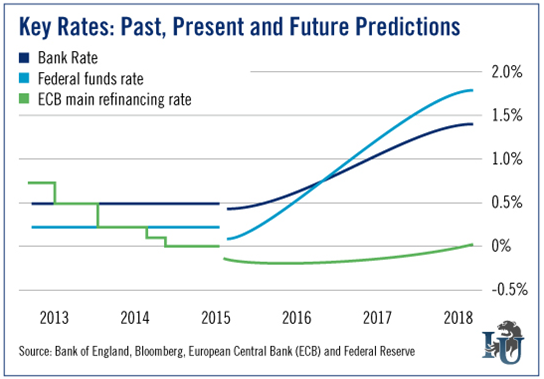

The chart below shows current rates in Europe, the United States and England. It also shows the market’s expectations for future rate hikes.

It doesn’t paint a pretty picture.

The chart is more proof that even if central bankers surprise us with rate hikes tomorrow, the small increases we’ll likely see over the next 36 months will have little material impact on the economy. After all, under current expectations, we still won’t be in normal territory three years from now.

Can you afford to wait that long?

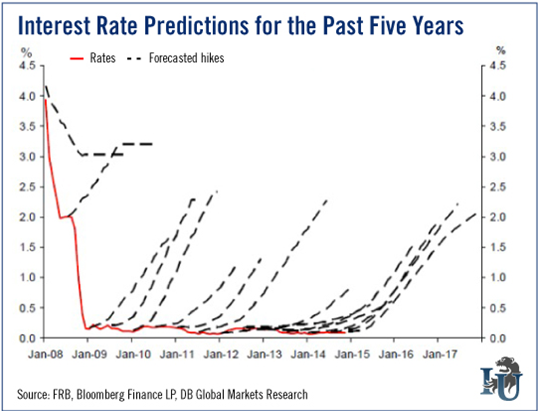

And let’s not forget, most of these forecasts have been overly hawkish. As the chart below shows, forecasters have grossly overestimated the speed of future rate hikes throughout this recovery.

Like we said, with each passing day, the addiction gets worse. The longer central banks across the planet keep rates artificially low, the harder it will be for them to raise rates.

As investors, the situation is not pure doom and gloom. Far from it.

Yes, traditional models must be tossed out the window. Investors using typical income strategies will get steamrolled as time marches on... and their accounts don’t budge. We’re also getting increasingly worried about business models that rely on rate arbitrage. Insurers... lenders... even entire pension funds are at risk as rates remain lower than most folks ever imagined they would.

But there is opportunity. Several ideas jump out.

For example, I was in Boston earlier this month meeting with a handful of CEOs and CFOs who recognize what’s happening. Some clearly aren’t prepared for sustained low rates, but others are eagerly taking advantage of the situation.

Two sectors every investor must explore are mortgage real estate investment trusts (mREITs) and business development companies (BDCs). Just remember, all are not created equal. While most BDCs have the ability to adapt to low rates, plenty cannot. Look for firms that are clearly focused on short-term investments. And with mREITs, focus on firms that have flexibility. For example, when I talked with the folks from Capstead Mortgage Corporation (NYSE:CMO), it was clear their exclusive focus on adjustable-rate mortgages allows the company to largely shrug off sluggish interest rates.

Speaking of mortgages, don’t fall for the hogwash that paying off your mortgage must be a priority. With rates this low, that sort of traditional logic doesn’t make sense. There’s a smarter strategy. Instead of using excess cash to pay off your mortgage, invest it where the return is larger. With mortgage rates hovering just north of 4%, it’s not difficult to find a better return.

It’s clear that interest rates are not returning to normal anytime soon. All across the globe, rates are still coming down.

That’s okay. It’s something we can easily deal with. But you must adjust your strategy.

Explore your portfolio and see if your investments depend on rising rates. If they do, it’s vital that you add assets that take advantage of this situation. There are plenty available.