Markets rose on Tuesday, continuing their advance off last week’s lows, as tension in Crimea dispersed and US housing data buoyed stock market investors. In currencies, the US dollar held its ground, while the British pound dropped and the euro reversed early losses.

Looking ahead, the big event of the week will be the FOMC interest rate decision and meeting, which is now underway.

Looking at the fundamentals this week, our analysis identifies opportunities in the USD/JPY and EUR/USD based on the COT (Commitment of Traders) reports and open position statistics.

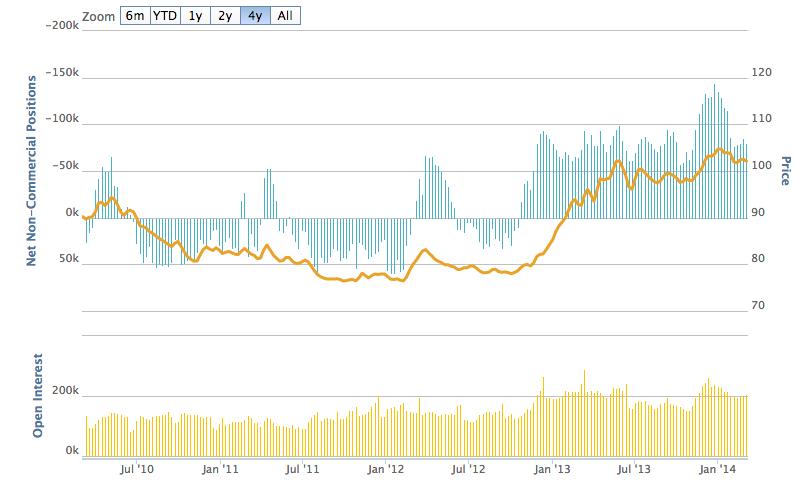

USD/JPY

A look at the COT reports for the USD/JPY shows that net non-commercial positions have stabilised around the -85,000 mark and unsurprisingly, this has seen USD/JPY fall back to 101.45.

According to the chart, dollar yen is nearing an important inflection point here that could see the currency move back towards 100.

As long as net commercial positions remain around the negative 50k - 85k mark, bias in the currency is likely to be on the bearish side with any resurgence in USD/JPY not likely to happen until the second half of the year.

USD/JPY 4 Year Chart" title="USD/JPY 4 Year Chart" width="474" height="242">

USD/JPY 4 Year Chart" title="USD/JPY 4 Year Chart" width="474" height="242">

USD/JPY Monthly Chart" title="USD/JPY Monthly Chart" width="442" height="242">

USD/JPY Monthly Chart" title="USD/JPY Monthly Chart" width="442" height="242">

EUR/USD

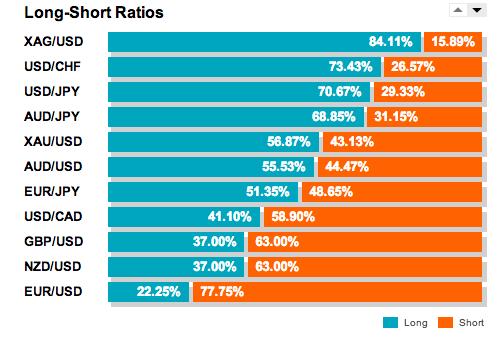

Once again, the other part of our focus is on the EUR/USD this week, as the currency remains in a significant one-sided condition according to open position data from large forex broker Oanda.

As you can see from the graph, EUR/USD is now the most one-sided currency pair out of all of the major trading partners, with just 22.25% of open positions being long positions.

In fact, this is down from last week, when around 25% of positions were longs and coincides with EURUSD making a break past 1.39. Indeed, the move past 1.39 has seen EURUSD break out of a long term descending triangle pattern to the upside.

For trend followers, this move could be a bullish signal to go long and there is likely a 30-40% chance that this could begin a new upward trend past 1.40.

However, the one-sided condition suggests that in the near term, EURUSD is due for a correction. The price chart shows that EUR/USD has closed higher 6 weeks in succession so there is no doubt that EURUSD is overbought here. A short, sharp correction should be in order very soon.