Nerves ahead of the Fed kill Asian volumes

The Fed meeting this evening has loomed large over Asian markets today. Volumes were down across the board, as investors decided to keep money on the sidelines until they see the ultimate decision from the Fed. With the ECB and the BOJ both seemingly de-emphasizing the importance of further currency devaluations at their meetings, there has been less upside pressure on the USD than one might have expected ahead of the meeting. Nonetheless, the DXY dollar index has recovered 1.3% from its mid-February low.

The challenge for the Fed is striking a delicate balance between warning the markets that a rate rise could come as soon as June, but not causing a rally in the USD that could kill off the nascent recovery in the US manufacturing sector. This delicate situation matters immensely for China, which would likely see a dramatic resurgence in capital outflows if the USD rallied strongly again. Continued strength in EUR and JPY in the wake of those central bank meetings has provided some much needed breathing space for the PBOC. Nonetheless, the CNY fix today saw a noticeable weakening of the currency by 93 pips ahead of a potential USD rally.

US economic data has improved dramatically of late, and has helped drive a recovery in the US stock markets as well as repricing for Federal Reserve rate hikes.

Source: Bloomberg Finance

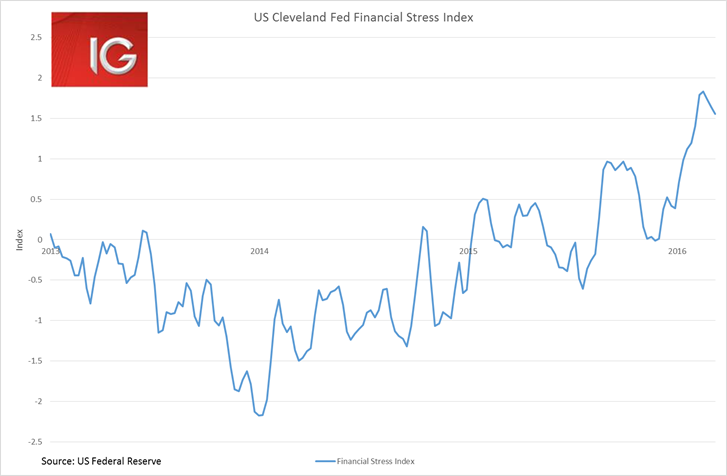

The moderation in the US dollar’s strength does seem to have assisted significantly in easing financial conditions. The Cleveland Fed’s Financial Stress Index has eased substantially since mid-February, which will no doubt reassure Fed members.

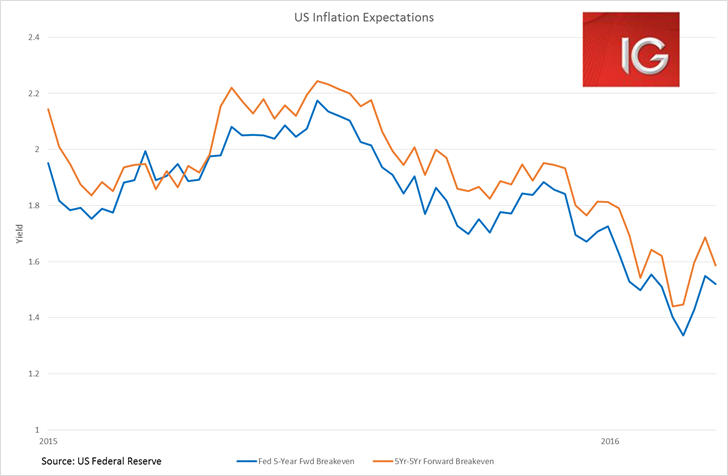

Inflation expectations in the US have also picked up noticeably alongside the recovery in oil prices since mid-February. The difference between Treasury Inflation Protected Securities (TIPS) and nominal Treasuries have been steadily rising over the past few weeks. The Fed’s 5-Year Forward Breakeven rate and the 5-Year 5-Year Forward Breakeven rate have both been reacting to the rise in oil prices, even though they are meant to measure long-term inflation expectations.

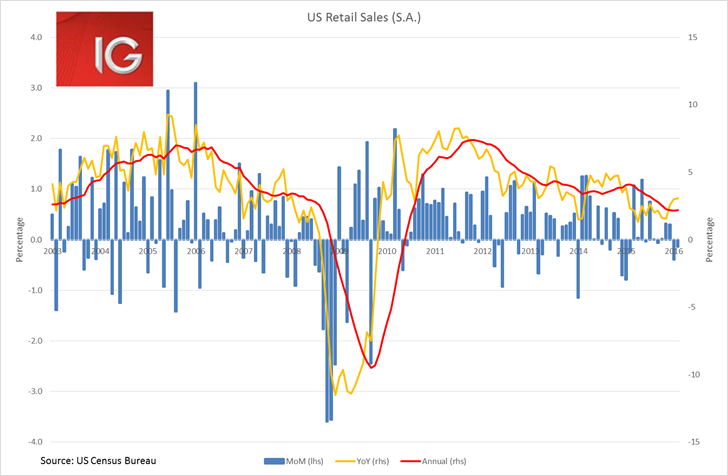

The overnight release of US retail sales for February came in slightly better than estimates, but were still weak particularly in the control group that feeds directly into the quarterly GDP calculation. But the noticeable recovery in year-on-year growth in headline retail sales (+3.1% YoY) does look to be leading the index higher into the first half of the year.

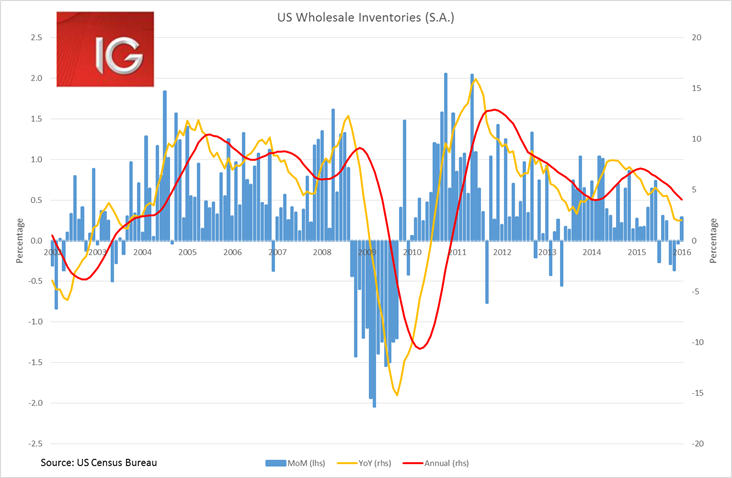

The overnight release of strong month-on-month growth in US wholesale inventories in January also points to a recovery in the US manufacturing sector. Inventories should provide a decent contribution to 1Q GDP in the US if this trend continues. The only concern is the very high inventory-to-sales ratios (currently at 1.4, the highest since the GFC), but hopefully these ease in February alongside the improvement seen in February Manufacturing PMIs.

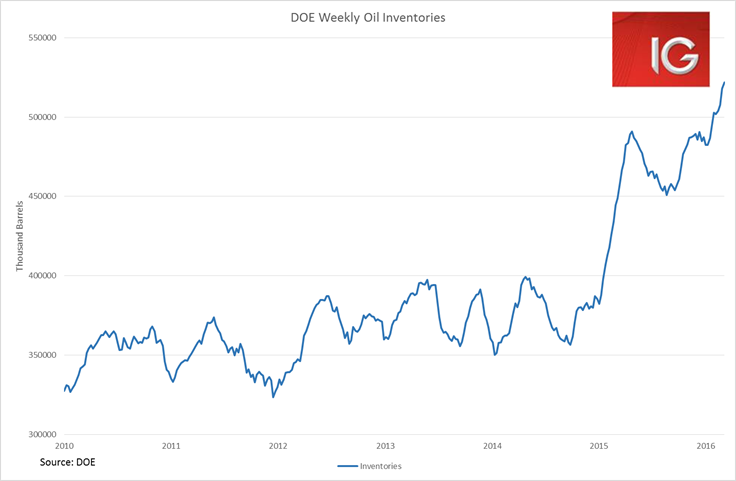

Oil prices have seen their biggest fall this week in almost a month after Iran re-emphasized its understandable position that it will not be party to any production freeze. Nonetheless, the API US oil inventories number only grew by 1.5 million barrels last week, and if a similar number were seen in this evening’s Department of Energy number it could be very bullish for the oil price. Currently, the consensus estimate is for crude inventories to increase by 3.1 million barrels, ahead of the API number. Market participants will also be looking for a further decline in gasoline inventories indicating that consumer demand from the low oil price is steadily leading to a rebalancing of the market.