Investing.com’s stocks of the week

Expectations for the ECB, bounce in Chinese inflation, RBNZ cuts rates

Asian markets have reacted fairly well to the bounce back in oil prices overnight. Chinese equities have reacted badly to the CPI release despite the fact that the weakening of the Core CPI provides further scope for significant monetary easing. The 4.5 million barrel decline in gasoline inventories in the US DOE data overnight indicates that a strengthening of consumer demand from low oil prices is helping drive the rebalancing of the market. Terrorist attacks on pipelines in Nigeria’s delta region are likely to further impact global supply as armed groups show their displeasure from the newly elected government cutting off their handouts. Expectations in the equity markets are clearly buoyant ahead of the ECB meeting this evening, although the sharp selloff seen in the wake of the ECB’s December meeting is still very fresh in the minds of many investors.

ECB

The ECB meeting takes place this evening and expectations are high for significant further easing measures. Markets are expecting a further 10 basis point cut to the deposit rate bringing it to -40 basis points. They may announce a tiered ratio to negative rates, as the BoJ has done, to protect some parts of the banking system from negative rates. And they should announce at least a further EUR 10 billion increase to their current EUR 60 billion of monthly asset purchases.

Markets were clearly very disappointed with December’s easing package by the ECB, and no doubt they will be keen to try and exceed market expectations this time. Some of the more hawkish representatives on the ECB are not voting at this meeting, and that may give ECB President Mario Draghi the space to exceed market

If he does manage to surprise the market we should see a decent move lower in the euro. The preferred way to play this meeting would be short against the EUR through AUD, JPY and CHF crosses. Although I think given the move lower in NZD this morning after the RBNZ’s surprise rate cut, the NZD could be a novel cross to play it through. New Zealand still has interest rates at 2.25% and the currency is still a great yield play, particularly for those facing negative rates (i.e. Europe and Japan)!

China

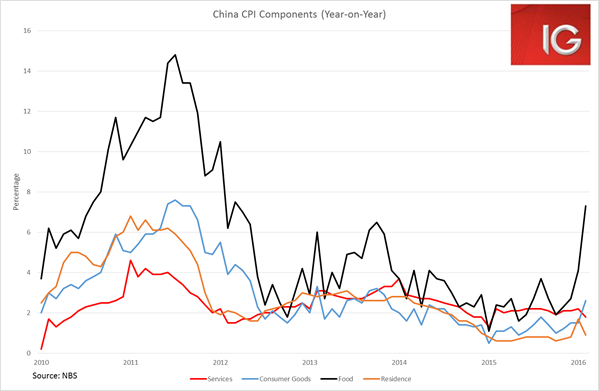

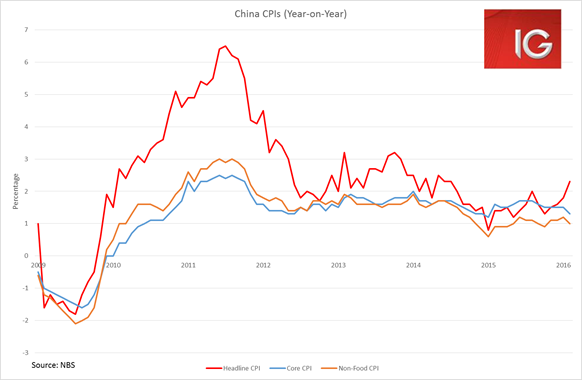

Chinese CPI surprised to the upside today, but rather than damaging expectations for further monetary easing a careful analysis of the breakdown makes clear the need for further monetary stimulus. The 2.3% YoY increase in headline CPI was driven by the 7.3% YoY increase in food prices, the biggest increase in food prices seen since March 2012. If such a situation persists, the PBOC may well have to resort to macro-prudential measures to control food prices. There is still considerable weakness evident in all the other price components, which warrants further monetary easing.

The lack of genuine price pressures in the economy was made painfully clear by the fact that both the Core CPI and Non-Food CPI measures weakened in February. Core CPI eased to 1.3% YoY, its weakest reading since January 2015, and a reading even lower than PCE Core inflation in the US! Such a dynamic shows the need for significant further monetary easing. Ex-food prices, real interest rates are clearly putting further pressure on an already weak economy.

New Zealand

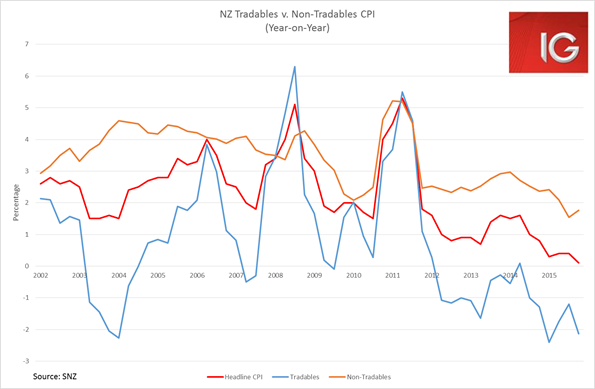

We were one of the 4 analysts out of 21 in the Reuters poll who correctly called the RBNZ’s “surprise” rate cut this morning. Slowing employment growth, barely positive CPI inflation and renewed declines in the dairy price all made a fairly compelling case for rate cuts. It is also interesting to note that the RBNZ appear far more concerned about China and the global deflationary effects of a potential CNY devaluation than any other central bank. The RBNZ learned to analyse China far more closely after being wrong-footed by adding 100 basis points to the policy rate in 2014, just as dairy prices collapsed and Chinese growth downshifted as capital inflows peaked and began to reverse.

We are currently calling for a hold on the policy rate at the RBNZ’s next meeting on 28 April, while they wait for the full release of 1Q data, and then another cut at their June meeting. CPI will have been released by April, but 1Q employment data is not out till 4 May. Based off RBNZ forecasts, inflation is unlikely to see any lift and employment growth is likely to weaken further, making the case for another cut by the RBNZ in June (even though 1Q GDP will not have been released by then). How Chinese economic data holds up this year largely dictates whether we see another rate cut after that, but it is clear that the RBNZ are well aware of the deflationary impact of a CNY devaluation and are trying to get out ahead of it and move the CPI upwards.

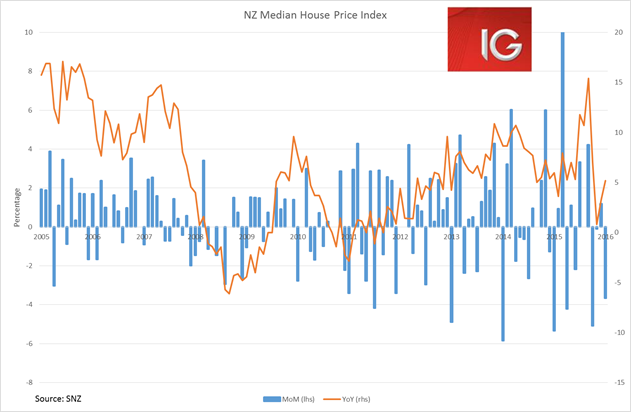

House prices in New Zealand also look to be easing off, making the financial instability risks less of a concern as they continue to cut rates to record lows.