- US Dollar to 111.00

- Euro to dollar-parity

- Oil to fall below $90

Key Events

On Wednesday, US futures on the Dow, S&P, Nasdaq, and Russell 2000 drew breath ahead of the publication of Federal Reserve meeting minutes, while European stocks rallied on relief after Norway's government intervened to end strikes at its oil and gas fields.

Global Financial Affairs

The STOXX 600 traded off its highs but was still up almost 2%. So, what's going on?

The pan-European gauge opened higher with all the major regional indices on the positive news from Norway as well as the announcement that Amazon (NASDAQ:AMZN) was going into partnership with Just Eat (AS:TKWY), which resulted in its shares jumping over 20%.

However, before purchasing Just Eat it is worth noting that today's jump does not change its overall trend.

The stock is trending lower and a better buying point is when the price rises above its 50 DMA.

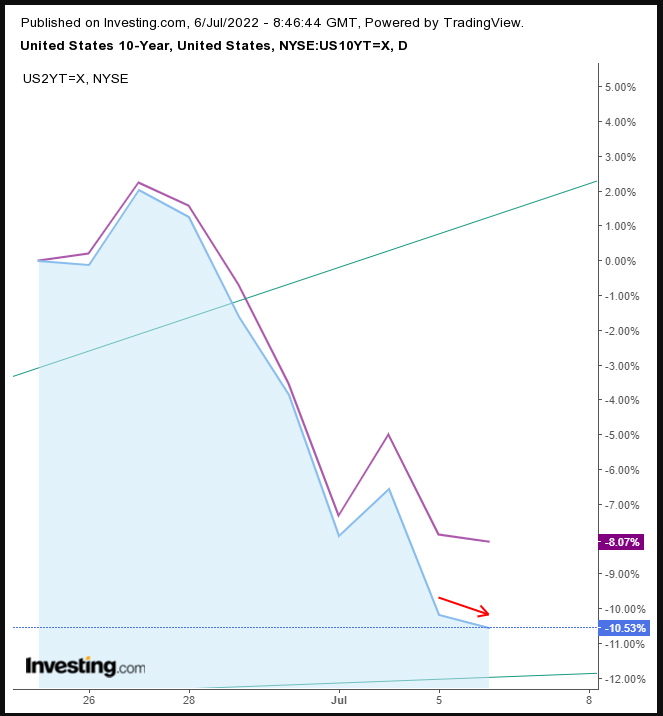

The bond market is still on a path to a recession. Yields on the 10-year note fell for the second day, extending yesterday's sharp decline. Investors are hoarding Treasuries, which tends to be a sign of risk aversion.

Yields have already fallen below their uptrend line and are testing a possible top.

The 10-2 year Treasury yield spread remained inverted as investors awaited the Fed minutes from its last meeting to gauge its policy priorities.

Not only has the 10-year remained lower than the 2-years, but it also deepened the inversion.

An inverted yield curve is a leading indicator of a recession. Investors are becoming entrenched in long-dated bonds even though they offer a lower payout than shorter-dated bonds, reflecting fears that things could get worse before they get better.

US equities rose yesterday with technology rallying at the expense of economically sensitive sectors, including energy, commodities, and industries.

The dollar was little changed, but held onto yesterday's 1.3% gain.

The greenback completed a bullish pennant, extending its uptrend. I forecast the dollar will hit 111.00, maybe even within as little as a week.

The market has been dumping the euro in favor of the dollar, the ultimate haven, sending it to a 20-year low. Moreover, the proximity to dollar parity has pulled bears out of the woodwork, initiating a wave of shorts.

The single currency completed an H&S Continuation pattern. The euro is likely to fall to at least parity with the dollar in as little as a month.

Gold is little changed after it plummeted 2.5% on Tuesday. The yellow metal may be falling on the increasing likelihood of a recession. After the 2008 crash, it slid as investors moved into the dollar.

The price broke through its uptrend line in March 2021, suggesting the downtrend since March 2022 is taking over. It is trading at its lowest level since October. At this point, I am bearish on gold.

And, perhaps, what may be the current leading recession indicator is oil, as its recent slump is indicative on an expectation of slowing demand as the economy contracts.

The price has finally completed its bearish flag, helping it fall through its uptrend line since December. The next test is the previous trough of $93 and I expect it will fall below that and even as low as the $86 level.

Up Ahead

- On Thursday the ECB publishes the account of its Monetary Policy Meeting.

- Initial jobless claims are published on Thursday.

- EIA crude oil inventory are reported on Thursday.