The Home Depot Inc. (NYSE:HD) has been a strong performer, evident from its robust earnings surprise history and the stock momentum. In fact, the company has been consistently doing well, courtesy of strength in Pro and DIY categories. Additionally, its efforts to provide an interconnected shopping experience to customers with localized and innovative products, and improved productivity are aiding its quarterly performance. As a result, Home Depot has emerged as an attractive investment option.

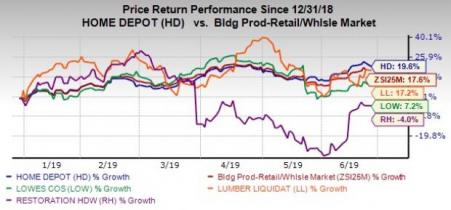

Driven by these positives, shares of this Zacks Rank #3 (Hold) company have gained 19.6% year to date, outpacing the industry’s 176% growth. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Home Depot is benefitting from its position as the world’s largest home improvement retailer. It is also reaping the benefits of the gradual improvement in the housing industry. The industry gains strength mainly from the efforts of constituent players to ramp up omni-channel capabilities along with inventory rationalization and elimination of underperforming stock-keeping units. Further, these companies are making investments toward enhancing the supply-chain system as well as delivery and fulfillment facilities, which should bolster growth.

Looking more closely at stocks in the broader industry, we note that Home Depot outpaced its peers. Notably, stocks like Lowe’s Companies (NYSE:LOW) and Lumber Liquidators (NYSE:LL) have witnessed growth of 7.2% and 17.2%, respectively, in the year-to-date period. Meanwhile, shares of Restoration Hardware (NYSE:RH) have declined 4%.

Let’s delve deeper and find out reasons that are placing Home Depot ahead of its peers.

Factors Aiding Stock Growth

A key driving force for Home Depot’s robust performance is its integrated retail strategy that encompasses digital properties and physical store assets. The company is witnessing improved customer satisfaction scores and conversion rates through investments in interconnected capabilities. In first-quarter fiscal 2019, online traffic remained sturdy and sales increased about 23%. The company remains focused on using its digital platforms in adjacent categories such as HD Home and pool.

Further, as a testament to its interconnected retail strategy, the physical stores continue to be relevant to shoppers as nearly 54% of online orders in the United States were picked up in stores. Moreover, the company continues to roll out automated lockers in its stores to make picking up of online orders easier and convenient.

Home Depot is also on track with the “One Home Depot” investment plans that were outlined in December 2017. It is benefiting from efforts to provide an interconnected shopping experience to customers, with localized and innovative products, and improved productivity.

The company reiterated its targets for fiscal 2020, anticipating total sales of nearly $115-$120 billion. This represents compounded annual sales growth of nearly 4.5-6%. Operating margin is expected to be 14.4-15%. Moreover, the company expects annual average capital spending to be about 2.5% of sales, with return on invested capital of more than 40%, reflecting the impact of the new tax reform. Alongside achieving these targets, it plans to accelerate investments in the next three years to enhance customer experience and shareholder value.

Moreover, Home Depot’s Pro segment is key revenue driver, with Pro sales outpacing DIY (do-it-yourself) sales for the past several quarters. The Pro segment is benefiting from the company’s efforts to enhance service capabilities for the Pros. Home Depot has been making investments to bring a more personalized experience for Pro customers through its new B2B website. In the fiscal first quarter, the company added 35,000 customers to its B2B website, bringing the total to 135,000 customers.

Based on customer feedback, Home Depot is continuously enhancing its online account management and ordering capabilities for the Pros. It expects to roll out this Pro online experience to more than a million Pros by 2019.

Bottom Line

There is no doubt that these efforts helped the company put forward strong quarterly results over the years. Notably, Home Depot delivered positive earnings surprises for over five years. Meanwhile, the company delivered sales beat in nine of the last 11 quarters.

These apart, we believe there is still momentum left in the stock as it has a long-term impressive earnings growth rate of 10.7% and a VGM Score of B.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Lowe's Companies, Inc. (LOW): Free Stock Analysis Report

The Home Depot, Inc. (HD): Free Stock Analysis Report

Lumber Liquidators Holdings, Inc (LL): Free Stock Analysis Report

Restoration Hardware Holdings Inc. (RH): Free Stock Analysis Report

Original post

Zacks Investment Research