Investing.com’s stocks of the week

Americans better fill up their gas tanks now, because oil prices are going back up soon.

Oil broke through $70 per barrel, just as I predicted. Prices may continue to drop to around $50 briefly, but the ultimate resting point will be around $60.

In classic American shortsightedness, the nation responded ridiculously by buying more of the gas-guzzling SUVs and trucks we love.

However, in a few months you’ll see the market start to recover and oil prices creep right back up, taking that $2 gas with it.

But don’t just take my word for it, look at the evidence…

Building the Case

Oil prices will recover for several reasons.

First, low prices are stimulating demand. That will sop up any excess production that’s hanging around.

Second, OPEC isn’t the only one that can manipulate prices. The U.S. fracking companies and oil majors are flexible enough to cut back production and put exploration and drilling plans on hold – which, in turn, will add upward pressure to prices.

Third, U.S. companies are willing to take desperate measures. The marginal players will close up shop or sell assets at fire-sale prices to survive.

And fourth, readers should remember that this is not a time-sensitive game. Much like the natural gas collapse, wells can get shut down and then restarted when prices recover – or when technology improves and reduces costs. The oil under the ground or in the Gulf doesn’t just disappear. The asset is still there and it’s still valuable… at the right time.

However, the fifth and most important factor has absolutely nothing to do with the cost of extraction.

Cash Wells Running Dry

I stand by my argument that low oil prices won’t last because most of the oil-producing nations simply can’t afford it.

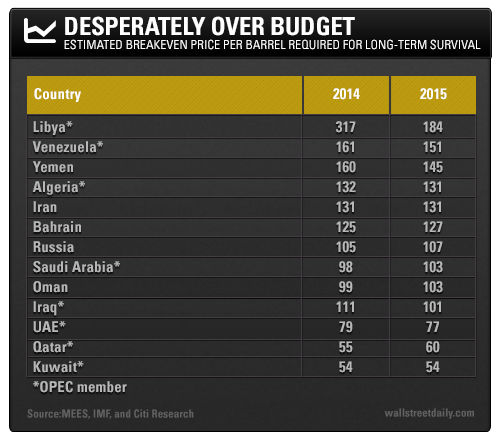

The chart below shows the fiscal 2014 and 2015 breakeven Crude Oil prices for most of the biggest oil-producing countries and OPEC members.

As you can see, it’s not a pretty picture for those countries.

With the exception of Qatar, Kuwait, and maybe the UAE, most oil-producing countries have been burning through their cash reserves ever since oil prices started dropping. Those cash reserves are the key to the future of oil prices.

You see, it’s not enough to just sell oil at whatever price you can fetch when your underlying economy is plunging into a recession and your political system is on the verge of destabilization. Just take a look at Russia.

When the country began its incursion into the Ukraine, it held over $550 billion in reserves, and its currency, the ruble, was trading at 30-to-1 compared to the US dollar. Since that incursion and the resulting sanctions and plunging oil prices, its reserves have fallen by more than $100 billion, and its currency is now trading 53 rubles to the dollar.

High reserves may cushion the fall for some time – maybe months or even a couple of years…

But in the end, as we’ve seen time and again, countries that blow their cash trying to defend themselves from the inevitable eventually collapse under the weight of their own stupidity.

And the OPEC nations have an even bigger problem.

Rickety Economics

OPEC members have trillions in reserves, but most of that cash is held by the rich Arab nations – Saudi, Qatar, Kuwait, Bahrain, and the UAE. The rest of the nations are economic basket cases.

Low oil revenue doesn’t just pose an economic threat to these countries. It could also damage their governments, which rely on huge subsidies (thanks to oil prices) to maintain order and stay in power.

As coffers run dry, they face two choices: social and political unrest that could lead to blood in the streets and coup-like rebellion, or cutting back production.

For them, it’s not about market share; it’s about survival, which is easier with prices at $80 per barrel or higher.

That’s the bet I’m making. It may not happen in six months or even a year, but regardless of where oil finally bottoms, the recovery is inevitable.

And “the chase” continues,