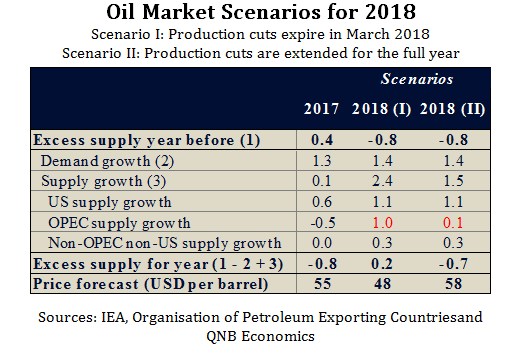

Oil prices have been considerably volatile in the last few weeks, having been range bound between USD50/b and USD55/b prior to that. Underlying such swings is a tug-of-war between rising oil output, mainly from the US, pushing prices down and declining inventory as a result OPEC cuts,which is pushing prices up. Despite these gyrations, expectations of the oil market rebalancing in 2017 have not changed. Global undersupply of around 0.8m barrels per day (b/d) iswidely projected and is the basis on which we maintain our forecast of an average price of USD55/b for the year. The bigger question, however, is what will happen in 2018. With OPEC’s production cuts set to expire in March of next year, the oil market outlook for 2018 is likely to hinge on whether the group decides to suspend or extend its production cuts. We believe the cuts are likely to be extended and prices will be capped at USD58/b in 2018, our estimated shale breakeven price.

The context for OPEC’s 2018 decision is framed by rising production from non-OPEC as well as Libya and Nigeria, OPEC members which are exempt from the cuts. According to the International Energy Agency (IEA), US oil production is expected to increase by over 1mb/d next year, which alongside increases from Canada and Brazil, will lift non-OPEC production to 1.4m b/d. Moreover, Libya and Nigeria have increased production in 2017 after long-running outages and could maintain higher levels of production going forward. These rises in production alone will completely exhaust the pickup in global demand growth, forecasted at 1.4m b/d in 2018.

In this context, there are two possible scenarios for OPEC in 2018. Under the first scenario, OPEC would allow cuts to expire at the end of March 2018 and resume normal production for the remainder of the year. This would result in an oil market that is over-supplied by 0.2m b/d in 2018.Based on our estimated historical relationship between oil balances and prices, we project oil prices would fall to an average of USD48/b in 2018 in this scenario.

In the second scenario, OPEC would extend its production cuts for the entire 2018. In this case, the market would be under supplied by 0.7m b/d as OPEC supply growth would increase by just 0.1m b/d due entirely to production by exempt members. In this case, prices would remain capped at USD58/b, the shale breakeven cost.

Oil Market Scenarios for 2018

Scenario I: Production cuts expire in March 2018

Scenario II: Production cuts are extended for the full year

Sources: IEA, Organisation of Petroleum Exporting Countriesand QNB Economics

Why do we see the second scenario as more likely?OPEC has an explicit goal to reduce the large accumulation of global inventories to their five year historical average of 2.7bn barrels. By extending the cuts for another year and creating under supply, inventories would be forced to decline to cover global demand. The drawdown so far has been stubbornly slow, stymied by rapid US production.However, at their current pace of decline, inventories would reach OPEC’s target by the end of 2018. A failure to extend the cuts would result in further delays in reaching that target.Moreover, given the negative impact of the fall in oil prices over the past few years on the fiscal balances of OPEC member states, there is limited appetite for another decline in oil prices even if it deters some US production.

Nonetheless, such a strategy comes with significant risks. An extension could cause OPEC to cede substantial market share. Compliance is also likely to be significantly challenged. But perhaps most important, such a strategy can create perverse incentives. By taking on the responsibility to clear the market, OPEC will be looked upon to do the same in the future while other producers maintain or ramp up production to maximise their share and benefit from higher future prices. Exiting from this strategy without causing major stress in the market will be increasingly difficult.

In conclusion, OPEC faces a major dilemma in 2018.While a lot can happen between now and November 30th when OPEC members formally decide their next course of action, the stated goal of clearing inventories and expected US production gains in 2018 suggests another extension is likely. Therefore, we expect prices to remain at USD58/b in 2018.