Key Points:

- OPEC elects to cut 700k b/pd of production.

- Iran, Nigeria, and Libya not bound by production caps.

- Russia suggests they will increase production by 400k b/pd.

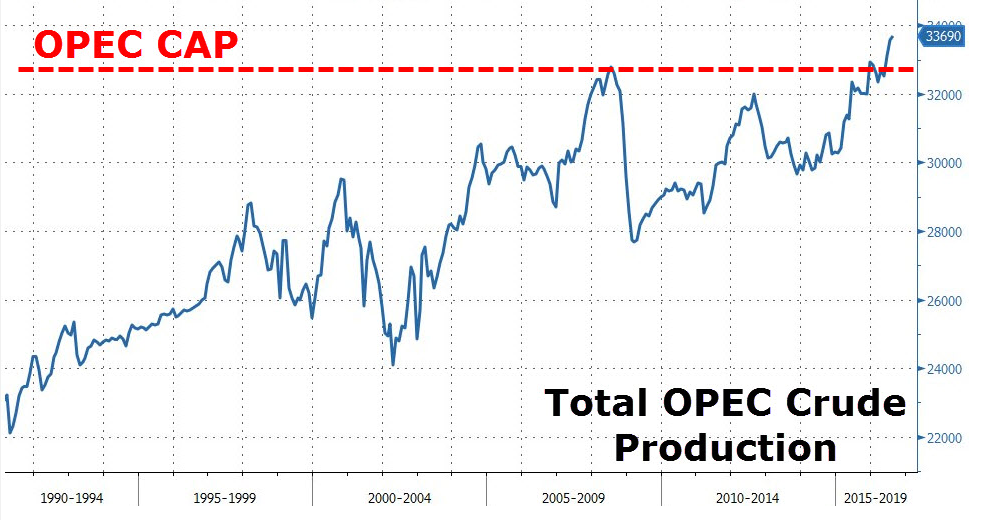

Crude Oil prices received a much needed bump overnight as OPEC appears to have finally agreed that cuts are needed to stabilise global prices. However, despite the Saudi Arabian led decision to cap output to 32.5 million barrels per day, the agreement appears to be nothing but a façade as it excludes Iran, Libya, and Nigeria from the production cap. Subsequently, plenty of questions remain as to just how `effective’ this non-agreement will actually be.

In fact, taking a look a look at the current production levels yields some interesting facts, given that the purported 700,000 b/pd cut simply reduces production to early 2016 levels relatively close to the long run high for oil supply. Additionally, this level of production is unlikely to have much in the way of a medium term impact on global oil prices given that much of the supply glut will need to be hoovered up first and this could potentially take quite a few months to flow through the supply chain.

Figure - Source: zerohedge.com

Also, the market should be questioning just how effective an OPEC led production cut will be without Iran, Libya and Nigeria agreeing to also cap production. Iran in particular is likely to stand up additional supply over the next few months which could go some way to offsetting the recent OPEC deal. In fact, cheating has often been a time honoured tradition amongst OPEC members and there is no suggestion that this time will be any different.

In addition, the Russian bear is looming behind the scenes and has already stated that they are planning on increasing production by approximately 400,000 b/pd. This would directly impact global crude prices whilst also ferreting away some of OPEC’s precious market share.

It would appear that the Cartel is still coming to grips with the reality of the new oil order and the fact that they no longer completely control oil supply in what has now become a global integrated market. There is now enough production amongst the Non-OPEC members to offset anything but the sharpest of production cuts and the reality is that the future of the oil markets now rests with marginal cost advantages not simply supply control.

Ultimately, crude oil prices are likely to continue to fall between the $38 .00- $48.00 range for the remainder of the year regardless of any `supposed’ production caps from OPEC. There is plenty more rebalancing needing to occur within the global markets before crude prices are able to climb to a more sustainable level. Subsequently, be very careful believing any of the Cartel’s hype in the upcoming months because they no longer exercise the same control over the global crude markets that they did a decade ago.