By Tom Kool

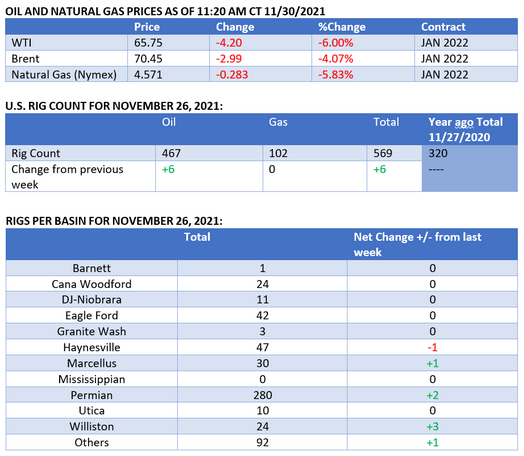

Oil prices witnessed their biggest day-on-day loss in 18 months on Friday, with WTI falling a whopping $10.2 per barrel to the low $70s as Omicron fears sent ripples across markets. The WTI Jan 2022 contract saw the highest number of traded volumes since April 2020, well above 800,000, as slumping oil prices broke through key technical levels and triggered algorithmic trading.

The rapid rise of Omicron cases across the globe and the lack of information regarding its health impacts triggered a series of travel restrictions, with some countries (notably Japan and Israel) shutting their borders altogether.

News of a potential OPEC+ policy rethink that would see the oil group pause its supply increments provided some supports for oil prices, though WTI fell on Tuesday morning towards the $66 mark.

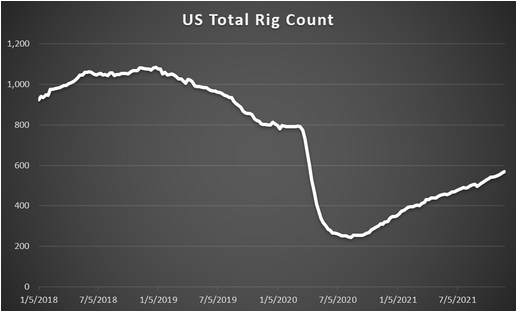

Chart of the week

Market Movers

US oil major ExxonMobil (NYSE:XOM) is in talks with Nigerian energy company Seplat to sell its shallow-water oilfields in Nigeria, as it seeks to divest assets in Europe and Africa to finance its US shale expansion.

BP (NYSE:BP) announced plans to build a green hydrogen production plant in northeast England, with the 60MW HyGreen Teesside project located next to a blue hydrogen project, aiming to deliver 30% of Britain’s hydrogen production by 2030.

Italian energy major ENI (MI:ENI) Eni SpA (NYSE:E) said it is ready to invest more in nuclear fusion, most notably in the Commonwealth Fusion System project led by MIT scientists, of which it remains the biggest shareholder.

Energy News Recap

Black Friday's price collapse shook the oil market, destroying the bullish sentiment that had been building throughout the month. While prices partially recovered on Monday, they plunged again on Tuesday morning as uncertainty intensified. Concerns over the rapid spread of the Omicron variant have bolstered fears of demand destruction.

Everyone is now focused on the upcoming OPEC+ meeting as the potential loss of 2-3 million b/d of global demand could convince the cartel to halt its 400,000 b/d monthly production additions.

Saudi Arabia Shrugs Off Omicron Fears. While other Middle Eastern countries were hesitant to assess OPEC+ prospects of incremental supply, Saudi Arabia’s energy minister Prince Abdulaziz bin Salman and Russia’s energy minister Alexander Novak were inclined to keep the oil group on its pre-charted course.

Jet Fuel Demand Poised to Suffer. Demand for jet fuel, by far the largest laggard in terms of post-pandemic recovery, is now under severe pressure as Omicron fears continue triggering border closures. Originally, it was expected to have a robust Q4, but these new developments could ruin that.

IEA Picks a Fight with Fossil Energy Producers. Fossil fuel energy producers are apparently to blame for high natural gas and power prices in Europe, according to the head of the International Energy Agency, Fatih Birol. The comment was in response to the heavy criticism that clean energy initiatives received when prices spiked.

Russia’s Latest LNG Project Secures Financing. Arctic LNG-2, Russia’s next LNG megaproject developed by Novatek (OTC:NOVKY), secured $10.7 billion in project financing from Chinese, Japanese, and Russian banks, thus failing to attract any European banking interest.

White House Seeks US Royalty Rate Revamp. In a recently published blueprint for the future development of oil and gas projects on federal lands, the Biden Administration is advocating an increase in royalty rates, currently some 12.5% on onshore leases and 12.5-18.75% on offshore leases.

Coal Prices Plummet on News of Further Chinese Intervention. China’s thermal coal futures as traded on the Zhengzhou exchange dropped 6% on Monday after the country’s economic planner NDRC indicated its willingness to “improve the mechanisms of coal pricing”, suggesting more government intervention might be on its way.

Iran Wants to Increase Production Capacity to 4 Million b/d. With the Vienna talks on Iran’s nuclear program restarted this week after a five-month hiatus, Iran’s national oil company NIOC is readying to return to a production capacity of 4 million b/d by March 2022.

Canada Vetoes Enbridge Pipeline Allocation. Canada’s Energy regulator rejected Enbridge's (NYSE:ENB) plan to sell all pipeline space on its 3mbpd Mainline trunk pipe system under long-term contracts, arguing the proposed allocation would excessively favor those with contracts.

Saudi Arabia Splashes the Cash for Shale Gas. Saudi Aramco (TADAWUL:SE:2222) started work on the country’s largest non-oil-associated gas field Jafurah this week, with development costs assumed to be at 24 billion, aiming to produce 2 BCf per day of natural gas and some 400MCf per day of associated ethane by 2030.

Russia Wants to Expand Strategic Partnership with China into Green Energy. Having dedicated oil and gas pipelines to supplying China’s consumption centers, leading Russian energy officials are now calling to extend the strategic partnership into renewables, most probably in the form of wind energy projects.

Lundin Energy Considering a Sale or Merger. Sweden’s Lundin Energy (ST:LUNE), whose operations’ scope increased manifold thanks to its stake in the giant Johan Sverdrup field, is considering strategic alternatives that could include a merger or outright sale.

Royal Dutch Shell Plans Libya Return. UK-based energy major Shell (LON:RDSa) is planning to return to Libya following its 2012 departure, eyeing oil and gas projects in the Sirte and Ghadames basins, as well as solar plants there.

Indonesia Offers 8 New Oil and Gas Blocks in New Round. The licensing round since the start of the pandemic, Indonesia is now offering 8 new oil and gas blocks located across the archipelago for licensing bids, stating the blocks had a total capacity of 500 MMbbls of oil and 22 TCf of gas.

Related: Could The World Run On Nitrogen?

Related: Green Fintech Is A New Trend Investors Can’t Ignore