On Friday, December 4, 2015, the Organization of the Petroleum Exporting Countries (OPEC) slammed the oil patch by adjourning without an agreement to put a cap on production. This quote from a Bloomberg article probably sums up the implications best:

“‘It means more OPEC oil next year,’ Jamie Webster, a Washington-based oil analyst for IHS Inc., said of the organization’s Dec. 4 decision. ‘OPEC is not cutting. With Iran looming, as well as largely only upside risk for Libya, the smart money is on more, and not less, production.'”

Another Bloomberg article titled “OPEC Takes Down Oil Majors as Lower-for-Even-Longer Kicks In” reminds us that OPEC’s move will force analysts and pundits to reset estimates a lot lower as oil prices will now likely stay lower for even longer than expected. Next year could be the year many oil companies are forced to face up to harsh realities and take drastic decisions that this year seemed unthinkable. While Friday saw oil prices plunge a full out rout across the oil complex waited until Monday, December 7th. To wit, “brent crude, the global benchmark, has slumped the lowest since February 2009 while West Texas Intermediate has dropped below $40 a barrel.”

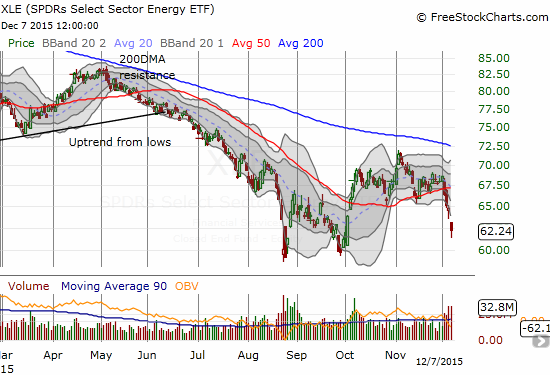

While I am now officially “trapped” in Memorial Production Partners LP (O:MEMP), I am looking to reshort some old favorites as a play on the resumption of the oil downtrend: Energy Select Sector SPDR ETF (N:XLE) through Direxion Daily Energy Bear 3X ETF (N:ERY) and Market Vectors Russia ETF (N:RSX) through Direxion Daily Russia Bear 3X ETF (N:RUSS). So much for that divergence between Russia and oil!

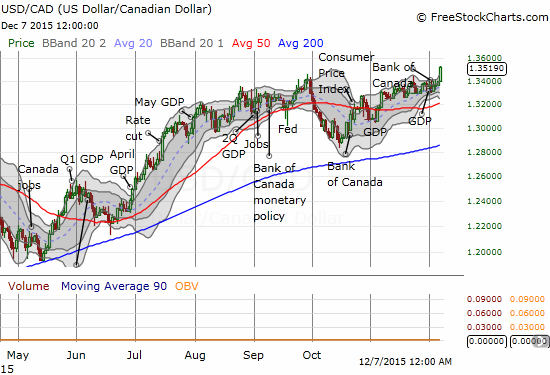

I was not fast enough to think of restarting a short on the Canadian dollar (N:FXC) by going long USD/CAD. I am looking to get more aggressively short the Canadian dollar in the short-term as I now expect the Bank of Canada to get even more dovish…and even more concerned about the oil-dependent part of the Canadian economy.

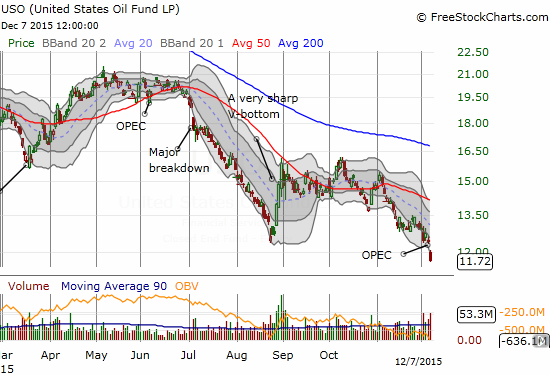

My trade on an extended trading range on United States Oil (N:USO) is now back in the red with little prospect of going flt anytime soon. I might look for an opportunity to double down by middle of 2016. The current options positions expire January, 2017.

Here is a quick review of the carnage and reverberations in graphs….

A new all-time low for United States Oil (USO)…

Trading volume surged to twice the daily average on United States Oil (USO). Are single digits in the near future?

A fresh 50-DMA breakdown on Energy Select Sector SPDR ETF (N:XLE) is now confirmed. I am looking to short/fade rallies for the foreseeable future.

The Canadian dollar (FXC) was crushed today. USD/CAD is at levels last seen in 2004. I am expecting the Bank of Canada to get even MORE dovish, maybe even proactive again, as the fresh decline in oil breaks the Bank’s forecasts and hopes.

So much for a breakout for Market Vectors Russia ETF (N:RSX) as relations between Russia and the U.S. seemed to be on the mend. Oil still rules.

This chart on Memorial Production Partners LP (O:MEMP) is enough said. While it is one of the best in its industry, is it possible even MEMP will go down for the count?!?

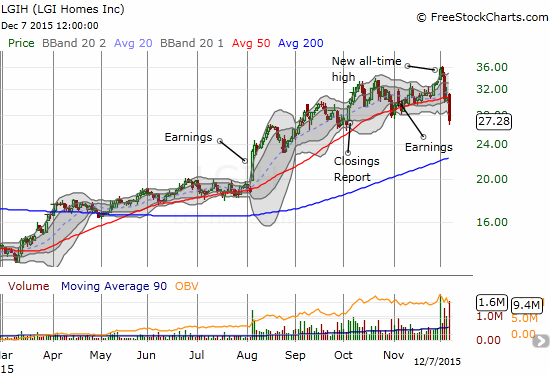

LGI Homes, Inc. (LGI Homes (O:LGIH)) still has a lot of business in Houston and Texas in general. Today’s 11% plunge on nearly triple average daily volume is definitive follow-through from Friday’s selling. Investors are clearly rushing to the exits ahead of what will likely be more extended economic issues for Texas’s oil-producing regions.

Be careful out there!

Full disclosure: long MEMP, short call spread and put options on USO, long FXC.