- An almost ten million barrel per day cut to balance the fundamental equation

- A rebound in the price took some pressure off

- A decision to taper- Waiting for a decision on the future of US output

In April, OPEC, Russia, and other oil-producing countries came together to address the energy commodity’s evaporating demand. They agreed to cut production by 9.7 million barrels per day for two months in an unprecedented move of cooperation. In June, they extended the quotas until the end of July.

The price of NYMEX WTI crude oil futures fell below zero on April 20, in the aftermath of the production cut deal. Brent futures reached a low of $16 per barrel, the lowest price of this century. Meanwhile, since the late April lows, the price of the energy commodity recovered. Both nearby WTI and Brent futures were sitting above the $40 per barrel levels on Wednesday, July 15, when the cartel and other producers met to discuss compliance with the quotas and the level of the output cut after the expiration at the end of this month.

While the price of crude oil recovered, the demand side of the fundamental equation remains fragile as the number of coronavirus cases continues to rise in the US and around the world. The production cut went a long way towards balancing the fundamental equation in the oil market. This week’s move to taper the cuts will test the market’s current state of supply and demand.

The United States Oil Fund (NYSE:USO) and the United States Brent Oil Fund United States Brent Oil Fund (NYSE:BNO) are the ETF products that track the prices of NYMEX WTI and ICE (NYSE:ICE) ICE Brent futures contracts.

An almost ten million barrel per day cut to balance the fundamental equation

It took some time for the April production cut of nearly ten million barrels per day to kick in and provide support for the oil price.

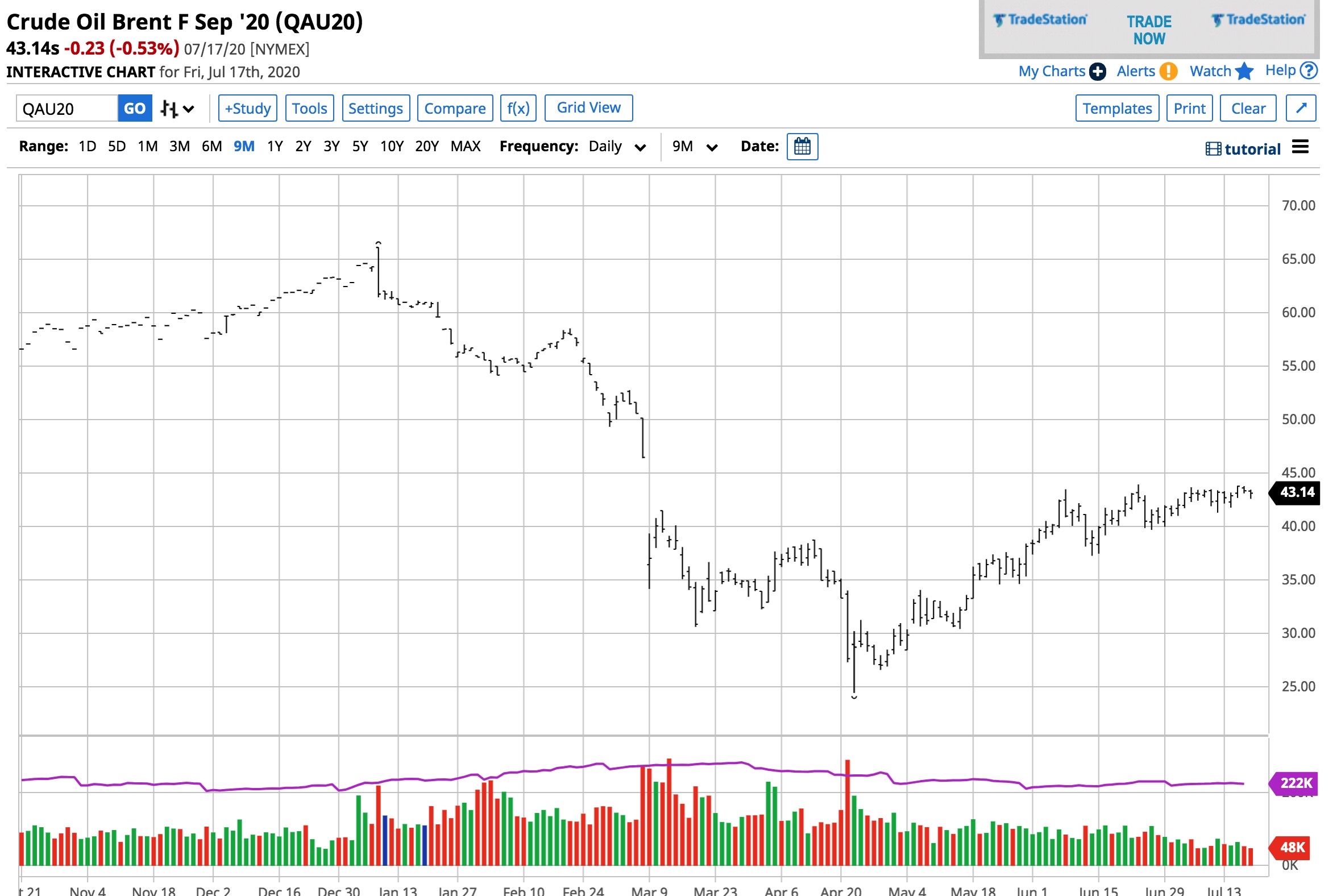

Source: CQG

As the chart shows, the production cut did not stop the price of nearby May NYMEX crude oil futures from falling to negative $40.32 per barrel on April 20. The unprecedented move came as those holding long positions nowhere to store the petroleum, and it became a bearish hot potato on the day it dropped below zero. Brent futures fell to $16, but both Brent and WTI turned around after the late April carnage.

The almost ten million barrel per day reduction in output and declining production from the United States began to balance the supply and demand equation. It lifted the price to the $40 per barrel level. The production cut was initially for two months, but in June, OPEC, Russia, and other producers agreed to extend it until the end of July, keeping the price above the $40 level.

On Wednesday, July 15, OPEC and the Russians, together with other world oil-producing nations, decided to reduce the level of the production cut to 7.7 million barrels per day starting in August. The rebound to $40 per barrel took some pressure off the producers.

Meanwhile, the reaction in crude oil futures was positive after the news of the reduced output cuts.

Source: CQG

The chart shows that the price of nearby August NYMEX futures moved over the $41 level and was closing in on the most recent high at $41.63 after the news on the production quotas. August futures settled at $40.59 on July 17.

Source: Barchart

Brent crude oil was also knocking on the door at its technical resistance level below the $44 per barrel level on the September futures contract. The price action on July 15 also came on the back of significant inventory declines in the US. Brent settled at $43.14 at the end of last week. The API said that crude oil stocks fell by 8.322 million barrels for the week ending on July 10, and the EIA reported a 7.50-million-barrel decline in stockpiles for the same period, which was supportive of the price.

A decision to taper- Waiting for a decision on the future of US output

With WTI and Brent futures above $40 per barrel, tapering of the production cut made sense of the world’s producers. Oil producers around the world are now waiting for the US election, which will serve as a referendum on the futures of energy policy for the world’s leading producer.

President Trump is a supporter of energy independence and favors a continuation of production in the US. His challenger, former Vice President Joe Biden, has embraced the “Green New Deal,” which would reduce or eliminate oil and gas production in the US starting in 2021. While the global pandemic will continue to determine the global demand for energy commodities over the coming months, the US election will decide if the US will hand control of fossil fuel production back to OPEC, the Russians, and other producers starting next year.

I expect lots of volatility in the crude oil market throughout the second half of this year. The current trend is higher, and the trend is always your best friend until it bends.