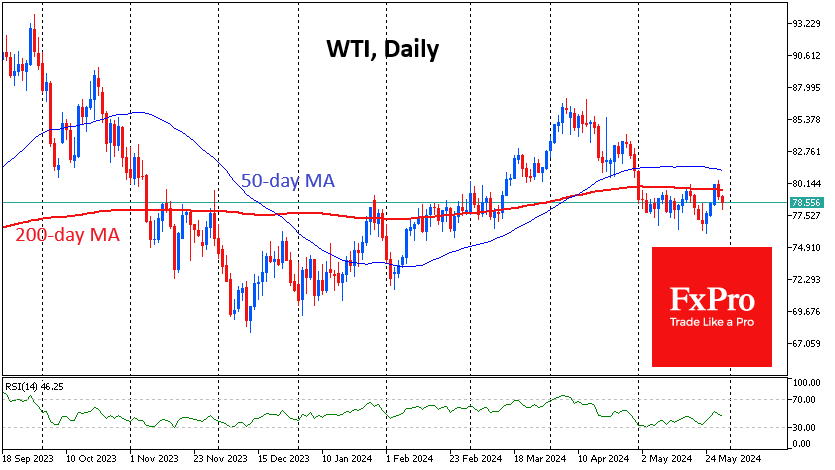

Oil declined for the second day in a row, reversing down from its 200-day moving average for the third time this month. An OPEC+ meeting is scheduled for this weekend with enough potential to break the tie.

Oil's upward trend that started in December stopped in April with an impressive 12% correction. But it failed to develop, and throughout May, we saw fluctuations around the $78 average level with increasing amplitude.

Technically, the failure to develop a rise above the 200-day average is a sign that the bears are in control. The same is evidenced by the 50-day average above price and reversing downward during May.

The news media has been thickening the colours by pointing out the fall in discipline within OPEC+, which is producing well above quota, so the market is not creating an oil shortage and lower inventories as the cartel's forecasts promise.

In 2014, Saudi Arabia, the leader of the cartel that provides the largest voluntary production cuts, had already surprised the world by suddenly expressing support for lifting the restrictions, which set off oil price wars.

But that strategy failed, eventually bringing the cartel to OPEC+, which includes members who agree on their production quotas but are officially in it, led by Russia.

So far, there is little sign that Saudi Arabia or Russia will return to the practice of oil wars. Nevertheless, for a rather fragile market, even a signal that no further cuts are expected and that the agreed quotas will be gradually raised could be a sufficient reason to sell off.

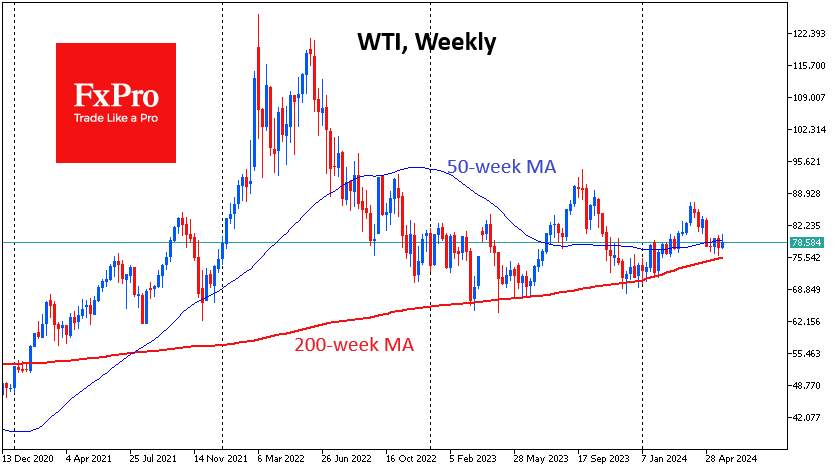

Special attention, in our view, should be paid to the support in the form of the 200-week moving average, which invariably triggered the cartel's response. It is now nearly $75. A decisive decline below it will indicate a change in the market regime.

The bullish scenario assumes that the price's proximity to the sensitive zone for the meeting will force OPEC+ to choose a tougher tone in its comments and promises, bringing oil back to growth. In this case, an important marker would be the ability to rise above $80.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

OPEC+ meeting could switch oil regime

Published 05/30/2024, 11:33 AM

OPEC+ meeting could switch oil regime

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.