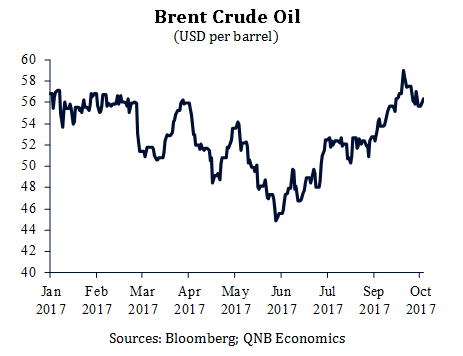

Oil prices have hovered around their highest levels of the year over the past few weeks, reaching a two-year high of USD59/b in late September. The bullish sentiment in the market reflects four major developments: higher global demand, the rising likelihood that OPEC will extend its production cuts until the end of 2018, the fading impact of hurricanes in the US and heightened geopolitical risks in Iraq and Iran. Non-OPEC output is expected to increase further in 2018 and we believe OPEC will therefore extend its production cut agreement from its expiry in Q1 2018 to the end of 2018 to support the market. As a result, we maintain our forecast for an average price of USD58/b for 2018.

Brent Crude Oil (USD per barrel)Sources: Bloomberg; QNB Economics

So, what is driving the recent bullish sentiment in oil prices? The first development is a firmer global demand outlook. In September, the International Energy Agency (IEA) raised its global oil demand forecast for the whole of 2017due to improving growth in the US and Europe. It now projects an increase of 1.6 million barrels per day (mb/d) in 2017 compared to 1.4mb/d previously.

The second major development has been increasing speculation of an extension of OPEC and non-OPEC production cuts beyond Q1 2018. We first highlighted that OPEC was increasingly likely to extend its production cuts back in early July (see our commentary, OPEC’s 2018 dilemma). Recently, Russia and Saudi Arabia have had high level talks discussing the possibility of an extension and Saudi Arabia has also said that it will unilaterally cut production by an additional 0.3mb/d, over and above its existing OPEC agreed cuts, beginning in November to further support prices.At the same time, although inventory levels have declined since the start of the year, they have not fallen quickly enough to achieve OPEC’s stated target of bringing inventories down to their five-year historical average by Q1 2018. All of these factors have pushed markets to expect that an extension of the agreement is increasingly likely

The third development is the fading impact of Hurricane Harvey on the US oil market. Hurricane Harvey, which hit the oil producing Gulf Coast region of the US, paradoxically resulted in lower and not higher crude oil prices in late August. This is because the hurricane disrupted refinery output and left crude oil production largely undisturbed. The end result was an increase in crude oil inventories in the US, depressing crude prices, and rapid draw down of refined product inventories. Now, prices have rebounded as refining capacity has mostly come back online and the crude oil inventory glut is being cleared by record high US crude oil exports.

The fourth development is heightened geopolitical risks. The Kurdish independence referendum has created some uncertainty over the future flow of 500kb/d from Iraqi Kurdish oil fields to Turkey. Furthermore, the US administration is considering re-imposing sanctions on Iran, which could put around 200kb/d of Iranian oil exports to Europe at risk. Although, the chances that either of these events could actually disrupt the global oil market appears relatively low at the moment but they have nonetheless spooked markets.

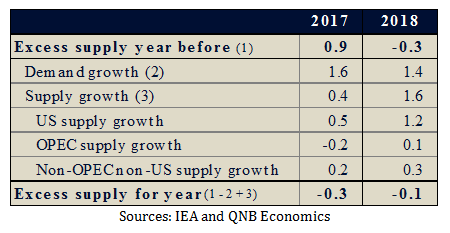

Global Oil Balance

(millions of barrels per day, unless otherwise noted)

Sources: IEA and QNB Economics

So, where do we stand? Despite the recent positive momentum, we believe prices will stay around current levels because the aforementioned factors are not enough to offset the strong production growth observed this year from non-OPEC countries, primarily the US. Non-OPEC countries have increased output by a combined 0.7mb/d this year alone. Additionally, OPEC’s production restraint has also slowed since the start of the year. Libya and Nigeria, both exempt from production cuts, have increased production since the start of the year and the 12 OPEC members adhering to the agreement have seen their compliance rate decline slightly every quarter this year.

Looking ahead to 2018, we maintain our view that OPEC will extend its production cuts from Q1 2018 to the end of the year to offset continued high production growth from non-OPEC. The IEA projects non-OPEC to raise production by 1.5mb/d in 2018, led by the US. Hence, in order to achieve its target of normalising inventories as well as reduce the risk of lower oil prices, we believe it is highly likely OPEC will extend its production cut agreement. However, we expect prices to be capped at our estimated level of US shale breakeven costs, which is an average of USD58/b for 2018.