Only one sector, the Telecom sector, has a rising ROIC. The Telecom sector – and specifically BCE (NYSE:BCE) – is this week’s Long Idea.

Improving Returns in Telecoms

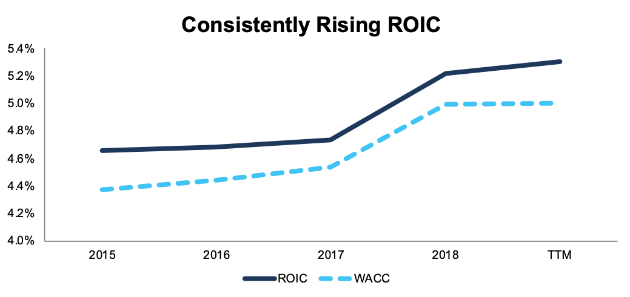

Not only does the Telecom sector have a rising ROIC over the TTM period, its ROIC has risen every year since 2015, as shown in Figure 1. The sector also generates consistently positive economic earnings due to the fact that its ROIC is higher than its weighted average cost of capital (WACC).

Figure 1: Telecom ROIC vs. WACC: 2015-TTM[1]

Sources: New Constructs, LLC and company filings.

Improving margins are driving the rising ROIC for this sector. The aggregate NOPAT margin for the sector rose from 10.2% in 2015 to 12.6% TTM. Invested capital turns have fallen from 0.46 to 0.42 over the same times. Firms in this industry have become less efficient at turning capital into revenue, but they’ve become much more efficient at cutting costs and turning more revenue into profit.

Appendix II shows NOPAT margin and invested capital turns for all 11 sectors going back to 1998.

While the Telecom sector is profitable overall, profitability is highly concentrated. Just four companies – Verizon (NYSE:VZ), Nippon Telegraph and Telephone (NTTYY), BCE Inc. (BCE), and America Movil (NYSE:AMX) – earned $19 billion in economic earnings over the TTM period. The remaining 33 companies we cover in the sector combined for $14 billion in economic losses.

This high level of concentration proves diligence remains important. The Telecom sector may be Very Attractive overall, but there are still plenty of risky stocks in the sector that investors should avoid.

One Stock to Buy in the Telecom Sector

Investors looking to find value in the Telecom sector should start by looking at the four most profitable companies in the industry per above.

BCE is another one of our top picks in the sector. The Canadian telecom giant shares many of the same traits that make us bullish on Verizon, including:

- The fastest network in its market, which allows it to grow its market share while also increasing its average revenue per user

- Growth potential over the next several years due to the upcoming deployment of 5G technology

- A cheap valuation and high dividend yield, which is supported by ample free cash flow

From 2015-2018, BCE grew its after-tax operating profit (NOPAT) by 4% compounded annually while maintaining a consistent ROIC of ~8%. Over the TTM period, NOPAT is up 3% year-over-year while ROIC remains steady.

Meanwhile, BCE’s stock has been almost flat, up just 2% over the past five years. It appears that the market does not recognize the value of this company’s cash flows.

At its current valuation of $48/share, BCE has a price to economic book value (PEBV) of 0.8. This ratio means the market expects BCE’s NOPAT to permanently decline by 20%. For a company with BCE’s track record of consistent profit growth, this expectation seems overly pessimistic.

If BCE can maintain its 2018 NOPAT margin of 18% and grow NOPAT by 2% compounded annually for the next decade, the stock is worth $70/share today, a 46% upside to the current stock price. See the math behind this dynamic DCF scenario.

BCE also offers a 5% dividend yield, which is well supported by the cumulative $9 billion (22% of market cap) in free cash flow it earned from 2015-2018. Investors in BCE get both a steady income and the opportunity for capital appreciation.