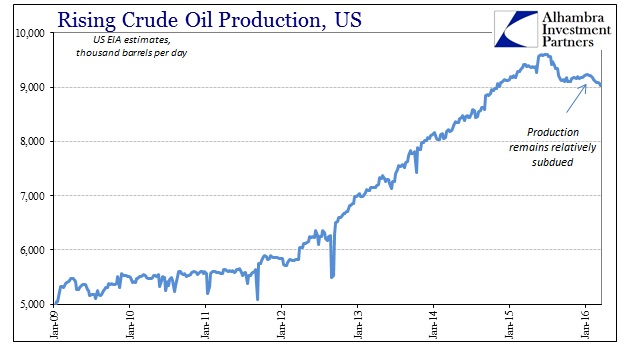

The fundamentals for crude oil continue to be atrocious. Production remains relatively stable if slightly reduced, which is about the only factor in favor of oil prices since the February 11 low. On the other side of the ledger, you don’t hear as much about how it’s all oil supply anymore other than the occasional reference to a “glut” that is now recognized for both parts of the imbalance.

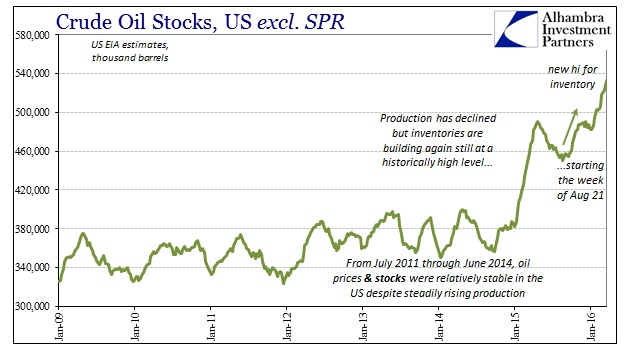

The inventory extreme has only become that much more so. It is difficult to state just how much that is the case. For example, in the past 26 weeks, half a year, domestic oil inventory has been drawn down in only four of them. Cumulatively since the week of September 25, 2015, coincident to the more significant turn toward economic weakness more generally, US oil stocks are reported up by a dizzying 78.6 million barrels. In the latest weekly reading for the week of March 18, that rise was more than 9 million barrels.

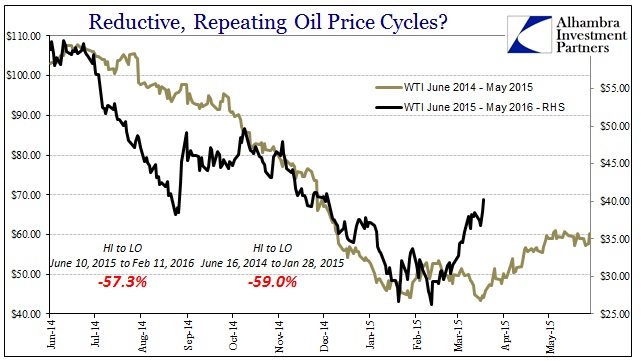

The only inventory “glut” even close to that was the one that preceded it at the outset of 2015. In other words, two separate, record inventory builds that just happen to have been heralded by two similar sized and timed oil price crashes.

The predictability of domestic production actually precludes the prospect of a supply imbalance driving either the price of oil or the inventorying of it.

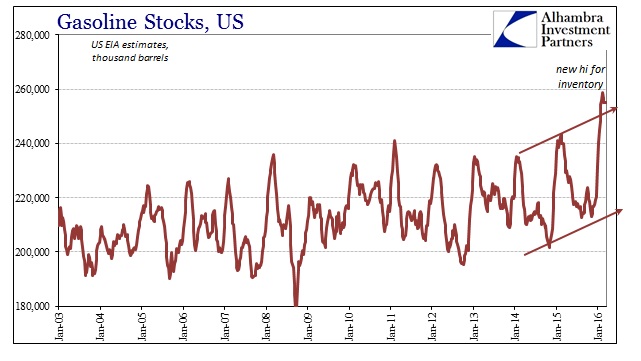

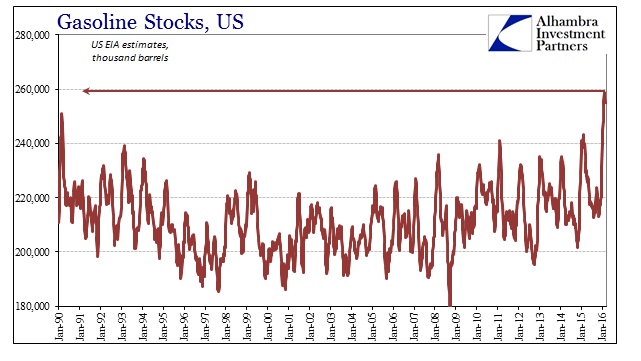

This second wave of oil imbalance has flowed into gasoline stocks, too, further registering “something” generally amiss on the economic side of demand. Gasoline inventories have also risen in alarming fashion to record highs.

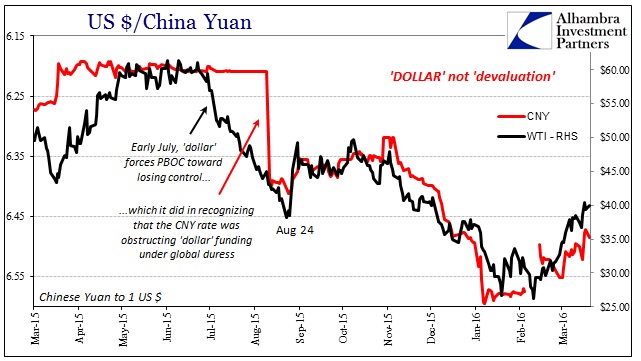

That leaves none of the fundamentals about oil justifying even the slightest hint of a rebound, save one. That one would be, as always, the “dollar” and in this case the lack of its immediate pressure that has allowed risk junkies to finally chase again. Given the momentum afforded, you can’t really blame them.

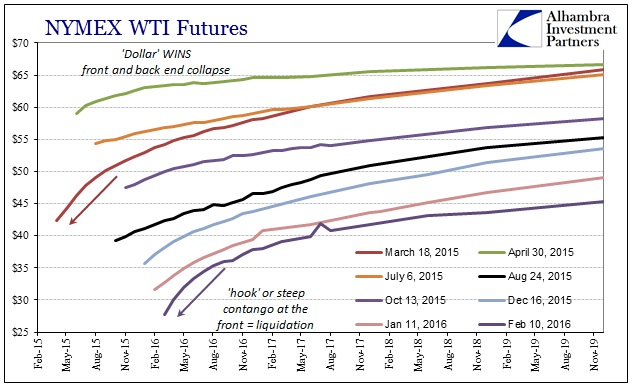

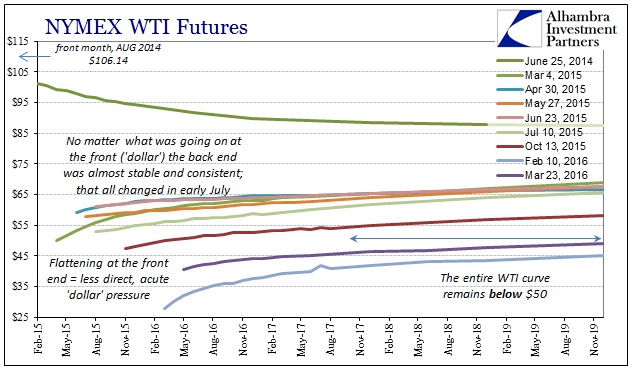

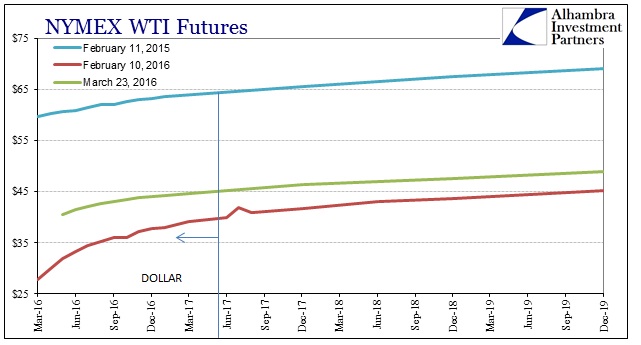

The WTI futures curve only suggests the same factor, as the front end has flattened considerably since mid-February in the unwinding of liquidation. The back end, however, has only rebounded very slightly; it is the outer years that are more attuned to physical factors while the very front months blow easily about in the “dollar” winds back and forth.

The front part of the curve is as flat (low contango) as it has been in nearly a year, but instead of anchored around $70 or so as was thought then the entire curve, despite the big move since February, remains below $50! The May 2016 contract (the current front month) is up almost $9 since the lows, but the December 2017 contract has gained less than $4.75.

There would be some positivity to all of this had global liquidity and general “dollar” indications suggested that global funding was rebounding with risk assets; it is not. Every symptom, from credit markets to the eurodollar curve to swap spreads (and basis spreads) still and only proclaims that nothing has changed except the proclivity to sell. The “dollar shortage” is still specified in far too many places, suggesting that now is not an inflection so much as another pause in between the last “run” and the next one likely already set up.

It goes to show how powerful even such a “pause” in “dollar” conditions can be, as despite some of the worst fundamental conditions imaginable oil prices have managed a sizable retracement back into the $40’s – at least at the front end. The back end isn’t so enthralled, and why would it be? It has been subject to the “dollar’s” gravity for almost two years now, as demonstrated by the two huge inventory builds.