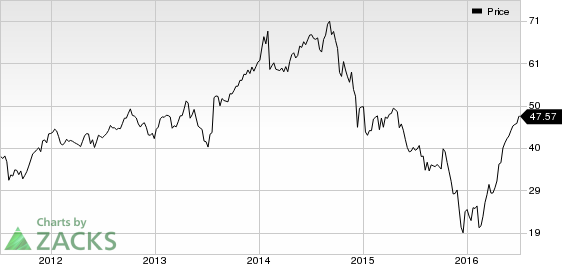

Shares of ONEOK Inc. (NYSE:OKE) scaled a new 52-week high of $47.76 during Friday’s trading session before closing slightly lower at $47.57.The company is the sole general partner and owner of 41.2% of ONEOK Partners L.P. (NYSE:OKS) as of Dec 31, 2015. ONEOK Partners is one of the largest publicly traded master limited partnerships engaged in natural gas and natural gas liquids (“NGL”) businesses.The stock has delivered a one-year return of about 32.5%.

Over the past 52 weeks, ONEOK Inc.’s shares have ranged from a low of $18.84 on Dec 18, 2015 to a high of $47.76 on Jul 01, 2016. The average volume of shares traded over the last three months is approximately 2.7 million.

What is Driving the Stock Up?

ONEOK Partners is the primary growth vehicle for ONEOK Inc. In the first quarter of 2016, the company obtained $197.5 million as distribution from ONEOK Partners, up 16.8% year over year. ONEOK Partners’ financial strength, diversified operations, excellent market connectivity and systematic investments in organic projects and strategic acquisitions provide ONEOK Inc. a distinct competitive advantage.

Additionally, ONEOK Inc. continues to drive reductions in operating and contract labor costs. This trend is expected to continue through 2016. ONEOK’s proactive approach to reducing capital spending and operating costs will strengthen its cash flow profile and boost performance.

Zacks Rank and Key Picks

ONEOK Inc.currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same space include Clean Energy Fuels Corp. (NASDAQ:CLNE) and MDU Resources Group Inc. (NYSE:MDU) . While Clean Energy sports a Zacks Rank #1(Strong Buy), MDU Resources holds a Zacks Rank #2(Buy).

ONEOK INC (OKE): Free Stock Analysis Report

CLEAN EGY FUELS (CLNE): Free Stock Analysis Report

MDU RESOURCES (MDU): Free Stock Analysis Report

ONEOK PARTNERS (OKS): Free Stock Analysis Report

Original post

Zacks Investment Research