By Tom Kool

Copper and zinc both hit record highs in 2021, and precious metals look set to soar alongside inflation, with one little-known stock offering exposure to it all.

Prices of base metals have nearly doubled from a year ago thanks to a demand explosion for electronics, helped along by a supply-chain-stifling pandemic.

Copper has had a fabulously historic year. It broke price records twice, peaking at $10,476 per ton ($.76/lb) in mid-October.

And zinc has now been added to the US critical minerals list because it’s essential to the economic and/or national security of the United States and because its supply chain is vulnerable to disruption.

We saw zinc prices decline in 2019 and 2020, but 2021 was a major rebound year—with a 50% YoY surge.

Starr Peak Exploration Ltd (TSXV:STE) caught our attention in 2019 with a number of acquisitions adjacent to a major discovery by Amex Exploration Inc (TSXV:AMX) (a play that earned shareholders up to 7,000% returns at one point).

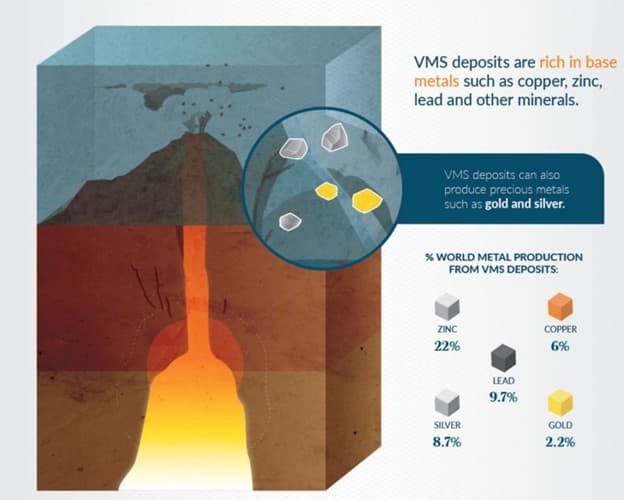

Then it stunned us with evidence of a VMS discovery in its maiden drill results. A VMS (volcanogenic massive sulphide) deposit is rock containing multiple base metals, including zinc, copper, silver, and gold. It’s the type of deposit the big miners are always scouring the globe for.

But 2022 may bring us the bigger news…

On Jan. 11, Starr Peak reported its best VMS intercepts yet at its NewMetal property in Quebec’s Abitibi Greenstone Belt, showing 8.98% zinc over 9.85 meters and 1.28% copper over 7.2 meters.

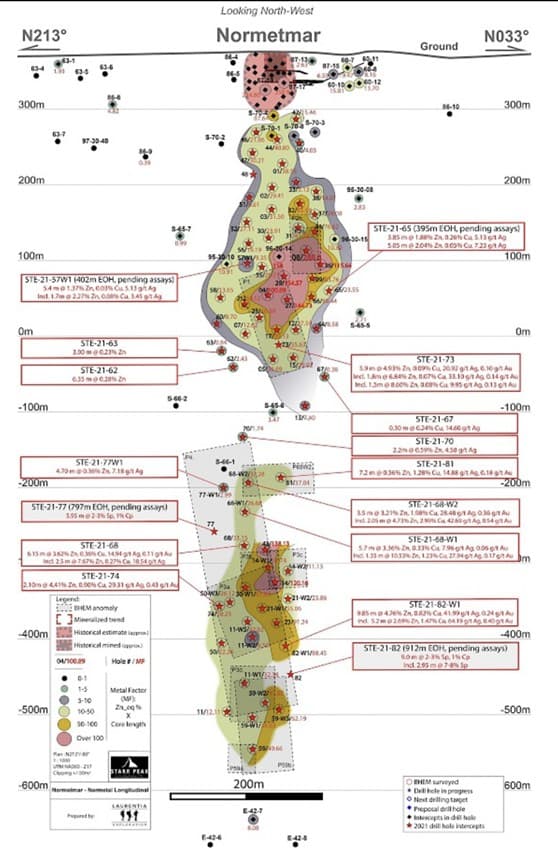

Starr Peak’s ongoing drilling program is targeting the Normetmar Upper and Deep Zones that sit directly below the Normetmar high-grade zinc deposit and just one kilometer west of the historic producing Normetal mine, which has to date produced over 10 million tons of copper, zinc, gold, and silver.

These are high-grade highlights that are just what we think investors want to hear from Starr Peak as its drilling takes off in the New Year:

- Upper Zone (above 400 meters, vertically): STE-21-73: 5.90 m of 6.04% Zinc Equivalent

- Deep Zone (below 400 meters, vertically): STE-21-82-W1: 9.85 m of 8.98% Zinc Equivalent, including 0.82% of copper

- Deep Zone (below 400 meters, vertically): STE-21-81: 7.20 m of 5.14% Zinc Equivalent, including 1.28% of copper

Will Starr Peak Keep Delivering?

Already as of last summer, Starr Peak had almost a 100% hit rate on its reported drill hole targets. The company released positive results from their maiden drill program in early May 2021, and then even higher-grade results in July—all of which led to a major expansion of the drilling program, leading up to January 2022’s exciting results.

While 2021 saw massive sulphide intercepts, 2022 may be gearing up to be much bigger.

Now, with the best drill results to date under its belt as of Jan. 11, Starr Peak has resumed drilling, targeting the Deep Zone below 600 meters.

A second drill will target the 4-kilometer prolific Normetmar-Normetal lithological contact on Starr Peak’s property.

And then there’s the gold: The gold targets in the northern half of Starr Peak’s Newmetal property are set to be drill-tested, too.

This is a huge land package that includes a past-producing mine adjacent to Amex Exploration’s discovery. And it’s all in the Abitibi Greenstone Belt—the most prolific Canadian ground for gold and polymetallic deposits, with Starr Peak’s properties right within the Normetal Volcanic Complex, otherwise known as the North Volcanic Zone.

Now, It’s All About Building Tonnage

With excellent drilling results coming in so far, with a large ongoing fully-funded drill program, it may all be about building tonnage now.

Everything they discovered in 2021 pointed to the robust potential for more zinc-rich massive lenses at great depth, and so far, 2022 shows further evidence that this may be a cornucopia of commodities—all of them experiencing growing demand, supply chain disruptions, and price increases.

Proving up a commercial VMS deposit of minerals is exactly what the major miners are after, and that’s exactly what makes a junior miner potentially incredibly valuable—far beyond any gold in the ground. VMS deposits are known for long-term production potential because they are found in clusters of deposits.

They are said to be among the rarest of discoveries, which means that everything is lining up for Starr Peak in a way that doesn’t usually happen for junior miners.

At this point, with the highest-grade results yet being announced on Jan. 11, Starr Peak’s assets look set for growth and value creation, and what comes next in the exploration stage might be a VMS kingmaker.

Starr Peak is fully funded to keep drilling with 7 private placement deals closed since May 2020:

- March 2020: closed first tranche of private placement for $450,000

- May 2020: closed final tranche of PP for $555,000

- August 2020: closed flow-through PP for $1,110,000

- November 2020: closed flow-through PP for $2,650,000

- June 2021: closed institutional flow-through PP for $3,756,000

- July 2021: closed institutional flow-through PP for $2,310,000

- November 2021: closed institutional flow-through PP for $3,760,000

And what we think is the crème de la crème at the exploration wheel: Dr. Jacques Trottier, PhD, founder and executive chairman of Amex Exploration and the man behind the Amex gold discovery at its Perron Project is now Starr Peak’s Chief Technical Advisor. Starr Peak’s new VP of Exploration, Yves Rougerie, PGeo, is also a VMS expert, with a track record across North America. And CEO and Director Johnathan More, also the Chairman of Power Metals Corp., made it all happen: He jumped on the acquisition train right before Amex made its 2019 discovery and scooped up all the adjacent territory, including a past-producing mine.

What started off as part of the new Quebec gold rush, might become something far bigger: A coveted VMS rush at a time when economic and national security have turned base metals into “precious” metals and prices are out of this world.

This is our pick for one of the best junior mining narratives in the market today, and the first month of 2022 looks to have already set Starr Peak on the road to potential discovery recognition and we think major miners are watching.

Other Miners To Watch As The Metals Race Heats Up

Barrick Gold (NYSE:GOLD, (TSX:ABX) is a Toronto-based mining, exploration and production company. It has operations in Canada, the US and South America with mines in North America (Nevada), Chile and Argentina. Barrick also operates an open-pit mine at Pascua Lama on the border of Chile and Argentina. The Company's growth strategy includes expanding its Carlin Trend gold deposit in Nevada through selective acquisitions of key properties to provide meaningful leverage to rising gold prices as well as increased exploration for new deposits.

As the future of the economy looks more-and-more uncertain, and the Federal Reserve continues to print money at a record rate, solid gold miners like Barrick have drawn a lot of attention for investors, especially considering the healthy 0.96% dividend per share that comes with the purchase

Barrick is a top-tier gold miner with a global footprint. The Toronto-based gold giant operates in 13 countries, including Argentina, Canada, Chile, Côte d'Ivoire, Democratic Republic of the Congo, Dominican Republic, Mali, Papua New Guinea, Saudi Arabia, Tanzania, the United States and Zambia. Though Newmont surpassed Barrick as the largest gold miner when it acquired Goldcorp, Barrick is still a force to be reckoned with.

Newmont Goldcorp (NYSE:NEM) is a global mining company with operations in the United States, Australia, Peru and Ghana. They are one of the world's largest gold producers and they have been operating for over 100 years. Newmont has its headquarters in Greenwood Village, Colorado (a suburb of Denver) where it was founded in 1921 by William Boyce Thompson.

Following its acquisition of Goldcorp, Newmont became the single biggest gold company in the world, but that doesn’t mean it doesn’t still have some room to run. As far as management goes Newmont doesn't have any weak spots. Its board includes veteran mining executives like Bob McAdam of Barrick Gold Corp., Tom Albanese of Rio Tinto (NYSE:RIO), Joe Jimenez of Dow (NYSE:DOW), and John Wiebe of Kinross Gold Corporation (NYSE:KGC).

In addition to producing and marketing their own mined resources, Newmont Goldcorp offers consulting services where they provide guidance on exploration projects around the globe. This company is an industry leader in exploration both domestically and abroad with offices located in 12 countries across 5 continents! Newmont works with their suppliers to find the best way to extract these materials from various sources including hard rock mines (rocks), soft rock mines (sedimentary rocks) or surface deposits of minerals like salt lakes or sand-based beaches.

Yamana Gold (NYSE:AUY), (TSX:YRI), one of the world's top gold companies, has seen its share price hit especially hard this year. The company has been producing gold for over 50 years and operates two mines: the Canadian Malartic mine in Canada and the Minera Florida mine in Chile. It also owns three other properties: Agua Rica, Tapada do Norte, and Caiena. One of Yamana's most notable mines is the Chapada mine in Brazil which has been operational since 2011.

In 2021, Yamana signed a deal with industry giants Glencore (OTC:GLNCY) and Goldcorp to develop and operate another Argentinian project, the Agua Rica. Initial analysis suggests the potential for a mine life in excess of 25 years at average annual production of approximately 236,000 tonnes (520 million pounds) of copper-equivalent metal, including the contributions of gold, molybdenum, and silver, for the first 10 years of operation.

Lithium Americas (NYSE:LAC) is one of North America’s most important and successful pure-play lithium companies. With two world-class lithium projects in Argentina and Nevada, Lithium Americas is well-positioned to ride the wave of growing lithium demand in the years to come. It’s already raised nearly a billion dollars in equity and debt, showing that investors have a ton of interest in the company’s ambitious plans, and it will likely continue its promising growth and expansion for years to come.

It’s not ignoring the growing demand from investors for responsible and sustainable mining, either. In fact, one of its primary goals is to create a positive impact on society and the environment through its projects. This includes cleaner mining tech, strong workplace safety practices, a range of opportunities for employees, and strong relationships with local governments to ensure that not only are its employees being taken care of, but locals as well.

Lithium Americas’ efforts have paid off in the market, as well. While many companies across multiple industries struggled last year, Lithium Americas’ stock soared. Since the beginning of the year, Lithium Americas has seen its share price climb by nearly 100%, and its showing no signs of slowing, especially as lithium demand continues to soar.

Teck Resources (NYSE:TECK) could be one of the best-diversified miners out there, with a broad portfolio of copper, zinc, energy, gold, silver and molybdenum assets. It’s even involved in the oil scene! With its free cash flow and a lower volatility outlook for base metals in combination with a growing push for copper and zinc to create batteries, Teck could emerge as one of the year’s most exciting miners.

Though Teck has not quite returned to its 2021 highs, it has seen a promising rebound since April lows. In addition to its positive trajectory, the company has seen a fair amount of insider buying, which tells shareholders that the management team is serious about continuing to add shareholder value. In addition to insider buying, Teck has been added to a number of hedge fund portfolios as well, suggesting that not only do insiders believe in the company, but also the smart money that’s really driving the markets.

Kirkland Lake Gold (NYSE:KL), (TSX:KL) is a Canadian gold mining company that has been in operation for over 50 years. They are one of the world's largest producers of gold, with their mines located throughout Canada. The company focuses on using sustainable practices to ensure they are leaving behind an environment that can be enjoyed by generations to come.

Though not quite as established as Barrick or Newmont, Kirkland is no stranger to striking headline-grabbing deals in the industry. In fact, just recently, Kirkland and Newmont signed a $75 million exploration deal that could wind up being a game-changer for the industry. The two companies have agreed to split the cost 50/50 over five years with each company investing $15 million every year into joint projects between both companies for exploration purposes only - at this point it seems like a win.

According to a joint press release in late 2020,

“Newmont has acquired an option from Kirkland on the mining and mineral rights subject to a royalty payable by Newmont to Royal Gold Inc. (NASDAQ:RGLD), (the Holt Royalty) in exchange for a $75 million payment to Kirkland Lake Gold. Newmont can exercise the Option only in the event Kirkland intends to restart operations at the Holt Mine and process material subject to the Holt Royalty”

This alliance will provide Kirkland with cash flow to evaluate new alternatives for the future of the mining complex, dive deeper into its existing properties, and weigh other opportunities where the two gold companies may be able to find common ground in the future.

Sociedad Química y Minera de Chile (NYSE:SQM) is a Chilean company that has been in operation for over 100 years and operates the most profitable commercial mine in the country. SQM produces more than 55 minerals, including lithium, iodine, potassium nitrate and copper. The company's headquarters are located on Avenida Kennedy, Santiago which was once an industrial area of the city with as many of 300 factories built there during its heyday between 1880 to 1930s.

Sociedad Química y Minera sees the lithium industry growing at around 20 percent per year in the long term, supported by rising EV sales and emission reduction goals from China to the United States.

The stock prices of major lithium producers and explorers, including Sociedad Quimica y Minera de Chile received a major hammering after Morgan Stanley forecast that Chilean low-cost brine producers could add as much as 200kt per year by 2025, while the expansion of China's and Australia's hard-rock mines could pump in another half a million metric tonnes over the next few years.