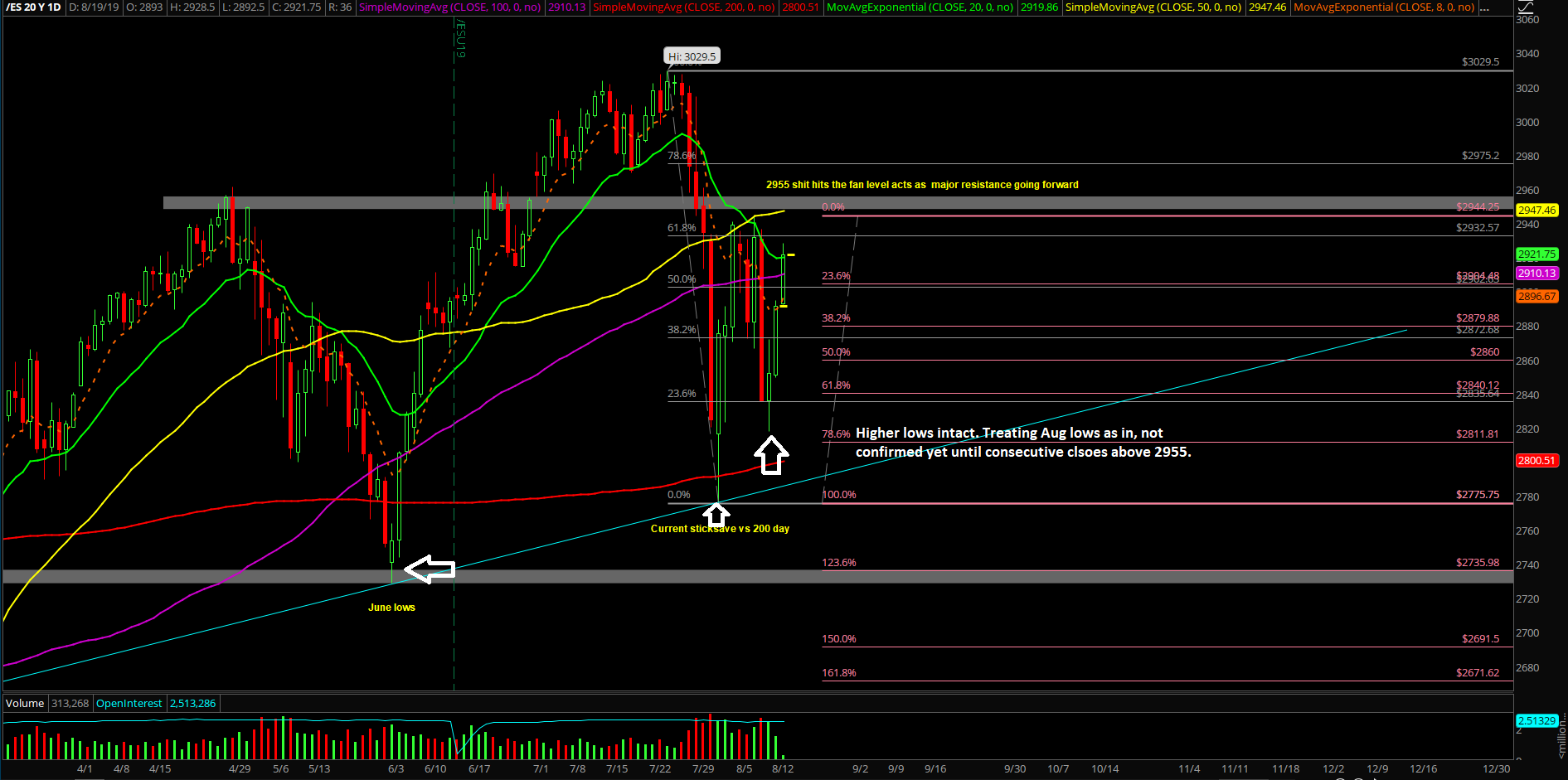

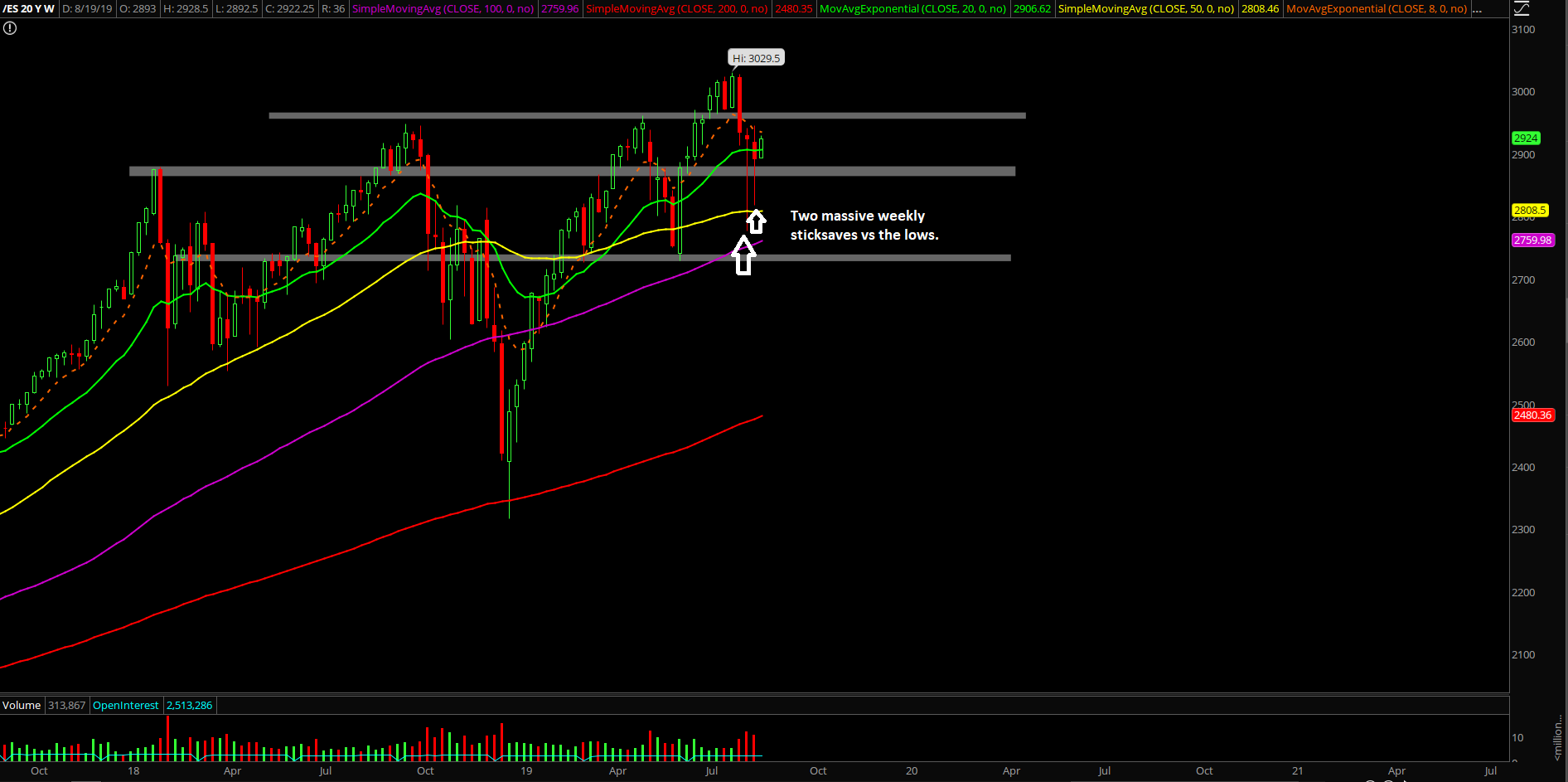

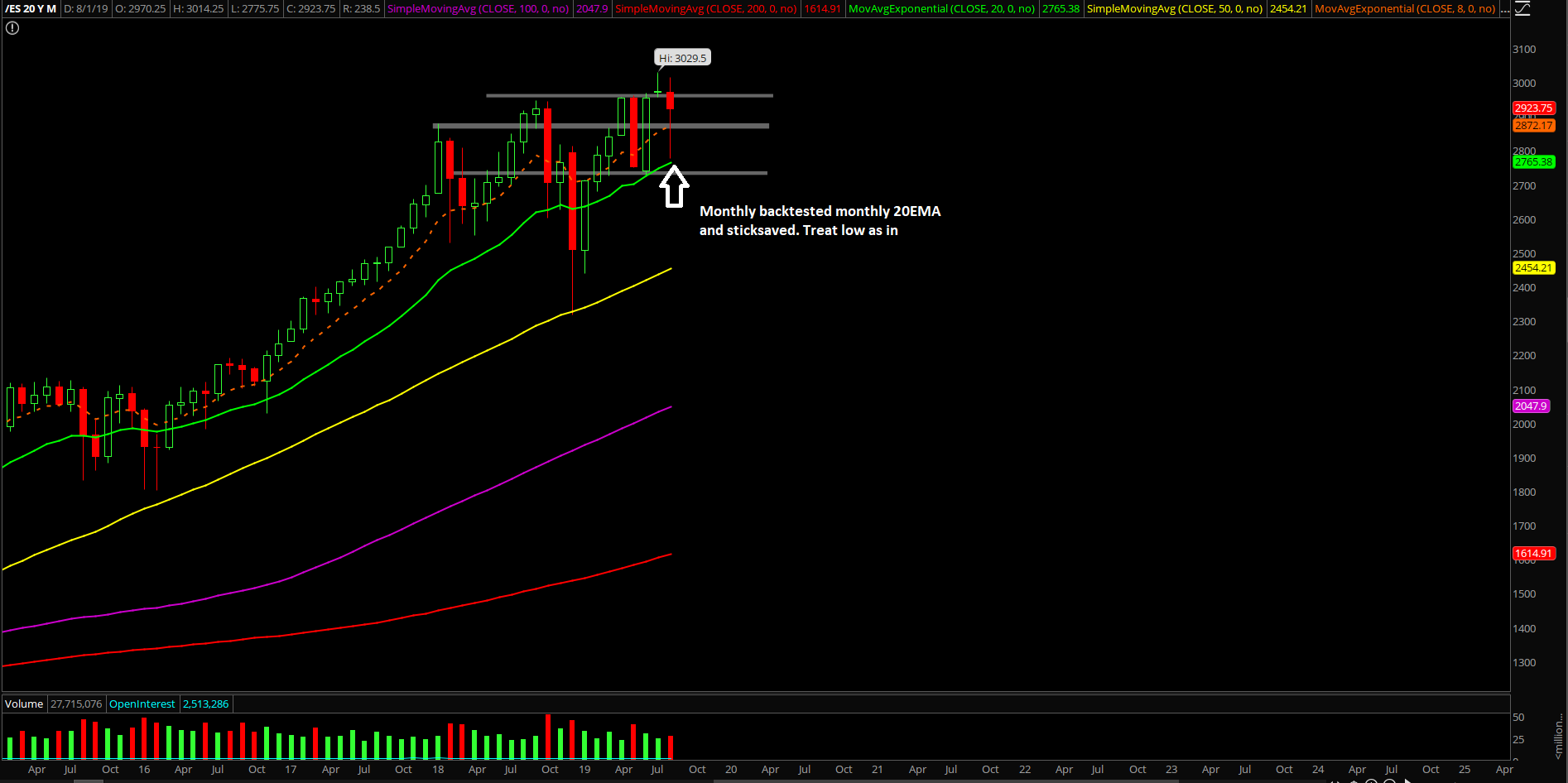

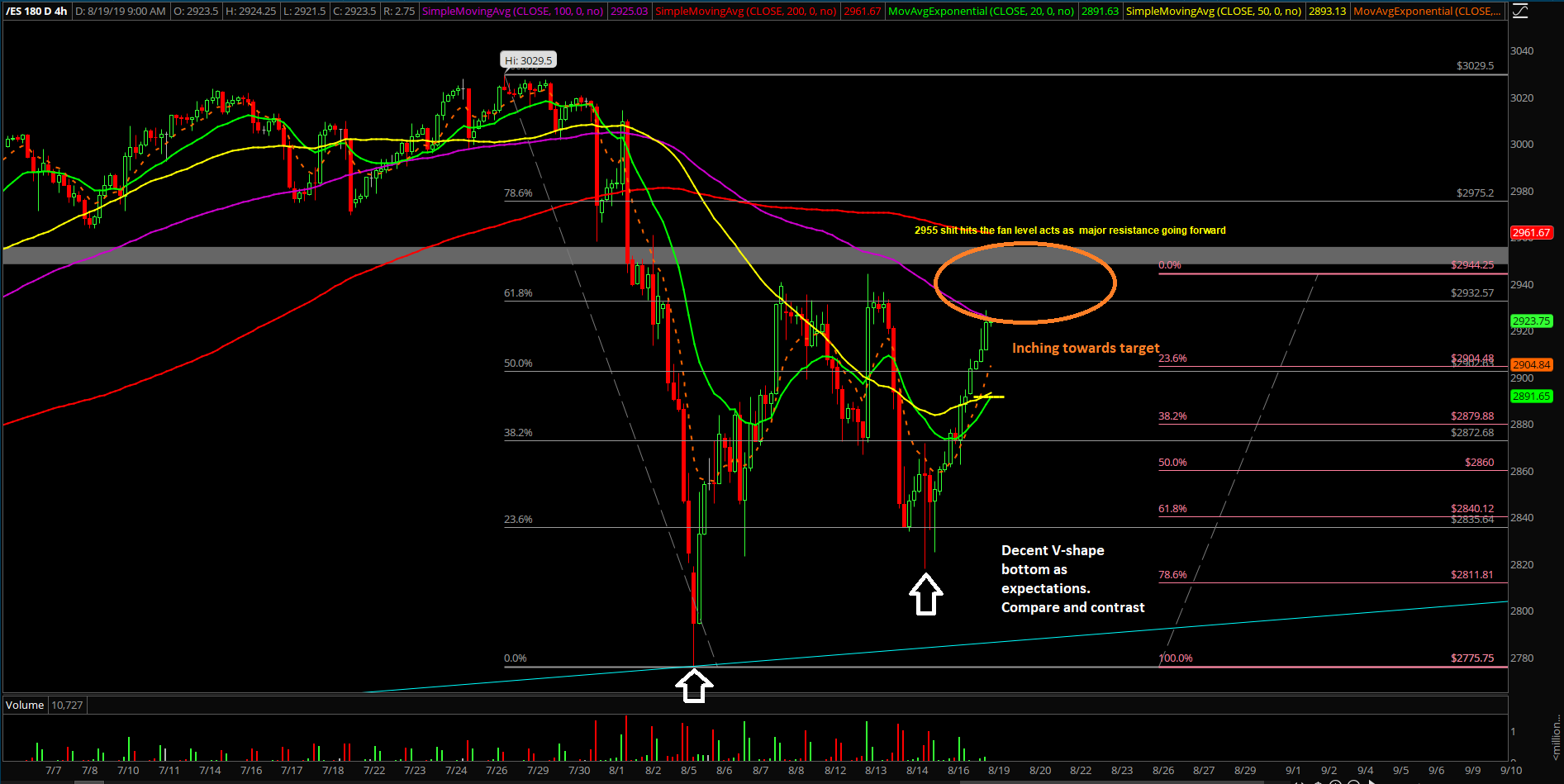

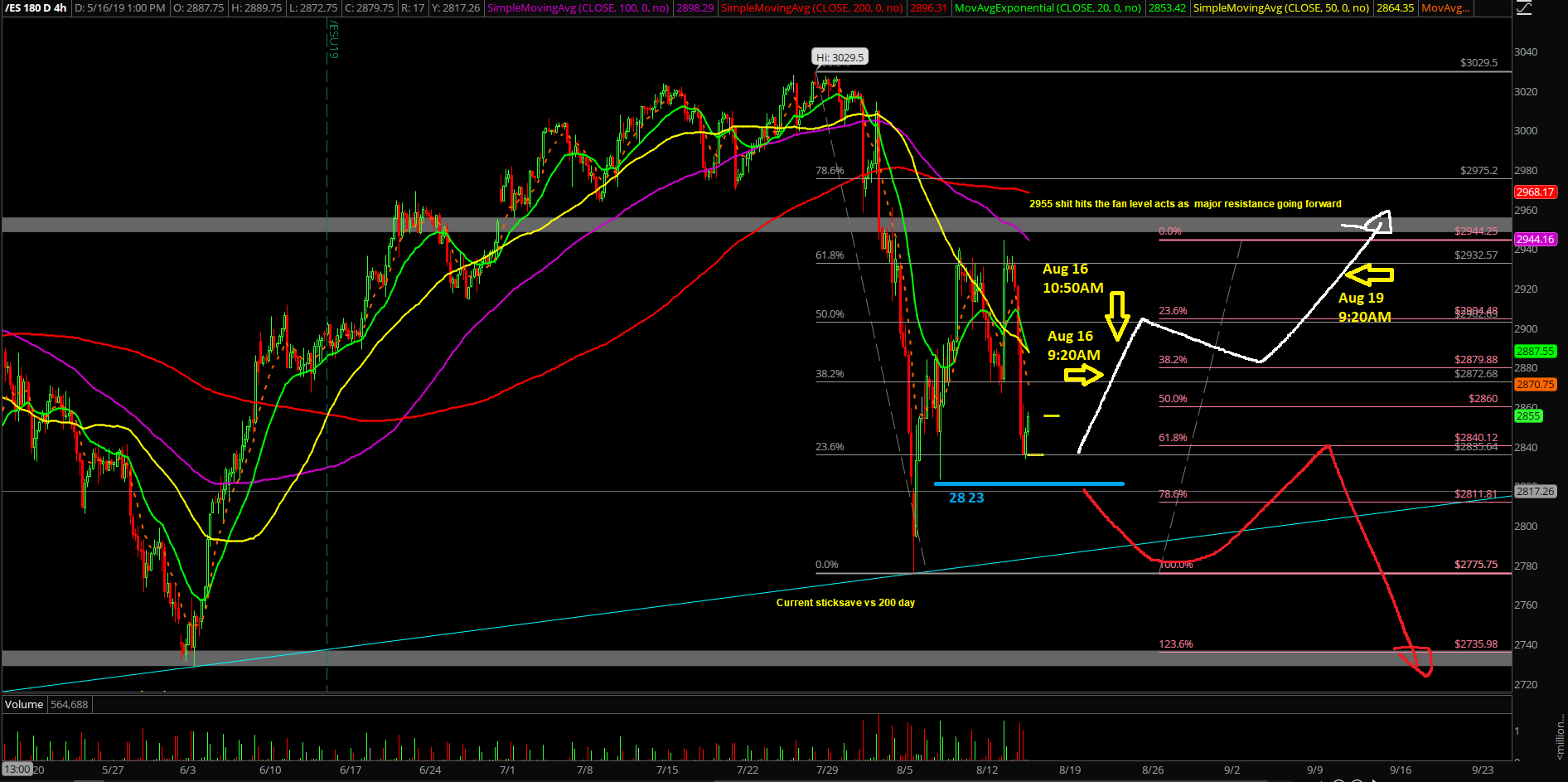

The second week of August was pretty simple as the market followed our expectations from the previous weekend report. If you recall, the market chose to follow scenario 1 on the daily chart time frame by back testing into the 2858-2836 zone on the Emini S&P 500 (ES). This was the 50%-61.8% Fib retracement zone of the 2775 to 2940 V-shape recovery, creating a higher-lows setup. In addition, our must-hold level at 2823 held last Wednesday and Thursday as price stick-saved against this key level precisely and the bulls did their job in terms of the two massive feedback loop squeeze setups.

What’s next?

The main takeaway from this week was that we are one step closer to confirming the August low as in. If you recall, we’ve been treating August lows as in for some time now and we still need three consecutive closes above 2955 to tell us without a doubt that it’s in.

In addition, the two massive ongoing feedback loop squeeze setups from last week remain valid, and bears should be clenching their butts right now as we backtest daily 20EMA 2920s and 2955 (the "sh*t hits the fan" level from July).

Last week closed at 2891.5 on the ES, and bulls need above 2955 in order for us to talk about ATH and 3193 again. Otherwise, we're still not 100% confirmed that the August low is in.

Current bias/parameters: