A quiet week for stocks with the exception of Wednesday and Thursday after the Fed says a rate hike should come sooner than later, which increased the likelihood of a June rate hike.

Markets, stocks and metals enjoyed this outlook and took off higher, so there really is no choice but to be long, still, and looking into the future.

Metals continue to look great so let’s take a gander at their charts this long weekend.

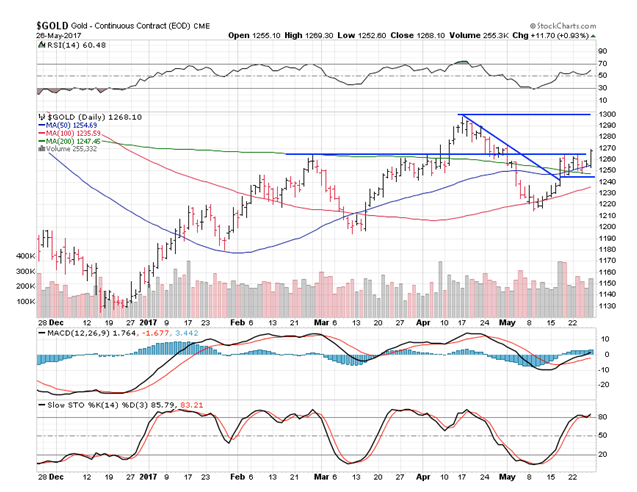

Gold rose 1.16%, mostly on Friday.

The breakout Friday is great to see after a weeks consolidation, and it came on a nice pop in volume which gives the move more conviction.

We should see $1,300 on this move before any more real rest comes into play.

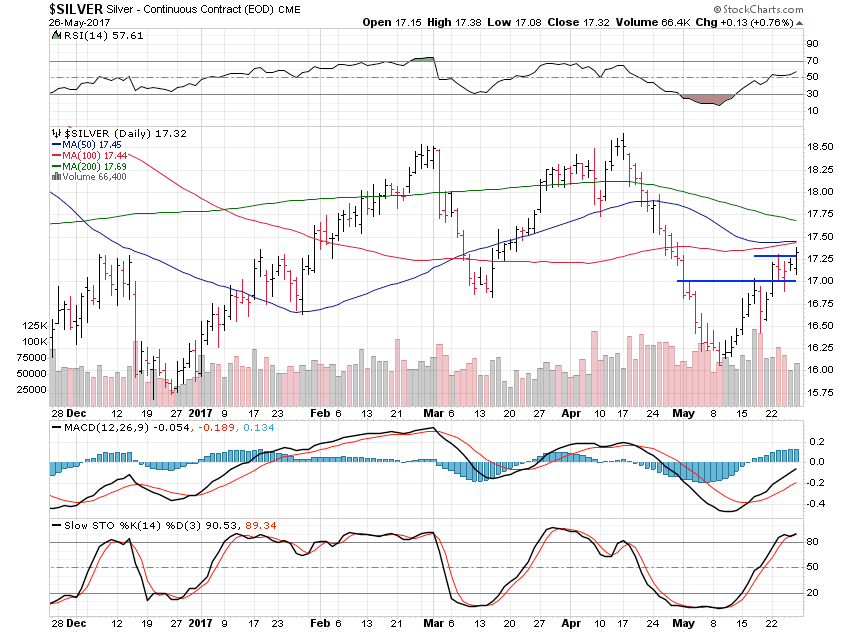

Silver moved nicely higher to the tune of 3.13% last week.

Silver has a few moving averages to contend with between $17.50 and $17.70, but if gold continues to move higher then silver should soon best those moving averages on it’s way to $18 again.

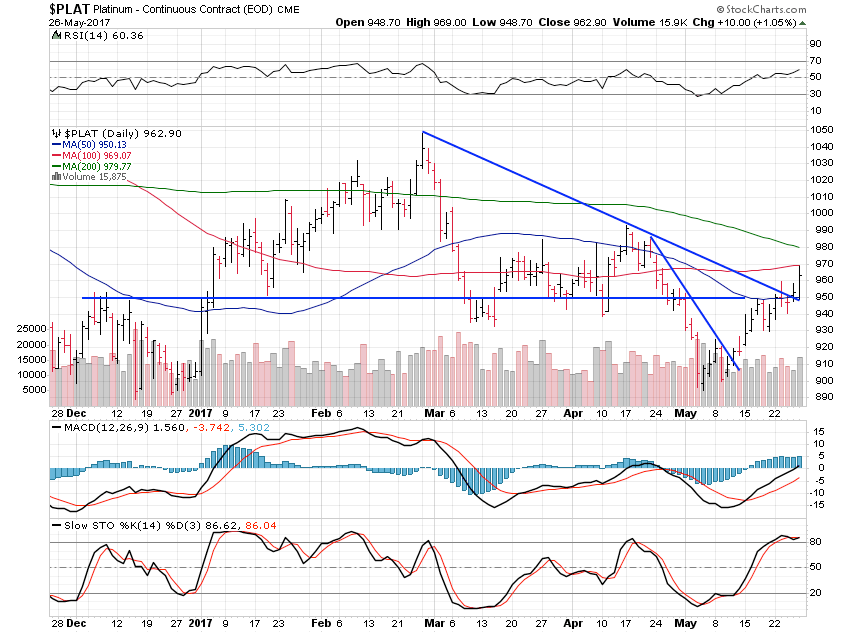

Platinum followed gold and silver higher and gained 2.41% while looking to continue its move skyward.

We saw a nice break of the large downtrend line this past week and really only have the 200 day moving average at $980 to contend with as we should see $1,020 on this move higher over the next few weeks.

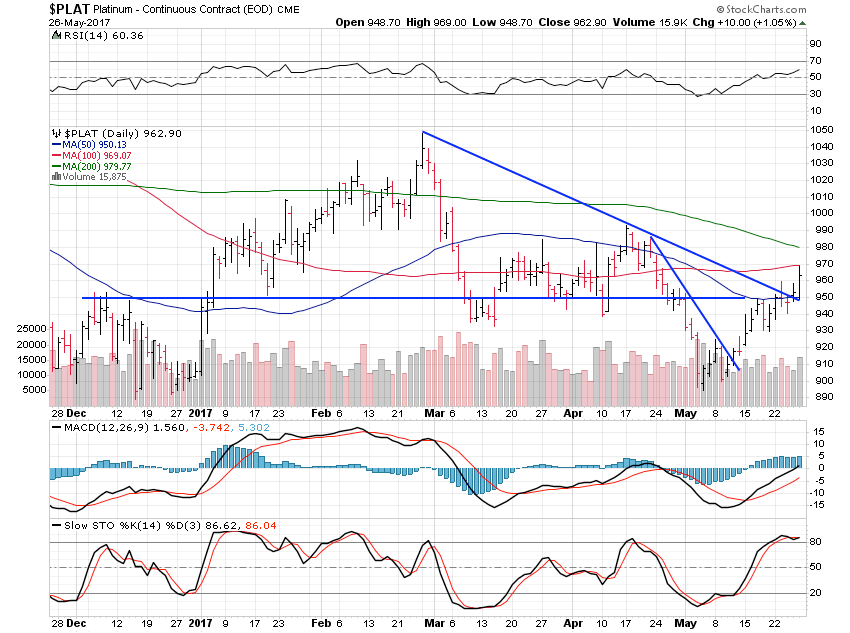

Palladium wasn’t to be left out in the rain and notched a slick 3.42% rise this past week.

Expect palladium to continue higher and quickly hit the $820 area as long as gold and silver continue to exhibit strength, which they should.