Metals and miners can't seem to get enough traction for a bounce and may be setting up to break lower sooner than I expected. If prices drop this coming week, I'll be watching for signs of a bottom and reversal. One more drop should complete the intermediate-term decline, and a new up cycle will likely begin.

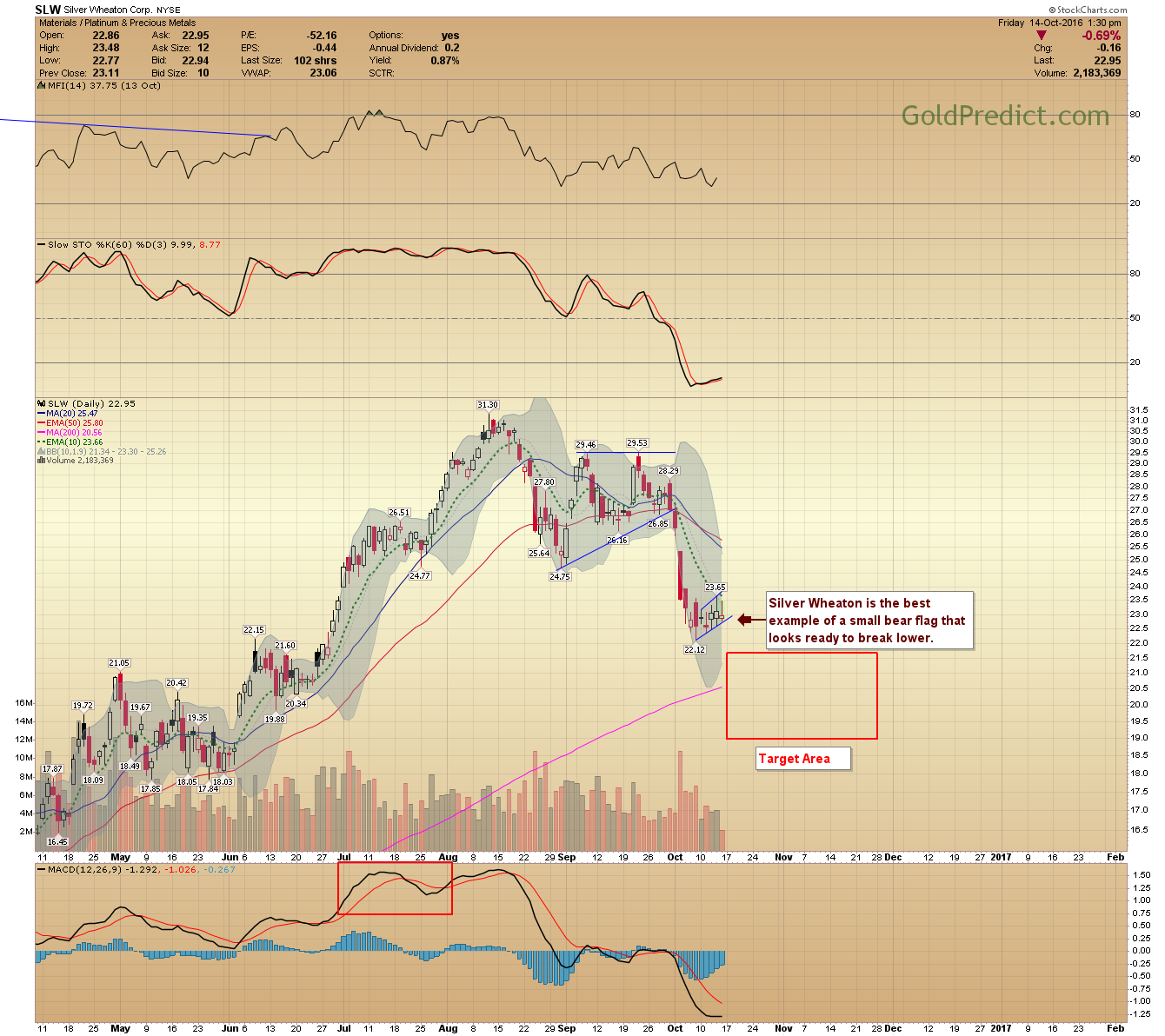

The miners are potentially making small bear flags, best seen in the Silver Wheaton (NYSE:SLW) chart, below. Prices dropping below the lower trendlines will trigger a quick move lower.

-SLW-

Silver Wheaton is the best example of a small bear flag that looks ready to break lower. A break lower could drop prices to around the $21.00-$20.50 level.

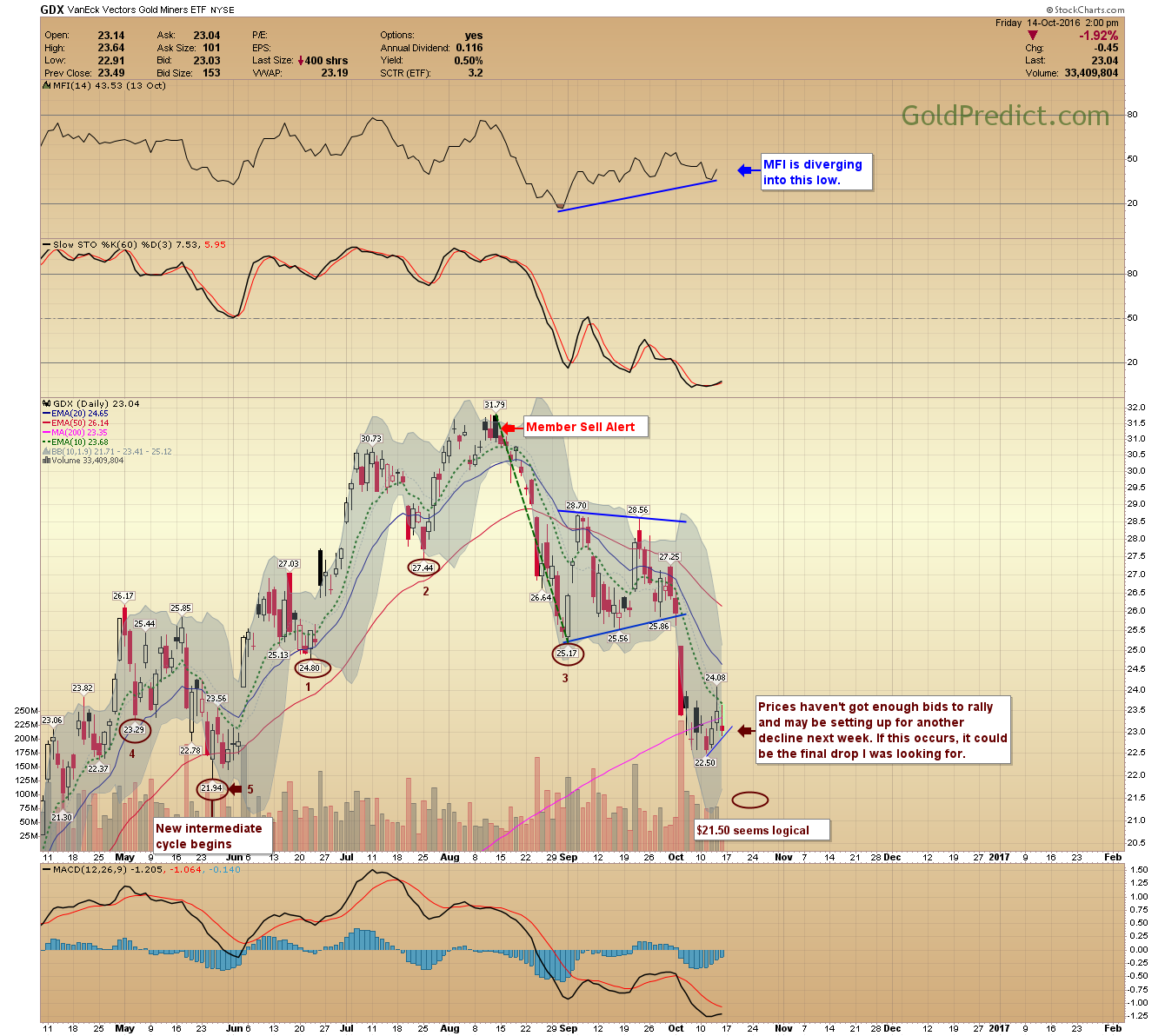

-GDX-

Prices haven't gotten enough bids to rally and may be setting up for another decline this coming week. If this occurs, it could be the final drop I was looking for. $21.50 seems like a logical objective in VanEck Vectors Gold Miners (NYSE:GDX).

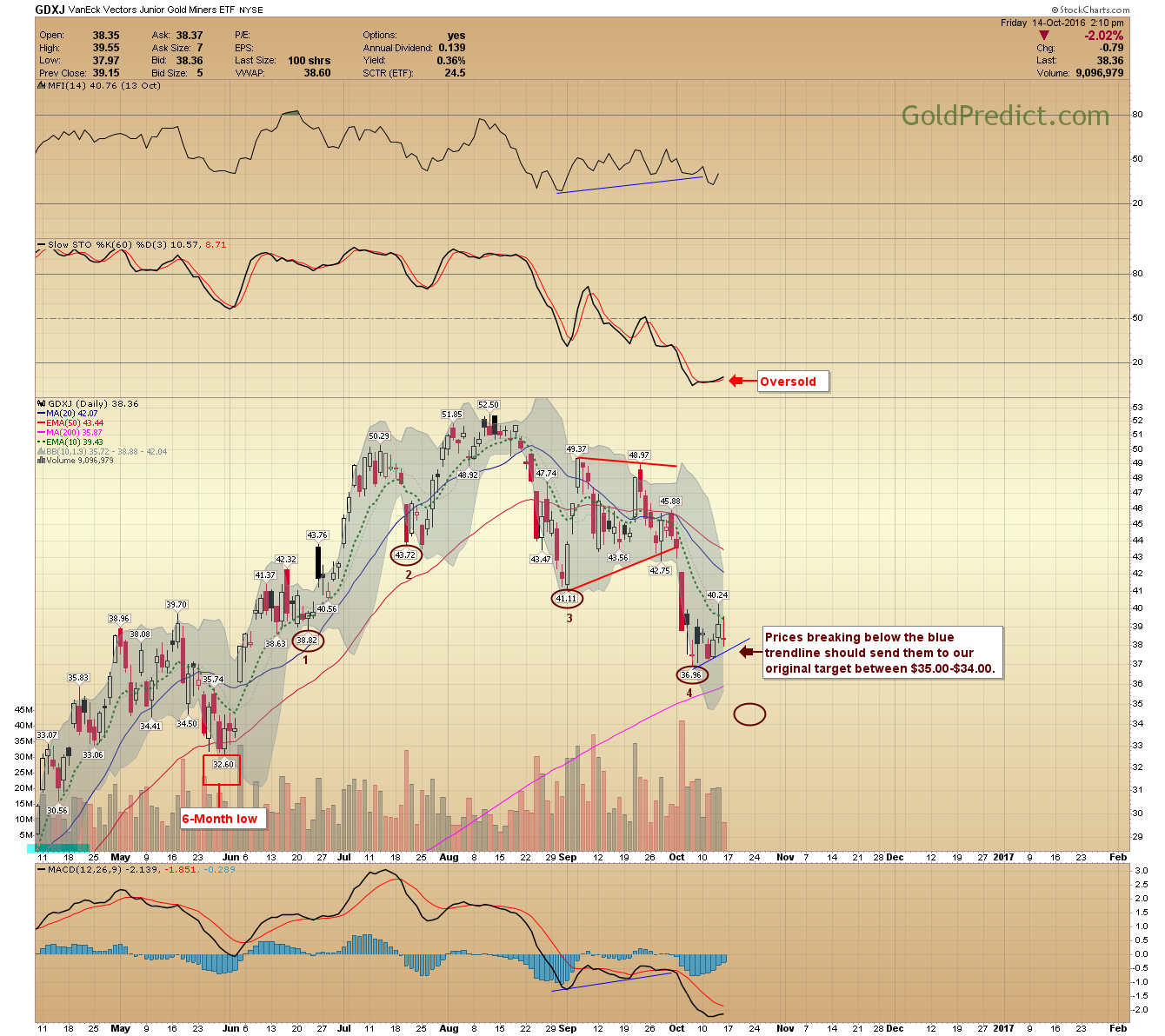

-GDXJ-

Prices breaking below VanEck Vectors Junior Gold Miners' (NYSE:GDXJ) blue trendline should send them to our original target between $35.00-$34.00.

Simply something I'm watching this coming week, prices have to break below the small trendlines to trigger the drop.