Investing.com’s stocks of the week

You’ve probably never given it any thought, but scrap metal is everywhere.

Just picture a construction site after a large demolition. Or imagine your old, beat-up car that you traded in to the dealer. Fortunately, all that scrap doesn’t end up in a landfill.

There’s actually a market for it – and soon, you’ll be able to trade it in the form of a futures contract.

Starting November 23, the London Metal Exchange (LME) will launch the LME Steel Scrap contract. The launch comes at a pertinent time for the steel industry, which is suffering from tightening margins.

The new futures contracts will allow the steel industry to hedge, and it will give the financial community the ability to gain exposure to a new market with unique supply and demand attributes.

Scrap – It’s Everywhere

No matter where you travel, you’re bound to see scrap metal. After all, people, industries, and governments are constantly building, renovating, demolishing, and discarding.

The United States is the largest scrap exporter. Last year, it exported 15.3 million tonnes, representing 30% of global trade.

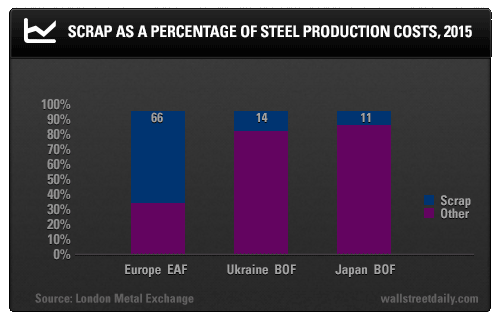

Scrap is an important additive to steel that makes up 10% to 20% of the total raw material mix. Furthermore, scrap can make up to 70% of steel production costs, as demonstrated in the chart below.

Because of this, the steel industry is both volatile and vulnerable to scrap prices.

So if that’s the case, and prices around the world vary considerably, then what scrap price will the futures contract actually represent? Believe it or not, Turkey.

Turkey is the largest global importer of scrap. In fact, it imported over 19 million tonnes in 2014, the equivalent of 19% of the global scrap trade, according to the LME. Thus, the Turkish import price is best positioned to become an effective global price, given the continuous level of interaction between Turkish steel mills and global scrap suppliers.

Here’s How It Works

The scrap contract is cash settled according to the TSI Turkish Import HMS #1&2 80:20, CFR Iskenderun Port Index price – which is quite a mouthful.

Like any commodity futures contract, the LME scrap contract is regulated in terms of specifications. It must be recognized as representing acceptable material for delivery and must meet the standards and quality of commercial scrap appropriate for steel production as defined by the Institute of Steel Recycling Industries (ISRI).

At the expiry date, outstanding contracts are settled against the monthly average of the reference price.

Investors Should Expect Volatility

Prices for scrap metal have long been volatile, and this is likely to continue going forward.

The biggest factor driving scrap’s volatility is currencies, as 50% of scrap trade is sourced from six different countries and priced across different major currencies – specifically the U.S. dollar, euro, British pound, and the Russian ruble.

But what makes scrap unique is that, unlike other commodities that represent a significant portion of a nation’s GDP, such as copper and the Chilean peso, scrap prices typically don’t impact those currencies.

Another important factor is the growing demand for electric arc furnace (EAF) steel, which is currently responsible for 60% of U.S. steel output and 26% of global steel production. The EAF method of steel production is more capital intensive, less environmentally sound, and more time consuming than the alternate method and thus is likely to create a significant tightening of future scrap supply.

What’s more, scrap is supply inelastic due to the limited ability of suppliers to react to structural demand changes.

Basically, changes in supply have limited scope because scrap sources aren’t incentivized by prices like other commodities. In other words, you’re no more or less likely to scrap your cars as scrap prices move.

Furthermore, there can be a significant time lag when the metal appears as scrap – sometimes up to 30 years. And in less developed nations, there can be logistical problems in getting scrap to market.

China’s Influence

Going forward, China will have a major impact on the scrap market. China produces about 50% of global steel, while its share of scrap in blast furnaces is as low as 8% (compared to 15% to 20% in other countries).

China is being encouraged to consume scrap for environmental reasons, and even a relatively small move from an 8% to 15% share would result in approximately 54 million extra tonnes of scrap being consumed. Meanwhile, if China fails to meet growing scrap demand domestically, it would seriously strain the global supply.

The bottom line is that the scrap contract will serve as a hedge for producers to lock in the price of their raw material – and what could be a better time than now, when the price of scrap steel is at six-year lows?

Finally, investors and speculators will have the ability to trade from the long or the short side or via contract spreads.

Good investing,