Turning heads and necks

Oncolytics Biotech Inc. (NASDAQ:ONCY) recently reported positive additional data from the restructured Phase II squamous cell carcinoma of the head and neck (SCCHN) [REO 018] study following censoring of the data for the key confounding factors resulting from an imperfect study design, which made the original data difficult to interpret. Positive preclinical results were also presented at the recent OV 2014, which suggested that Reolysin has potential benefit in additional cancer and anti-viral indications. Reolysin is in seven ongoing randomised Phase II trials, which are expected to deliver results in 2014.

Positive additional SCCHN data

Additional data from the restructured Phase II trial for 165 (of 167) SCCHN patients (REO 018) with loco-regional disease ± metastases showed that Reolysin achieved, over five cycles of therapy, a statistically significant improvement in progression-free survival (PFS) [p=0.0072] and overall survival (OS) [p=0.0146] after censoring patients for the key confounding factors, and a positive trend towards better tumour stabilisation (0% growth) or shrinkage. In the 47 patients with metastatic-only disease, eight were still alive by April. Reolysin maintained a PFS benefit for five cycles of therapy and there was statistically significant better tumour stabilisation or shrinkage (p=0.021).

Encouraging preclinical results at OV 2014

Positive preclinical results were presented at the recent Oncolytic Virus (OV) 2014 conference on Yes-Associated Protein (YAP-1) as a potential reovirus biomarker for SCCHN and the potential for reovirus to be used in the treatment of hepatitis B (HBV) and hepatitis C (HCV) ± hepatocellular carcinoma (HCC). Reolysin can also cross the human blood brain barrier and may be synergistic with granulocyte macrophage colony stimulating factor (GM-CSF) for treating a range of cancers.

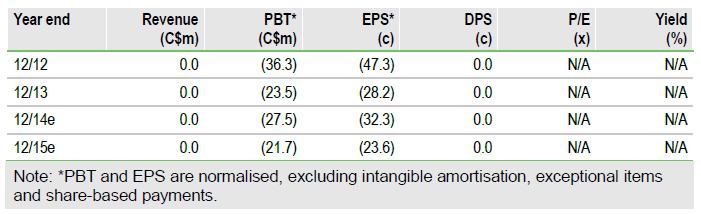

Financials: Funded to H215

Oncolytics had cash of C$20.2m at 31 March 2014. In February 2014, the company entered into a share purchase agreement with Lincoln Park Capital Fund, LLC for an initial investment of US$1.0m and up to US$25.0m over 30 months.

Valuation: Risk-adjusted NPV of C$442m

We reduce our rNPV slightly to C$442m due to the implied delay in launching the lead product. By comparison, Oncolytics’s EV is C$108m, based on a market cap of C$128m and end-Q1 cash of C$20m.

To Read the Entire Report Please Click on the pdf File Below